AI trading is one of the most exciting developments in finance, and if you’re looking to dive into building an AI trading bot, there’s a wealth of programming languages, libraries, and machine learning models to choose from. Whether you’re automating CFD trading, spread betting, or exploring the complexities of forex, the choice of tools you use can significantly influence the success of your strategies.

In this guide, we’ll explore which programming languages (Python, OCaml, C#) are the most suitable for AI-driven trading, examine useful Python libraries (PyTorch, TensorFlow, Scikit-learn), and dive into key machine learning algorithms like K-Nearest Neighbors (KNN), Random Forest, and Regression. We’ll also touch on Object-Oriented Programming (OOP), and how it plays an essential role in structuring AI trading systems.

1. Choosing a Programming Language for AI Trading: Python, OCaml, or C#?

When building AI models for trading, choosing the right programming language can make or break your strategy. Here’s a breakdown of the three key contenders:

Python

Python is by far the most popular language for building AI and machine learning models in trading. Its vast library ecosystem and simplicity make it a go-to choice for AI trading.

- Strengths:

- Libraries: Python boasts powerful libraries such as Scikit-learn for machine learning, Pandas for data manipulation, and TensorFlow and PyTorch for deep learning models.

- Ease of Use: Python’s straightforward syntax and widespread use in the data science community make it beginner-friendly.

- Backtesting and Data Handling: Libraries like Backtrader and Zipline enable backtesting of trading strategies with ease.

- When to Use: Python is best for building complex AI models, data analysis, and research-driven algorithmic strategies. Its flexibility makes it suitable for both beginner and advanced traders.

C#

C# is predominantly used in platforms like cTrader, where the focus is on high-speed execution. It’s great for automated strategies that need to act quickly in volatile markets.

- Strengths:

- Execution Speed: C# is faster than Python when it comes to executing trades in real-time environments, making it a better choice for high-frequency trading (HFT).

- cTrader Integration: If you’re using cTrader and working with cBots, C# is essential. It’s tightly integrated into the trading platform for both live trading and backtesting.

- When to Use: C# is ideal when high-speed execution is critical, such as in scalping or HFT. However, its machine learning capabilities are less developed than Python’s.

OCaml

Though less popular in the trading world, OCaml has advantages in statistical modeling and algorithmic precision. Its strong type system and performance efficiency make it appealing to hedge funds and quantitative trading firms.

- Strengths:

- Speed and Efficiency: OCaml is compiled and offers fast execution with less memory overhead.

- Statistical and Algorithmic Precision: It’s favored by firms for writing financial algorithms due to its reliability in handling complex mathematical operations.

- When to Use: OCaml is less mainstream but valuable if your trading strategy relies on mathematical models and extreme precision. However, fewer resources and libraries mean a steeper learning curve.

2. Python Libraries for AI Trading: PyTorch, TensorFlow, and Pandas

If Python is your language of choice, you’ll need to become familiar with its ecosystem of libraries that are pivotal for building AI-based trading bots. These libraries help in data analysis, machine learning, and deep learning.

Scikit-learn:

This is the go-to library for traditional machine learning methods such as KNN, Random Forest, and Regression models.

- Use Case: If you’re building a bot to predict asset price movements based on historical data, Scikit-learn provides excellent tools for classification and regression models.

Pandas:

An essential library for data manipulation and analysis. You can easily import, clean, and manipulate financial data, which is crucial before running any AI models.

- Use Case: Use Pandas to manage your price data (OHLCV – Open, High, Low, Close, Volume) and then feed it into machine learning algorithms.

