Opening a spread betting account is relatively simple. Here’s a guide to getting started.

Spread betting has long been a favourite among UK traders. Why? Because it’s tax-free (for now!), offers incredible flexibility, and allows you to speculate on a huge range of markets without actually owning any assets.

But how do you get started? Don’t worry—it’s not as complicated as it might seem. With this guide, I’ll walk you through the entire process of opening a spread betting account in the UK, breaking it down into easy steps and key considerations.

Let’s dive in!

What Is Spread Betting, and Why Is It So Popular in the UK?

Spread betting is a form of derivatives trading where you speculate on the price movements of an asset—be it forex, stocks, indices, or commodities—without owning the underlying asset. Instead, you bet on whether the price will rise or fall.

Why Do UK Traders Love Spread Betting?

- Tax-Free Profits: Any profits from spread betting are exempt from Capital Gains Tax (CGT) and Stamp Duty. (Disclaimer: Tax laws can change, so always double-check with HMRC!)

- Leverage: You can control larger positions with smaller capital, meaning you can maximise potential returns (but remember, it also magnifies losses).

- Flexibility: Trade across thousands of markets—forex, commodities, stocks, and indices—all from one account.

- Hedging: Many traders use spread betting to offset risks in their investment portfolios.

Now that we know the “why,” let’s move on to the “how.”

Step 1: Choose a Reputable Broker

The first and most important step is selecting the right spread betting broker. In the UK, you’ll want to stick with FCA-regulated brokers to ensure your funds are safe and the broker operates transparently.

What to Look for in a Broker

- FCA Regulation: This guarantees your funds are protected under the FSCS scheme (up to £85,000) and that you benefit from safeguards like segregated accounts and negative balance protection.

- Market Range: Look for brokers that offer a wide selection of spread betting markets, from forex and stocks to indices and commodities.

- Platform Features: Check if the broker provides tools like advanced charting, risk management options, and fast execution speeds.

- Costs: Compare spreads, commissions (if any), and overnight fees. Remember, tight spreads mean lower trading costs.

- Customer Support: Ensure the broker has reliable support in case you run into issues.

Top UK Spread Betting Brokers

Some of the best FCA-regulated brokers for spread betting in the UK include:

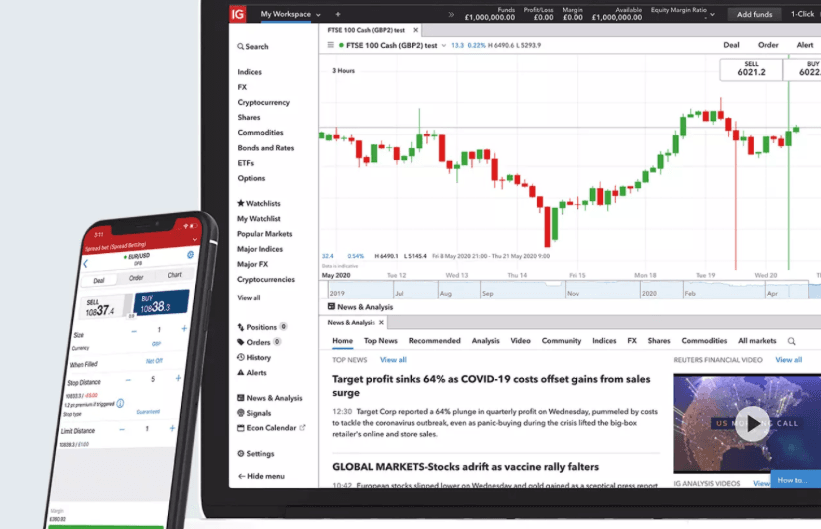

- IG: The market leader with 17,000+ markets, excellent tools, and tight spreads.

- City Index: A great option for beginners with a user-friendly platform and competitive pricing.

- Pepperstone: Known for its fast execution and low forex spreads.

Step 2: Register for an Account

Once you’ve chosen a broker, the next step is signing up for an account. This process is straightforward but involves some paperwork (don’t worry, it’s all digital).

What You’ll Need

- Personal Information: Name, address, date of birth, and contact details.

- Proof of Identity: Typically a passport or driving licence.

- Proof of Address: A recent utility bill or bank statement.

- Trading Experience: Many brokers will ask about your trading experience and financial background to assess whether spread betting is suitable for you.

If brokers ask for bank statements, utility bills and / or more personal information, you shouldn’t;t be worried, they do this in order to meet their compliance regulation and ensure proper KYC (Know Your Customer) regulations required by the FCA.

Step 3: Complete the KYC (Know Your Customer) Process

FCA-regulated brokers are legally required to verify your identity before you can start trading. This is part of the KYC process, which helps prevent fraud and money laundering.

How KYC Works

- Upload your proof of identity and address.

- Wait for the broker to verify your documents—this usually takes 24-48 hours.

- Once verified, you’re good to go!

Step 4: Deposit Funds

With your account verified, it’s time to fund it. Most brokers offer a range of deposit methods, including:

- Debit/Credit Card: Funds are typically available instantly.

- Bank Transfer: May take 1-3 working days.

- PayPal/Skrill: Fast and secure, though not all brokers support these methods.

How Much Should You Deposit?

