Spread betting on Forex (foreign exchange) is one of the most popular ways to speculate on the movement of currency pairs. It’s a tax-efficient way to trade, and because of the inherent volatility of currency markets, there are numerous opportunities to make profits. However, if you’re new to Forex spread betting, it’s crucial to understand the key concepts, including points, pips, and currency pair meanings. This guide will walk you through everything you need to know.

What is Forex Spread Betting?

Forex spread betting is a type of financial trading that allows you to speculate on the price movement of currency pairs without actually owning the underlying currencies. It’s called spread betting because you’re betting on whether the price will rise or fall, and the cost of your trade is embedded in the spread (the difference between the buy and sell price).

With Forex spread betting, you profit from the difference between your opening position and your closing position. This type of trading allows you to go long (bet on a rise in price) or short (bet on a fall in price) with leverage, which amplifies both your potential profits and losses.

Understanding Currency Pairs in Forex

Forex trading always involves a currency pair, where one currency is quoted against another. The first currency in the pair is called the base currency, and the second currency is called the quote currency.

What Does a GBP/USD Quote Mean?

A quote like GBP/USD = 1.3500 means that 1 British pound (GBP) is worth 1.3500 US dollars (USD). If the value of GBP/USD rises, it means that the pound has strengthened against the dollar. If it falls, the pound has weakened relative to the dollar.

Let’s look at some common currency pairs:

- EUR/USD: Euro vs. US Dollar

- GBP/USD: British Pound vs. US Dollar

- USD/JPY: US Dollar vs. Japanese Yen

- AUD/USD: Australian Dollar vs. US Dollar

- USD/CAD: US Dollar vs. Canadian Dollar

Key Terms Explained: Pips, Points, and Lots

What is a Pip?

A pip stands for “percentage in point” and is the smallest movement that a currency pair can make. In most currency pairs, a pip is the fourth decimal place (0.0001), but for pairs involving the Japanese Yen, a pip is the second decimal place (0.01). For example, if GBP/USD moves from 1.3500 to 1.3501, that’s a one-pip movement.

A pip is the smallest price move that a given currency pair can make, typically the fourth decimal place for most pairs or the second decimal place for pairs involving the Japanese Yen.

What is a Point?

A point is another way of measuring price movement. In Forex trading, one point typically refers to one pip. However, some brokers may use “points” to describe movements in fractions of a pip (for example, 0.1 or 0.01 pip). Make sure to clarify this with your broker.

What is a Lot?

Forex trades are often executed in lots:

- Standard lot: 100,000 units of the base currency.

- Mini lot: 10,000 units of the base currency.

- Micro lot: 1,000 units of the base currency.

Each lot size affects the value of each pip in your trade. For example, if you are trading a standard lot in EUR/USD, each pip movement will be worth $10. If you’re trading a mini lot, each pip movement will be worth $1.

How to Spread Bet Forex: Step-by-Step

Step 1: Choose a Forex Pair

The first step in spread betting Forex is to select a currency pair to trade. You might choose a major pair like EUR/USD, or a more volatile minor or exotic pair like USD/ZAR (US Dollar/South African Rand). The choice of currency pair often depends on market conditions and personal preference.

Step 2: Decide Whether to Go Long or Short

Once you’ve chosen a currency pair, decide if you expect the price to rise (go long) or fall (go short). If you expect the base currency to strengthen, you go long (buy). If you expect the base currency to weaken, you go short (sell).

Step 3: Set Your Bet Size (Per Point)

Next, decide how much to bet per point of movement. For example, if you bet £5 per point, and the price moves 20 points in your favor, you will make £100 (20 points x £5). If the price moves 20 points against you, you will lose £100.

Step 4: Use Leverage (Optional)

One of the benefits of spread betting is the ability to use leverage, which allows you to control a larger position with a smaller deposit (known as margin). For example, if you use leverage of 1:30, you can control a £30,000 position with just a £1,000 deposit. Keep in mind that while leverage amplifies profits, it also amplifies losses.

Step 5: Manage Risk with Stop-Loss Orders

It’s crucial to manage your risk with stop-loss orders, which will automatically close your position if the market moves against you by a certain amount. For example, if you set a stop-loss 20 pips below your entry point, your trade will automatically close if the market moves 20 pips in the wrong direction.

Step 6: Monitor and Close Your Position

After placing your trade, monitor the market and close your position when you’re satisfied with the profit or when you want to limit losses.

How to Measure Profits and Losses in Forex Spread Betting

Your profit or loss in spread betting depends on three factors:

- The number of points or pips the market moves.

- Your stake per point/pip.

- Whether you went long or short.

Example of a Winning Trade:

You bet £10 per point on GBP/USD at 1.3500, expecting it to rise. The market moves up to 1.3530, a 30-point movement. Your profit is:

- 30 points x £10 per point = £300.

Example of a Losing Trade:

You bet £10 per point on GBP/USD at 1.3500, expecting it to rise. Instead, the market falls to 1.3480, a 20-point movement against you. Your loss is:

- 20 points x £10 per point = £200.

