When it comes to online trading in the UK, two popular methods stand out: Contract for Differences (CFDs) and Spread Betting. Both offer unique opportunities and challenges so understanding their nuances is crucial for traders to make informed decisions.

Here I’ll explore the differences between CFDs and Spread Betting, hopefully I’ll provide some insight in which method best suits your investment goals and trading style.

What is the difference between CFDs and Spread Betting?

The main difference between CFD trading & spread betting in the UK is tax treatment. Spread betting is tax-free according to the UK government, in 2025 where as CFD’s are liable for capital gains tax.

Here are some other core differences between them that we’ll explore together:

- Tax treatment

- Market access & range

- Trade sizing

- Regulation

What are CFDs?

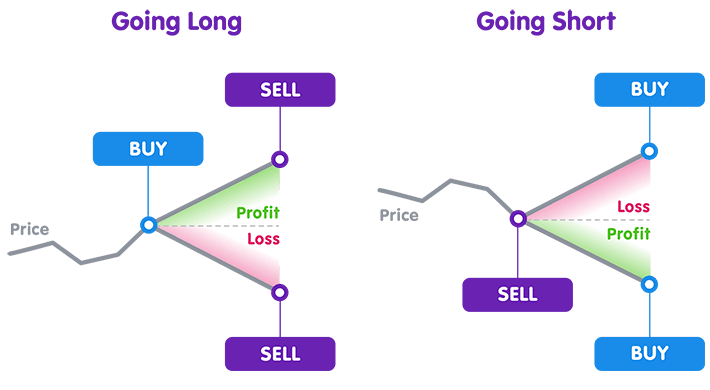

CFDs (Contracts for Difference) are derivative products where a trader agrees to exchange the difference in an asset’s price from the moment the position opens to when it closes. Rather than purchasing the asset itself, you’re essentially betting on its price movement, allowing for speculative opportunities on assets like stocks, forex, commodities, indices, and even cryptocurrencies.

Example of How CFDs Work: Let’s say you speculate that the value of Apple stock will increase. You open a CFD position with your broker at Apple’s current price. If Apple’s stock rises, you profit based on the amount the price has moved. Conversely, if the price drops, you incur a loss.

What is Spread Betting?

Spread betting is another form of derivative trading that allows you to bet on the direction of an asset’s price movement. Unlike CFDs, spread betting is unique to the UK and Ireland and offers tax-free profits, making it attractive to many traders. In spread betting, you stake a set amount of money per point of price movement, making it straightforward and highly flexible for those new to trading.

Example of Spread Betting: Imagine you bet £5 per point on the FTSE 100, expecting it to rise. If the FTSE climbs by 10 points, you earn £50 (10 points x £5). However, if it falls by 10 points, you lose £50.

Key Differences Between CFD Trading and Spread Betting

Tax Treatment

CFD Trading

In the UK, profits from CFD trading are generally subject to Capital Gains Tax (CGT). This tax treatment can benefit traders who may use any CFD trading losses to offset gains in other investments, potentially reducing overall tax liabilities. However, traders must be mindful of CGT reporting requirements, as any taxable gains must be declared on tax returns. Additionally, tax rates and rules may vary significantly depending on individual circumstances and jurisdiction.

Spread Betting

Spread betting offers a key advantage for UK-based traders: profits are tax-free under current UK tax law. Unlike CFD profits, spread betting profits are not subject to CGT, making this a particularly appealing option for those seeking a straightforward trading approach without additional tax obligations. However, it’s crucial to note that for traders who are classified as “professionals” by HMRC, there’s a possibility that spread betting could be taxed as income, depending on the frequency and scale of trading.

Market Access and Range

CFDs

CFDs can involve multiple types of costs, including commissions, spreads, and overnight financing fees. Commission fees are typically charged for stock CFDs, while forex and index CFDs often come commission-free but with slightly wider spreads. The overnight financing cost (also known as a “swap” fee) applies to leveraged CFD positions held overnight, and it can impact profitability for long-term positions. Additionally, some brokers may adjust spreads based on liquidity and volatility, so costs can fluctuate significantly during market events.

Direct Market Access (DMA): Some CFD brokers offer DMA, allowing traders to view and interact with the order books of global exchanges. This can be particularly advantageous for experienced traders looking for depth of market visibility and better trade execution.

Equity CFDs: The ability to trade individual stocks as CFDs offers opportunities for targeted investments and corporate actions like dividends and stock splits, which can affect CFD positions.

Spread Betting

With spread betting, most costs are incorporated within the spread itself, meaning traders do not pay separate commissions on trades. While overnight financing charges apply for leveraged positions, there are typically no additional fees outside of the spread. The spread cost can vary, widening during periods of volatility or major economic announcements. For traders focused on minimizing trading fees, spread betting’s streamlined cost structure can be advantageous.

Trade Sizes

CFDs

CFDs are generally traded in lots (standardized quantities of the underlying asset), which can restrict the level of precision for smaller positions. While brokers may offer mini or micro lots for certain assets, the standardized size can sometimes limit how granularly traders can control their position size.