Most brokers have a minimum deposit requirement, which is usually around £100-£250. However, you don’t need to max out your deposit initially—start small and get comfortable with the platform first.

If you have an issue calculating the correct lot size to start trading you can always use our lot size calculator which quickly calculates lot sizes for UK forex traders.

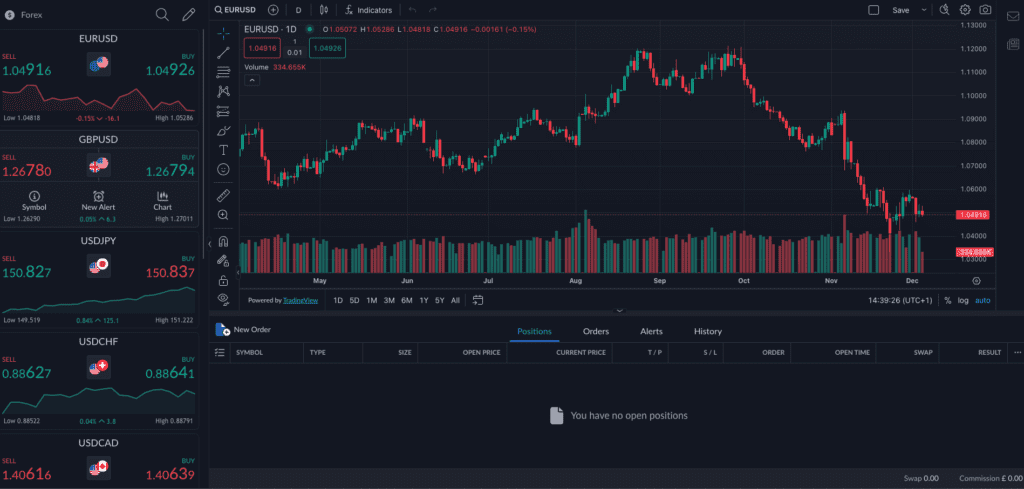

Step 5: Explore the Trading Platform

Before placing your first trade, spend some time getting to know the broker’s trading platform. Most brokers offer:

- Proprietary Platforms: IG’s web trader or City Index’s Web Trader.

- MetaTrader 4/5 (MT4/MT5): Popular for forex and algo traders.

- TradingView Integration: Ideal for advanced charting.

Use the Demo Account

Many brokers offer demo accounts, which let you practice spread betting with virtual funds. This is a great way to:

- Test the platform’s features.

- Experiment with different strategies.

- Get familiar with placing and closing trades.

Step 6: Place Your First Spread Bet

You’ve chosen a broker, verified your account, deposited funds, and explored the platform—now it’s time to place your first trade.

How Spread Betting Works

When you place a spread bet, you’re speculating on the price movement of an asset:

- Buy (Go Long): If you think the price will rise.

- Sell (Go Short): If you think the price will fall.

The size of your bet (e.g., £1 per point) determines your profit or loss. For example:

- If you bet £1 per point and the price moves 10 points in your favour, you make £10.

- If it moves 10 points against you, you lose £10.

Managing Risk

- Use Stop Losses: Automatically close your position if the market moves against you by a certain amount.

- Set Take Profit Levels: Lock in profits once a certain price is reached.

- Don’t Over-Leverage: Stick to the FCA’s leverage limits to avoid excessive risk.

Tax Implications of Spread Betting in the UK

One of the biggest advantages of spread betting is its tax-free status. Unlike traditional trading, profits from spread betting are exempt from:

- Capital Gains Tax (CGT): No matter how much you earn, it’s all yours.

- Stamp Duty: Because you don’t own the underlying asset, there’s no stamp duty to pay.

A Word of Caution

While spread betting is tax-free for now, tax laws can change. Always keep an eye on updates from HMRC.

Risks and Things to Watch Out For

Spread betting offers plenty of perks, but it’s not without risks. Here’s what you need to keep in mind:

- Leverage Amplifies Losses: While leverage can boost profits, it can also wipe out your account if the market moves against you.

- Overnight Fees: Holding positions overnight incurs a fee, which can add up if you’re not careful.

- Market Volatility: Sudden price swings can lead to unexpected losses, so always have a risk management plan.

Is Spread Betting Right for You?

Spread betting isn’t for everyone. Here are some pros and cons to help you decide:

Pros

- Tax-free profits.

- Access to thousands of markets.

- The ability to trade both rising and falling markets.

Cons

- High risk due to leverage.

- Overnight fees for holding positions.

- Limited availability outside the UK and Ireland.

Final Thoughts

Opening a spread betting account in the UK is a straightforward process, but it’s important to approach it with the right mindset. Choosing a reputable broker, understanding the risks, and practising on a demo account are all steps that can set you up for success.

Spread betting offers an exciting way to trade a huge range of markets, but it’s not a get-rich-quick scheme. Manage your risk, stay informed, and always trade within your means.

If you are interested in spread betting platforms, feel free to check out our site a bit more. If you want to get started, here’s a broker we recommend, IG.

£500 Recommended Deposit

Best for Variety

IG offers 17,000+ trading instruments and combines robust regulation with cutting-edge tools like ProRealTime, TradingView, and L2 Dealer.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-450x338.jpg)

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)