The world of spread betting and trading is rapidly evolving, driven by technological advancements and innovative tools. These cutting-edge innovations are not only enhancing the trading experience but are also fundamentally transforming how traders approach the market. Here, we explore ten such innovations that are reshaping the landscape of spread betting and trading.

1. Algorithmic Trading with MetaTrader’s Expert Advisors

MetaTrader’s Expert Advisors (EAs) have revolutionized automated trading. When I first started trading, I couldn’t imagine leaving my trades to a bot. But now, MetaTrader’s Expert Advisors (EAs) have become one of my go-to tools. These algorithmic programs allow you to automate your strategies, removing the emotion from trading and letting you capitalize on opportunities 24/7.

Expert Advisors are custom-programmable using MetaQuotes Language (MQL), and whether you’re day trading or swing trading, they can execute orders, manage risk, and analyze market data far faster than we can manually. If you like having your trades work while you sleep, EAs are the way to go.

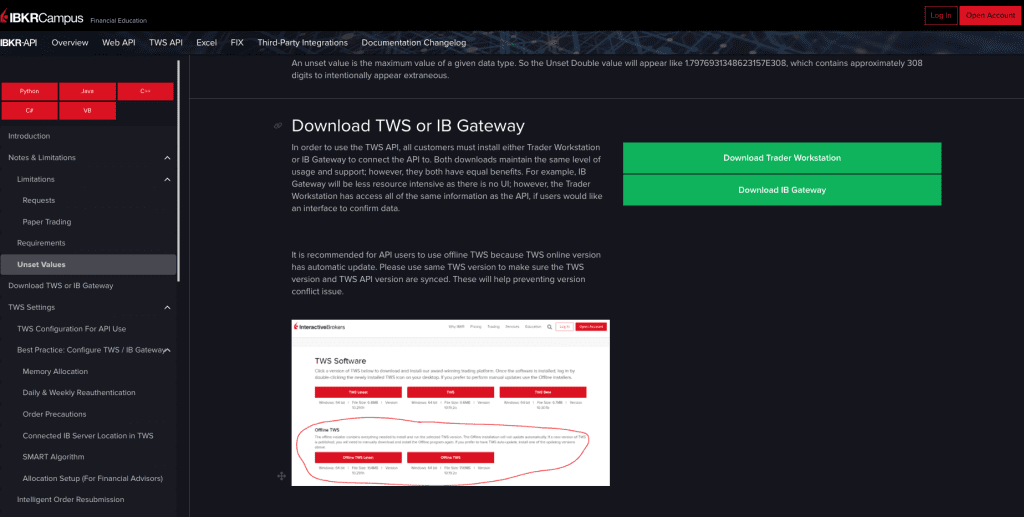

2. Interactive Brokers’ TWS API for Advanced Trading Integration

Interactive Brokers offers a powerful Trader Workstation (TWS) API, allowing traders to create custom trading applications for automated strategies. With the TWS API, you can design your own automated trading applications, access real-time and historical market data, and use sophisticated order types that are perfect for fine-tuning your spread betting strategies.

I’ve found this tool frankly incredible for integrating multiple systems into one cohesive trading environment. If you’re tech-savvy and like customizing your trading workflow, this API is an excellent addition.

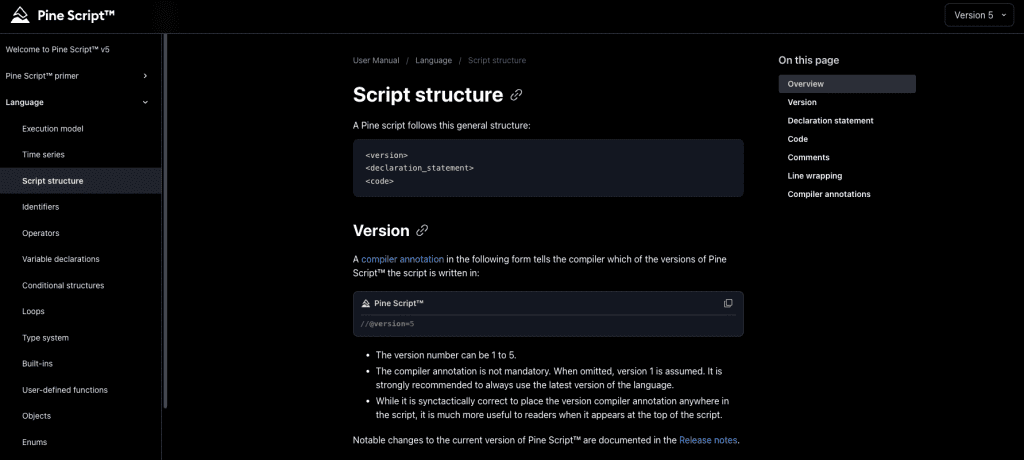

3. Pinescript Automation with TradingView

TradingView has always been one of my favorite platforms, but proper usage of Pinescript for backtesting strategies takes it to a whole new level. TradingView helps analyze charts and provide insights into spread betting strategies, highlighting potential trading opportunities.

Whether you’re a beginner trying to get a sense of direction or an advanced trader looking for nuanced insights, sriously consider using PineScript on TradingView.

4. High-Frequency Trading (HFT) Solutions

High-Frequency Trading (HFT) firms use proprietary algorithms to execute a large number of orders at lightning speeds. These solutions have transformed trading dynamics, particularly in spread betting, by capitalizing on minute price movements.