Spread Betting

In spread betting, you bet a specific amount per point of price movement, providing greater control over trade size. This per-point stake structure allows traders to adjust exposure in increments as small as a single point, catering to individual risk tolerance and position management preferences. This flexibility makes spread betting particularly user-friendly for traders who want to scale positions according to specific strategies.

Regulation and Protection

Both CFD trading and spread betting are regulated by the Financial Conduct Authority (FCA) in the UK, which enforces stringent standards to protect traders and ensure fair trading practices.

CFD Trading

CFD brokers operating in the UK must comply with FCA regulations, including providing negative balance protection and maintaining segregated client funds. These measures ensure that traders are protected from owing more than their initial deposit and that client funds remain secure even in the event of broker insolvency.

Spread Betting

Spread betting brokers are similarly required to offer FCA-compliant protections. Spread betting accounts also fall under the Financial Services Compensation Scheme (FSCS), meaning that in the event of a broker’s failure, traders could be compensated up to £85,000. This security feature adds another layer of trust and protection for UK-based spread betting traders.

Pros and Cons of CFD Trading

Advantages

- Access to a diverse range of global markets

- Potential tax offsets on losses (CGT)

- Availability of margin trading and leverage for increased returns

- Investor protections, including negative balance protection

Disadvantages

- Capital Gains Tax applicable in the UK

- Additional costs, including commissions and overnight financing

- Complexity and steep learning curve for beginners

Pros & Cons of Spread Betting

Advantages

- Tax-free profits for UK-based non-professional traders

- Simplified trading cost structure without commissions

- Flexible position sizing per point of price movement

- FCA-regulated with robust consumer protections

Disadvantages

- Limited market access compared to CFDs

- Potentially higher costs due to spread variations during volatility

- Often seen as a beginner-friendly option, potentially limiting advanced features

Should I Spread Bet or Trade CFD’s?

Deciding between CFD trading and spread betting depends on your financial goals, trading experience, and tax situation. For newcomers, spread betting may offer a straightforward introduction to the markets with the added benefit of tax-free profits in the UK. On the other hand, seasoned traders might find the broader range of instruments and advanced features in CFDs more aligned with their strategies.

Here are some considerations:

1. Tax Implications

For UK-based traders, spread betting offers the tax advantage of being free from CGT, making it appealing for those focused on tax-efficient trading. However, for professionals or those making significant profits, tax liabilities could still apply, so it’s wise to consult with a tax advisor.

2. Investment Goals and Time Horizon

Short-term traders may prefer spread betting for its simple tax structure and cost efficiency, while long-term investors who want to diversify portfolios across global markets might find CFDs more suitable due to their extensive market coverage and access to DMA.

3. Market Preferences

If you want to trade niche markets or specific international assets, CFDs provide greater market flexibility. For traders focused on UK indices, commodities, or major currency pairs, spread betting can offer all the necessary tools with fewer complications.

4. Managing Costs and Capital

Consider how the spread costs, commissions, and overnight fees affect your overall trading capital and profit margins. Spread betting is generally more cost-effective for those trading smaller positions, while CFD traders should be mindful of the cost implications, especially with leveraged positions held over the long term.

5. Risk Management in CFD and Spread Betting

Regardless of which approach you choose, risk management is essential. Using stop-loss orders, keeping leverage low, and regularly assessing your financial exposure can help manage risks, especially given the potential for rapid losses in leveraged positions.

6. Education and Research

Invest in learning the fundamentals of market analysis—from technical indicators to economic factors—to make informed trading decisions. Both spread betting and CFD brokers usually offer demo accounts, which provide a low-risk way to practice strategies and gain experience.

7. Diversifying Across Both Methods

Experienced traders may benefit from using both spread betting and CFDs as part of a balanced trading approach. This diversification allows traders to capitalize on the tax benefits of spread betting while leveraging the extensive market access of CFDs, spreading risks across different instruments.

Our Thoughts

Due to it’s more favourable tax treatment, we are big proponents of spread betting and our thoughts are that you can try both with small amounts of capital to get started.

Remember, never risk more than you can afford to lose, trading is risky and trading on leverage can lead to significant losses. Please always consult a financial advisor. This is article is for informational and entertainment purposes nand cannot be construed as financial advice.

Conclusion

Both CFDs and Spread Betting offer unique opportunities for traders. The decision largely depends on individual circumstances, trading goals, and market preferences. Hopefully this article got your somewhere closer to figuring out which method might best suit you and if you would like to get started with spread betting then feel free to check out Pepperstone – our October broker of the month and one of the most-awarded CFD & spread betting brokers.

£500 Recommended Deposit

Best Overall

Pepperstone is a Melbourne-based broker that offers an excellent selection of trading instruments in the financial trading markets, including commodities, shares, ETFs and more.

75.5% of retail investor accounts lose money when trading on margin with this provider

Sources / Further Reading

Paul Williams is an experienced Senior Analyst working with experience working for HSBC in their derivatives trading division for 5+ years. He is a regular contributor to major financial news publications and has experience both trading his own capital and managed capital. He is currently the Chief Analyst and Reviewer for Spreadbet.AI.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-450x338.jpg)

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)