When I first started trading, TradingView was my go-to charting platform before I even knew much about brokers or automation tools like MT4, MT5, or cBots. The intuitive interface, clean charts, and powerful tools are pretty alluring for first-time traders & beginners. So, when I discovered PineScript—TradingView’s proprietary scripting language—it felt like opening a door to endless customisation in my favourite platform by that point. That was 5 years ago now and I’m still an avid fan of TradingView’s proprietary scripting language.

So, if you’ve ever wondered whether PineScript is a serious contender for automated trading or just a beginner’s toy, hopefully I’ll be able to clear some of that up for you today. Trust me, I’ve been there, questioning whether it could compete with heavyweight tools like cBots or the more established MT4/MT5 ecosystem. The short answer? It depends on what you’re looking for. Let’s dive in and see if & where PineScript can compete.

What Is PineScript, and Why Does It Matter?

PineScript is TradingView’s native coding language, designed to help traders create custom indicators and strategies. Whether you’re plotting moving averages or building a full-fledged trading bot, PineScript gives you the tools to bring your ideas to life directly within the TradingView platform.

What makes PineScript special is its simplicity. Unlike MQL (used for MT4/MT5) or C# (used for cBots), PineScript is designed for traders who might not have a coding background. It’s a scripting language you can pick up quickly, and because it’s embedded within TradingView, there’s no need for external software or clunky integrations.

Why TradingView Is the Go-To Platform for UK and US Traders

Before diving deeper into PineScript, it’s worth highlighting why TradingView has become the preferred choice for many traders, particularly in the UK and US:

- Intuitive Design: TradingView’s interface is clean, modern, and easy to navigate, making it perfect for beginners and advanced traders alike.

- Powerful Tools: From real-time data to an extensive library of indicators, TradingView offers everything you need for technical analysis.

- Community-Driven: One of my favorite aspects is the vast community sharing ideas, scripts, and insights. It’s a hub for collaboration and learning.

- Cross-Platform Availability: Whether you’re on desktop, mobile, or tablet, TradingView’s functionality remains consistent.

If you’re trading with brokers like Pepperstone or EightCap, which fully integrate with TradingView, you’re already in a fantastic position to leverage PineScript to its fullest potential.

How to Set Up PineScript for Automated Trading

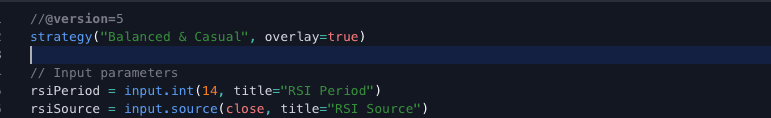

One of PineScript’s biggest selling points is its ease of setup. Unlike MT4/MT5, where you need separate software installations and plugins, PineScript is built directly into TradingView. Here’s how to get started:

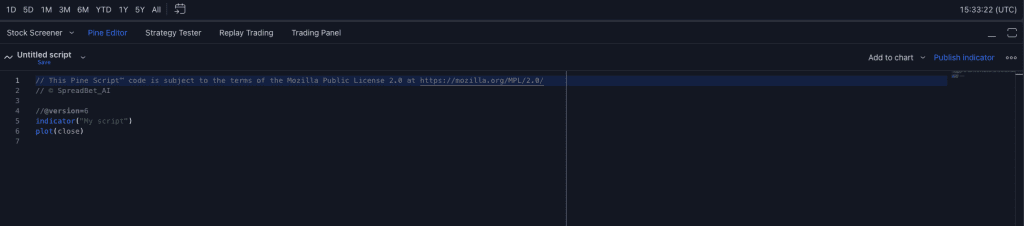

- Accessing the Pine Editor:

- Open TradingView and select any chart.

- Click on the “Pine Editor” tab at the bottom of the screen.

- This opens a code editor where you can write, modify, and run scripts.

- Creating Your First Script:

- Begin with a simple example, such as plotting a moving average:

//@version=5 indicator("Simple Moving Average", overlay=true) plot(sma(close, 20))- Click “Add to Chart,” and you’ll see your moving average appear immediately.

- Testing and Deploying Scripts:

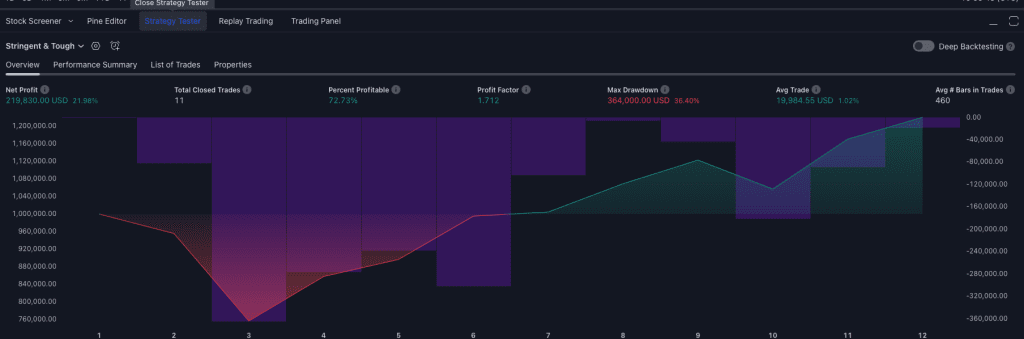

- Use TradingView’s built-in strategy tester to backtest your script.