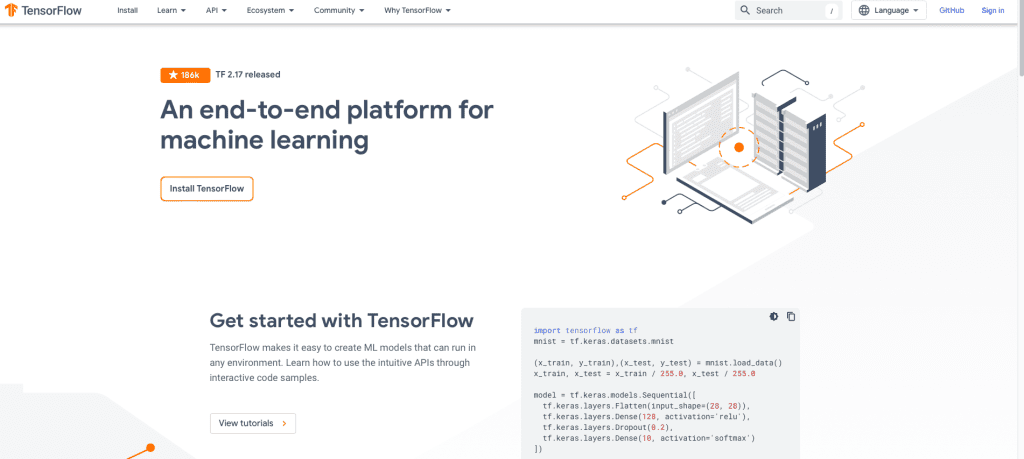

PyTorch and TensorFlow:

These are the heavyweights in the deep learning space. Both libraries allow you to build neural networks for AI trading systems.

- Use Case: For more advanced AI bots that employ deep learning, such as predicting market conditions with neural networks, both TensorFlow and PyTorch are invaluable. PyTorch is often favored for research purposes, while TensorFlow is better suited for production-level deployment.

3. Trading Strategies for Your Bot

Understanding the language and libraries you need for your AI trading bot is great but understanding what kind of strategy you want is is the most important part, here is a sample of the kinds of strategies you could implement:

Moving Averages

A simple yet effective tool for trend detection. You can implement simple moving averages (SMA) or exponential moving averages (EMA) as features in your AI models to identify trends or reversals.

Relative Strength Index (RSI)

This momentum oscillator is used to determine overbought or oversold conditions in a market. RSI can be used as a feature in both classification models (e.g., predicting market direction) and regression models (e.g., predicting price levels).

Bollinger Bands

Bollinger Bands measure market volatility. These can be used in conjunction with your AI models to detect price breakouts or to identify periods of high market volatility that may offer trading opportunities.

4. Machine Learning Algorithms in Trading: KNN, Regression, and Random Forest

K-Nearest Neighbors (KNN)

KNN is a simple yet powerful algorithm used for both classification and regression tasks. It can classify whether an asset will rise or fall, or predict price levels by comparing the asset’s current state with its historical data points.

- Use Case in Trading: KNN can be used for pattern recognition in market data. By identifying similar past market conditions, KNN can help forecast future price movements.

Regression Analysis

Regression analysis is fundamental in predicting continuous outcomes like asset prices. Linear regression can be used for price forecasting, while more advanced forms like Lasso regression or Ridge regression handle more complex models.

- Use Case in Trading: Regression is commonly used in trading to model the relationship between an asset’s price and various independent variables, like volume or time.

Random Forest

This algorithm is highly effective for complex classification tasks, where decision-making is based on the aggregation of multiple decision trees. It’s excellent for capturing non-linear relationships in market data.

- Use Case in Trading: Use Random Forest to predict whether to enter a long or short position based on several market indicators. It’s particularly useful in ensemble models that combine multiple features for more accurate predictions.