Companies like Virtu Financial represent the forefront of HFT but traders using spread betting platforms benefit indirectly from the liquidity these firms provide. If you trade fast-moving markets like forex, understanding how HFT influences market depth and liquidity can offer crucial insights.

5. Quantum Computing in Financial Analysis

This one sounds like it’s out of a sci-fi movie, but quantum computing is starting to make waves in the financial world. Quantum computers can process vast amounts of data exponentially faster than traditional computers, and that includes the kind of complex calculations used in financial analysis.

While we’re still a few years from seeing quantum computing widely used in retail trading, firms like IBM are already exploring how quantum tech can optimize portfolios, improve risk models, and offer more precise market forecasts. It’s definitely an area to keep an eye on.

6. Blockchain Technology for Enhanced Security

When it comes to transparency and security, blockchain technology is leading the charge. In trading, it’s being used to improve the security of transactions and to create smart contracts, which automatically execute based on agreed-upon conditions without the need for a middleman.

Platforms like Blockchain.com are already offering decentralized transaction options, which can be game-changing for spread bettors who want to ensure their transactions are safe, transparent, and fast. The added benefit is that blockchain technology reduces the risk of fraud, making it a highly secure option for the future of trading.

7. eToro’s Social Trading Platform

Social trading has become one of the biggest trends, and eToro is leading the way with its innovative platform. I love how eToro integrates social features into trading, making it easy for users to follow and even copy the strategies of more experienced traders.

This is particularly beneficial for spread bettors who are new to the market and looking to learn from the best. It’s also a fantastic way to test out different trading strategies before committing large sums of capital. eToro’s CopyTrader feature is ideal for this.

8. Machine Learning for Predictive Market Analysis

We’ve already seen how AI can assist in technical analysis, but machine learning takes things one step further. Platforms like AlgoTrader (now Wyden) use machine learning to analyze massive datasets and make predictive models of market behavior. By constantly learning and adapting to new data, these algorithms help traders anticipate market movements more accurately.

In spread betting, machine learning can provide you with actionable insights on when to enter or exit a trade, especially in volatile markets. This is a must-have tool for those looking to stay ahead of the curve.

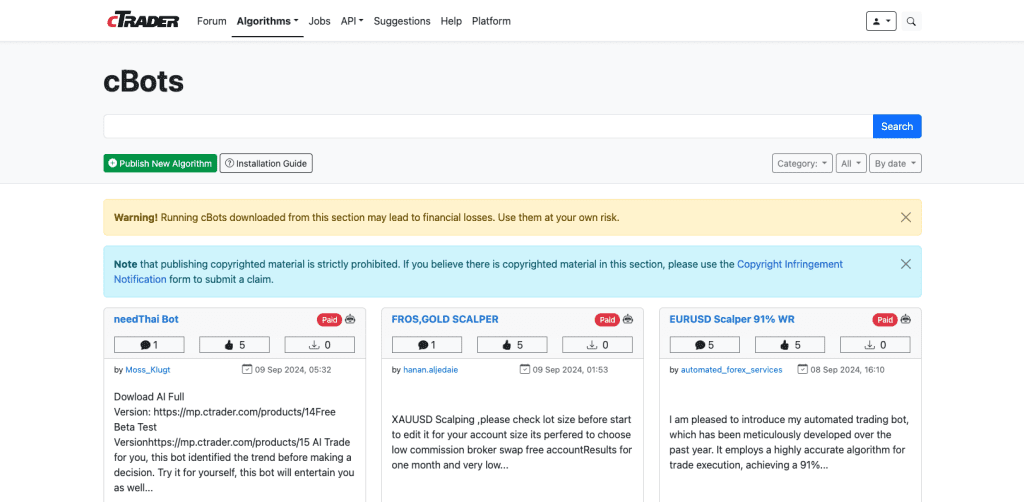

9. cTrader’s cBots for Automated Trading

For traders who use cTrader, their cBots are an excellent alternative to MetaTrader’s EAs. Written in C#, cBots allow you to automate your trading strategies, much like EAs. However, cTrader’s advanced interface offers an intuitive, easy-to-use environment for automating your trades.

I’ve personally found cTrader to be one of the best platforms for seamless execution, and its cBots are particularly great for traders looking for precision and speed in the markets. You can also backtest strategies, making it a powerful tool for perfecting your approach.

10. Robo-Advisors for Personalized Investment Strategies

Finally, robo-advisors have made huge strides in the investment world. While they’re more common in long-term investing, they’re starting to make waves in spread betting and trading as well. Platforms like Betterment offer personalized, algorithm-driven investment strategies that adjust based on your financial goals and risk tolerance.

Robo-advisors are perfect if you prefer a hands-off approach to trading. They take the guesswork out of strategy formulation and allow you to focus on other aspects of your portfolio.

Conclusion

These ten innovations represent the cutting edge of technology in spread betting and trading. From AI-driven analysis tools to advanced automated trading solutions, each innovation plays a crucial role in empowering traders with sophisticated, data-driven strategies. Whether you are a novice trader or a seasoned professional, these tools can significantly augment your trading approach, helping you navigate the complexities of financial markets with greater insight and efficiency.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-450x338.jpg)

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)