- Adjust parameters and refine your logic based on performance metrics like net profit, drawdown, and win rate.

- Integration with Brokers:

- For live trading, PineScript integrates seamlessly with brokers like Pepperstone and EightCap. This allows you to execute trades directly from your PineScript strategies.

Strategies vs. Indicators: What’s the Difference?

One common question is whether PineScript strategies and indicators are interchangeable. While they share similarities, their purposes are distinct:

- Indicators: Tools that analyze market data and display visual signals. Examples include RSI, Bollinger Bands, or moving averages. Indicators help you decide when to trade but don’t execute trades themselves.

- Strategies: Built for execution. A PineScript strategy not only signals when to trade but can also automate entry and exit points based on predefined rules.

Can You Use a Strategy as an Indicator?

Yes, you can adapt a strategy to function as an indicator in PineScript. By modifying the script’s declaration from strategy() to indicator(), you can transform trading signals into visual cues without simulating trades. This approach is useful if you want to monitor conditions without executing trades automatically.

Is PineScript Better than cBots and MT4/MT5?

When it comes to automated trading for beginners, PineScript stands out for its simplicity and integration with TradingView. However, tools like cBots (used with cTrader) and MT4/MT5 (MetaTrader platforms) are industry benchmarks for professional algo trading. Let’s compare them head-to-head:

Best for Beginners PineScript |

Best for Intermediate Traders cBots (cTrader) |

Best for Classic Traders MT4/5 | |

|---|---|---|---|

| Ease of Use | Beginner-friendly; easy to learn | Moderate; requires C# programming | Complex; requires MQL4/MQL5 knowledge |

| Platform Integration | Built directly into TradingView | cTrader platform | Separate MT4/MT5 software |

| Broker Compatibility | Works with TradingView-integrated brokers (e.g., Pepperstone, EightCap) | Supported by brokers offering cTrader | Widely supported by most brokers |

| Automation Support | Limited to TradingView so no VPS required | Strong VPS support; tailored for automation | Full VPS and EA support |

| Community and Resources | Active TradingView community | Smaller but growing community | Large community, long-established |

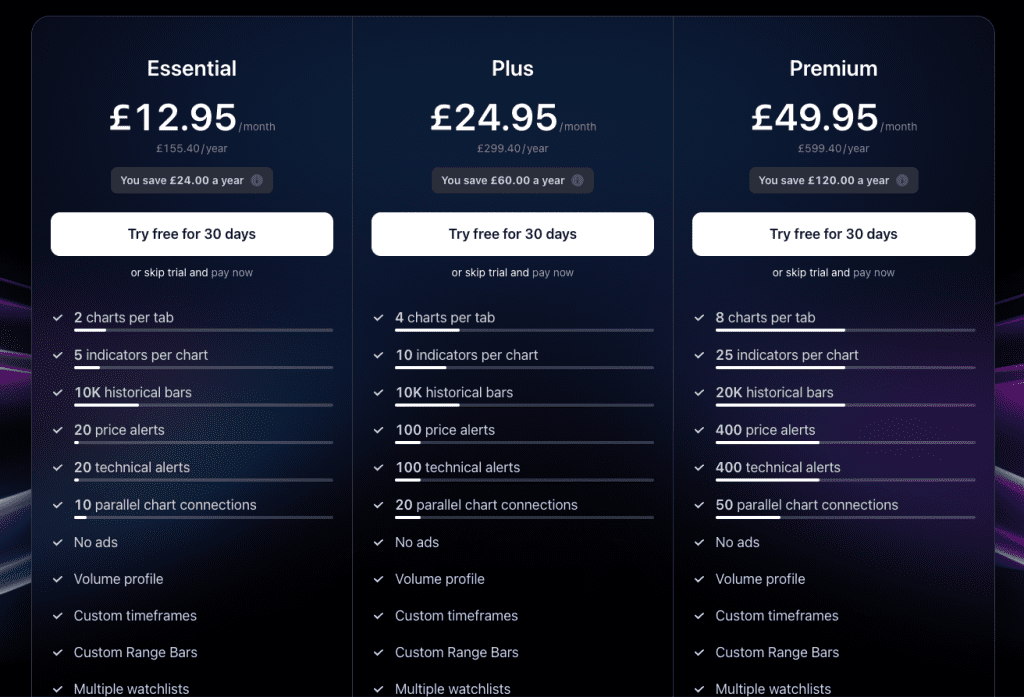

| Strategy Testing | Built-in strategy tester; fast and visual (Premium Plans) | Strong backtesting tools in cTrader but less user-friendly | Advanced backtesting in MT5 |

| API Access | No API support | Full API for custom trading systems | Limited API; relies on third-party tools |

| Best Use Case | Visualizing and testing ideas quickly | Advanced custom automation | Comprehensive algo trading and manual traders |

Which One Is Right for You: cBots, MT4/5 or PineScript?