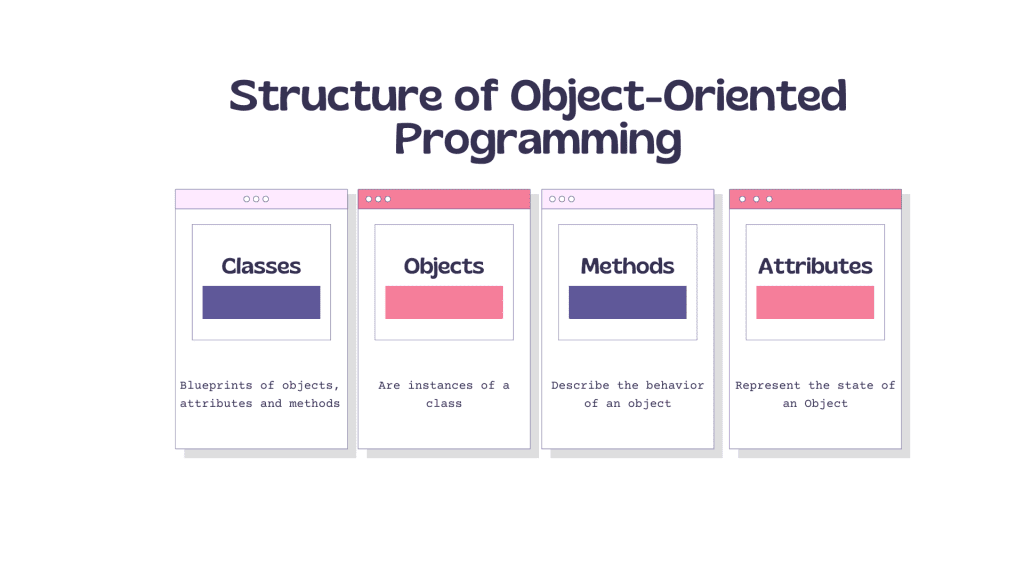

5. Object-Oriented Programming (OOP) and Its Role in AI Trading

Object-oriented programming (OOP) is a method of structuring code so that individual elements of a program (objects) represent distinct entities or concepts (e.g., market data, indicators, trading strategy). OOP is crucial for trading bot development because it allows for the modular design of complex systems.

- Modularity: You can create distinct classes for handling data collection, trade execution, and model prediction, which makes your trading bot easy to manage and scale.

- Reusability: By defining classes for common tasks like fetching data or applying technical indicators, you can reuse and refine your code efficiently across multiple projects.

Example of an Object-Oriented Class in Python:

class MovingAverageStrategy:

def __init__(self, data):

self.data = data

def calculate_sma(self, period):

return self.data.rolling(window=period).mean()

def generate_signals(self):

sma_50 = self.calculate_sma(50)

sma_200 = self.calculate_sma(200)

return sma_50 > sma_200 # Buy if SMA(50) crosses above SMA(200)

6. PyTorch and TensorFlow in Deep Learning Trading

PyTorch and TensorFlow offer deep learning capabilities, where you can build sophisticated models like Long Short-Term Memory (LSTM) or Recurrent Neural Networks (RNN) to predict market prices.

- PyTorch: Easier for research and experimentation. If you’re just starting and want to prototype, PyTorch’s dynamic computation graph makes it a good choice.

- TensorFlow: Ideal for production deployment. If your AI trading bot will be used in a live environment with high-frequency trading, TensorFlow’s scalability is perfect.

Putting It All Together: Building an AI Trading Bot

Building an AI trading bot requires careful consideration of the tools, algorithms, and programming languages you choose. Python is by far the most versatile option for AI trading due to its ecosystem, while C# is best for high-speed execution in platforms like cTrader. Machine learning algorithms like KNN, Regression, and Random Forest form the core of data analysis, while deep learning frameworks like PyTorch and TensorFlow take your bot to the next level.

Building an AI trading bot requires integrating the right tools, languages, and algorithms to craft a solution tailored to specific markets such as CFDs, forex, and spread betting.

Key Python Libraries for AI Trading

- Pandas: Essential for handling and cleaning time series data, which is foundational in financial markets.

- Scikit-learn: For machine learning, offering a vast array of algorithms such as K-Nearest Neighbors (KNN), Random Forest, and Regression models.

- TensorFlow/PyTorch: These are needed for deep learning and can help build neural networks capable of more sophisticated predictions, such as price forecasting using historical data.