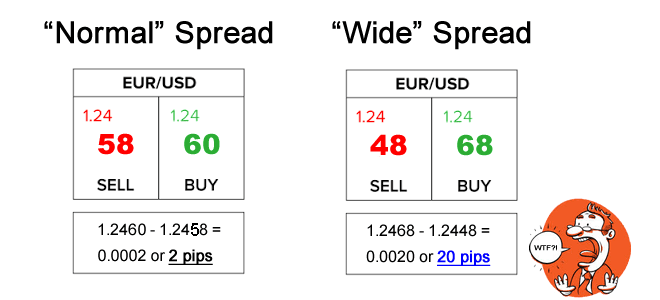

Understanding the Spread in Forex Betting

The spread is the difference between the buy (offer) price and the sell (bid) price of a currency pair. For example, if EUR/USD is quoted as 1.2100/1.2102, the spread is 2 pips. This spread is the cost of entering the trade. You need the market to move by at least the spread before you start making a profit.

What is the Spread?

The spread is the difference between the buy and sell prices in a market. It’s essentially the broker’s fee for placing your trade. The smaller the spread, the less the market needs to move in your favor before you start profiting.

Choosing a Forex Spread Betting Broker

Not all brokers are created equal, and choosing the right broker is crucial for your success in Forex spread betting. Here are some factors to consider:

- Regulation: Ensure your broker is regulated by a recognized financial authority such as the FCA in the UK.

- Spreads: Look for brokers with tight spreads, as this will reduce the cost of your trades.

- Leverage: Check the leverage options available and choose a broker that offers leverage that suits your trading style.

- Risk Management Tools: Make sure the broker offers risk management features like stop-loss orders and guaranteed stop-losses.

Our recommendation is either Pepperstone or ActivTrades for spread betting in the UK.

Is Forex Spread Betting Tax-Free?

In the UK, spread betting is tax-free, which means profits are not subject to capital gains tax or income tax. However, this tax-free status only applies to individuals who are not classified as professional traders by HMRC. If your spread betting activities are considered professional, you may be liable for taxes.

Callout: Is Forex Spread Betting Tax-Free?

Yes, spread betting is tax-free for most individuals in the UK, meaning your profits are not subject to capital gains tax. However, if HMRC considers your trading activity as professional, you could be taxed.

What is Automated Forex Trading?

Automated Forex trading involves using pre-programmed algorithms to execute trades on your behalf. These algorithms follow predefined rules based on technical indicators, price levels, or market conditions. Once the strategy is set up, the software continuously scans the markets and executes trades when the conditions meet your set criteria.

What is Automated Forex Trading?

How Automated Strategies Work in Forex

Automated strategies work by using trading platforms that allow traders to program their trading rules. For example, platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) allow traders to write scripts or use Expert Advisors (EAs) to automate their trading, traders can also use TradingView’s Pine Script code to create an automated strategy. Traders input their parameters such as:

- Entry points (e.g., when the price crosses a moving average)

- Exit points (e.g., profit targets or stop-loss levels)

- Lot sizes and risk management rules

Once these rules are set, the trading bot will execute trades when the parameters are triggered, often 24/7. Automated trading is particularly useful in high-volume trading or for strategies that require quick decision-making, such as scalping.

Using AI in Forex Trading

AI trading takes automated strategies a step further by allowing the system to learn and adapt from market data. Unlike traditional automated strategies, which follow rigid rules, AI systems can modify their behavior based on patterns they detect over time. This is done through techniques like machine learning and deep learning.

What is AI Trading?

AI trading uses advanced machine learning algorithms to analyze market data and automatically adjust trading strategies. These systems can evolve and improve over time, identifying patterns in real-time that may not be apparent to human traders.

Key Differences Between Automated Trading and AI

- Automated Trading: Follows predefined rules strictly, such as moving average crossovers, price breakouts, or RSI levels. It doesn’t learn from new data; the strategy remains static unless modified manually.

- AI Trading: In contrast, AI trading systems can adapt and evolve based on market conditions. AI models use historical and real-time data to spot trends, adjust strategies dynamically, and even predict market movements.

Conclusion

Forex spread betting is a flexible, tax-efficient way to speculate on the price movement of currency pairs. Understanding how pips, points, and spreads work is key to succeeding in this type of trading. Whether you’re a beginner or an experienced trader, using proper risk management strategies like stop-loss orders and leveraging the benefits of tax-free profits (for UK residents) can help maximize your trading potential while minimizing risks.

As with any leveraged product, itis essential to stay informed, practice with demo accounts, and manage risks effectively. With the right knowledge and approach, spread betting on Forex markets can be a powerful tool for traders seeking to capitalize on global currency movements.

Remember: Before placing any trades, make sure you understand how points, pips, and spreads work, and always choose a regulated broker that fits your trading style and risk tolerance.

Get Started

To get started trading Forex simply sign-up to our recommended broker, Pepperstone and you can start trading today.

Sources for Further Reading:

- https://www.investopedia.com/terms/f/forex-spread-betting.asp

- https://www.fxcm.com/uk/forex/spread-betting/

- https://www.ig.com/uk/spread-betting

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-450x338.jpg)

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)