Building AI Trading Bots: The Process

Python AI Bot Development (for platforms like Interactive Brokers)

- Data Collection:

- Use APIs to pull historical market data. Python libraries like yfinance or ccxt can fetch historical data for forex, cryptocurrencies, and stock prices.

- Data Cleaning & Preprocessing:

- Use Pandas to clean and format the data, handling missing values and standardizing data before feeding it into models.

- Building the Model:

- Implement models like KNN, Random Forest, or Regression using Scikit-learn. For deep learning, leverage TensorFlow or PyTorch.

- Example: Using a neural network to forecast price movements based on historical OHLCV data.

- Backtesting:

- Backtrader or Zipline allows you to backtest your strategy against historical data to validate its performance before going live.

- Deployment:

- Integrate with a broker’s API (such as Interactive Brokers using their Python IB API) to execute trades based on the model’s signals.

C# Bot Development (for cTrader and cBots)

- cAlgo/cTrader Setup:

- Write the trading bot using C# and deploy it directly in cTrader. You can use cAlgo, the native algorithmic trading tool for cTrader.

- Automated Strategy:

- Define automated strategies based on technical indicators (e.g., moving averages, RSI) or custom strategies coded in C#.

- Backtesting & Optimization:

- Use cTrader’s backtesting feature to test the bot’s performance using historical data, similar to Python’s Backtrader.

Is KNN or Random Forest Useful in AI Trading?

Both KNN and Random Forest have their place in AI trading strategies:

- KNN: Best for small datasets and pattern recognition. It’s great when you want to identify recurring patterns in market movements, but it struggles with high-dimensional data.

- Random Forest: A much more robust algorithm for AI trading. By aggregating multiple decision trees, it makes more accurate predictions about market direction, even in volatile markets.

Role of PyTorch and TensorFlow

For deep learning, PyTorch and TensorFlow are invaluable. While PyTorch offers a more user-friendly and dynamic approach (often favored in research), TensorFlow is more robust for deploying large-scale AI models in production environments. Both can be used to build LSTM (Long Short-Term Memory) models, which are especially useful for predicting time series data like asset prices.

Using ChatGPT to Help Build AI Trading Bots

Building AI trading bots can be a complex and iterative process, but leveraging ChatGPT can simplify it by helping you generate code, structure strategies, and debug logic in real-time. In this section, we’ll explore how ChatGPT can help you create an AI trading bot step by step and provide examples of how to craft effective prompts for bot creation.

1. Why Use ChatGPT for AI Bot Development?

ChatGPT can act as an intelligent coding assistant, capable of helping you:

- Generate algorithm templates and strategies.

- Translate trading ideas into code in Python, C#, or other programming languages.

- Debug and improve existing code.

- Offer explanations of complex concepts like machine learning, KNN, LSTM, and Regression Analysis.

- Automate workflows like backtesting or optimizing trading strategies.

This meta-AI scenario (using AI to build AI) allows you to quickly scale up your bot development process and even automate complex decision-making systems for trading.

2. How to Structure Prompts for Bot Creation

The key to getting the most out of ChatGPT is writing clear and structured prompts. Here’s a breakdown of how to use ChatGPT for developing AI trading bots with example prompts:

Example Prompt: Strategy Design

"I want to build a Python trading bot that uses the MACD and RSI indicators to trade forex pairs like EUR/USD. The bot should buy when RSI < 30 and MACD crosses above zero, and sell when RSI > 70 and MACD crosses below zero. Can you help me structure the code?"

This prompt clearly outlines the strategy and provides the necessary indicators, which helps ChatGPT generate clean, usable code.

Example Prompt: Risk Management

"How can I integrate a risk management module in my Python trading bot? I want to risk only 2% of my total account balance on each trade and use a trailing stop-loss of 10 pips."

This prompt clarifies the risk management parameters, allowing ChatGPT to help you integrate them into your bot.

Example Prompt: AI for Predictive Modeling

"I’m building a Python bot that uses Random Forest to predict stock price direction based on historical data. Can you help me write a function that collects data from an API, preprocesses it, and trains a Random Forest model?"

Here, the prompt gives ChatGPT the context to generate code for data collection, preprocessing, and training an AI model.

Example Prompt: cAlgo Bot

"Help me create a simple cAlgo bot in C# that uses the Bollinger Bands strategy for trading forex. The bot should place a buy trade when the price closes below the lower band and a sell trade when the price closes above the upper band."

With this, you can receive C# code for cAlgo bots that automate Bollinger Bands strategies.

3. Building Trading Bots Using ChatGPT

Let’s break down the actual process of how you can use ChatGPT for AI bot creation:

- Define the Strategy: Start by clearly stating the rules you want your bot to follow. This could be a simple technical indicator-based strategy or a complex machine-learning approach.

- Code Generation: Once you define the strategy, ask ChatGPT to help you write or structure the code. If you’re using Python, prompts can focus on libraries like Pandas, Scikit-learn, and TensorFlow.

- Debugging and Testing: ChatGPT can help troubleshoot and identify bugs. For example:

"I’m getting an error with my MACD strategy in Python when backtesting it. Can you help me fix the issue?" - Backtesting and Optimization: You can ask ChatGPT to write scripts for backtesting and optimizing your AI bot. This ensures you can validate the strategy before live deployment.

4. AI-Assisted Trading: Best Practices

To get the most out of AI bot development, keep the following in mind:

- Iterate Frequently: Use ChatGPT to continuously refine and optimize your strategy by tweaking parameters and indicators.

- Data Handling: Ensure that the bot can handle real-time data collection and preprocessing, and ChatGPT can help you structure your bot’s data pipeline.

- Risk Management: ChatGPT can assist in implementing advanced risk management features, such as trailing stop losses and dynamic position sizing.

5. Ultimate Meta-AI Scenario

The concept of using ChatGPT to help you build an AI trading bot highlights the ultimate meta scenario—where AI supports the development of AI-driven trading bots. For instance, by prompting ChatGPT to generate machine learning code that incorporates advanced algorithms like LSTM or Random Forest, you’re essentially using AI (ChatGPT) to build AI models that make market predictions and automate trades.

Example Prompt: Meta-AI for Model Training

"I want to use LSTM in Python to predict stock prices based on historical time series data. Can you generate the necessary code to collect data, train the LSTM, and output buy/sell signals based on the model's predictions?"

By leveraging ChatGPT’s ability to generate sophisticated Python scripts for machine learning, you can quickly implement powerful predictive models.

6. Combining AI with Automation for Trading Success

Once you have a functional AI bot, you can combine it with real-time data, automation, and broker APIs like Interactive Brokers or cTrader. For example, once ChatGPT helps you build the bot, you can deploy it on MetaTrader using Expert Advisors (EAs) or cBots on cTrader to automate execution across forex or CFD trades.

Conclusion

In summary, Python is the go-to for machine learning models and flexibility, especially when working with AI-driven models like Random Forest, LSTM, or Regression Analysis. It’s perfect for data analysis, pattern recognition, and predictive modeling. Meanwhile, C# with cTrader is ideal for performance-critical environments where low latency is essential.

- For AI-powered strategies: Python, combined with libraries like Scikit-learn, TensorFlow, or PyTorch, is your best bet.

- For high-speed execution and forex/CFD trading: C# with cTrader and cAlgo offers a robust, performance-driven environment.

By combining the strengths of both languages, you can design AI trading bots that are both sophisticated and scalable, whether you’re trading CFDs, forex, or other financial markets.

Our Recommended Broker

Just as a final thank you / bit of advice, if you enjoyed reading this article please check out Pepperstone to begin your journey with automated trading strategies. I know it’s difficult to get started and can be confusing at times, so that’s why I personally started with cTrader on Pepperstone which gave me excellent spreads, super quick execution and was honestly the best broker i could have asked for in terms of their customer service.

Check them out using this link here and sign-up today – happy trading :).

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-450x338.jpg)

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)