If you’re new to algo trading or primarily use TradingView, PineScript is your best bet for simplicity and accessibility. For traders requiring deep automation, VPS integration, and custom APIs, cBots or MT4/MT5 might be better choices. However, they come with steeper learning curves.

Ease of Use:

- PineScript: Designed for simplicity, making it accessible even if you’re new to coding.

- cBots: Requires knowledge of C#, which might be challenging for beginners.

- MT4/MT5: Uses MQL language; a steeper learning curve but well-documented.

Customization and Functionality:

- PineScript excels in creating custom indicators and visual tools within TradingView.

- cBots and MT4/MT5 offer more advanced automated trading capabilities, suitable for complex algorithmic strategies.

Broker Compatibility:

- TradingView integrates with brokers like Pepperstone and EightCap, enabling direct trading from the platform.

- cTrader and MT4/MT5 are widely supported by many brokers, offering more options.

Execution Speed:

- For high-frequency trading, execution speed is critical. MT4/MT5 and cBots can leverage VPS hosting for low latency.

- PineScript execution depends on TradingView’s servers, which might not be ideal for ultra-fast trading strategies.

Different Types of PineScript: Indicators vs. Strategies

One of PineScript’s strengths is its flexibility. Whether you’re plotting simple indicators or building complex trading strategies, PineScript has you covered. But understanding the difference between these two approaches is key.

What is a PineScript Indicator?

Indicators are designed to provide visual cues on the chart. They don’t place trades but instead give you insights into when and where to act.

For example, you could create an RSI-based indicator to highlight overbought and oversold conditions:

//@version=5

indicator("RSI Indicator", overlay=true)

rsiValue = rsi(close, 14)

plot(rsiValue, color=color.blue)

hline(70, "Overbought", color=color.red)

hline(30, "Oversold", color=color.green)

This indicator helps you spot trends but leaves the decision-making to you.

What is a PineScript Strategy?

Strategies take the next step by automating trades based on predefined rules. These can be backtested directly on TradingView to refine their profitability.

Here’s a simple moving average crossover strategy:

//@version=5

strategy("Simple MA Crossover", overlay=true)

fastMA = ta.sma(close, 10)

slowMA = ta.sma(close, 30)

plot(fastMA, color=color.green)

plot(slowMA, color=color.red)

if ta.crossover(fastMA, slowMA)

strategy.entry("Buy", strategy.long)

if ta.crossunder(fastMA, slowMA)

strategy.close("Buy")

This strategy places a long trade whenever the fast-moving average crosses above the slow-moving average and exits when it crosses back.

Can You Use a Strategy as an Indicator?

This is a question that often comes up among beginners exploring PineScript: can a strategy be used as an indicator? The short answer is yes, but there are nuances to consider.

Strategies vs. Indicators: What’s the Difference?

- Indicators: These are tools designed to analyze price data and display information on a chart. They can suggest possible buy or sell opportunities based on user-defined conditions. However, indicators themselves do not execute trades.

- Strategies: Unlike indicators, strategies in PineScript are designed for automated trading. They can both display signals and execute trades based on the logic you’ve programmed. When running a strategy on TradingView, you can backtest it and simulate trades to evaluate its performance.

The distinction lies in their functionality: indicators help guide decisions, whereas strategies can automate them.

How Can You Turn a Strategy into an Indicator?

By removing the trading logic (e.g., strategy.entry commands) and focusing solely on signalling (e.g., plotting arrows or markers), you can convert any strategy into a visual indicator. This approach is perfect for testing ideas visually before committing to live execution.

Advanced Use Cases for PineScript

PineScript isn’t just for simple indicators or strategies. Its flexibility allows traders to build highly customized tools to fit their specific trading needs. Here are a few advanced use cases:

1. Multi-Timeframe Analysis

PineScript enables the inclusion of data from multiple timeframes in a single script. For example, you can create an indicator that shows the RSI of a higher timeframe while you trade on a lower timeframe chart. This adds a layer of context to your trading decisions.

Example:

//@version=5

indicator("Multi-Timeframe RSI", overlay=false)

higherTimeframe = request.security(syminfo.tickerid, "D", close)

rsiHTF = ta.rsi(higherTimeframe, 14)

plot(rsiHTF, color=color.orange, title="Daily RSI")

This script overlays the RSI from the daily chart onto your current timeframe, helping you align trades with broader trends.

2. Custom Alerts

One of PineScript’s standout features is its ability to create tailored alerts. Whether you want to receive a notification when a moving average crossover occurs or a breakout happens, PineScript can deliver alerts directly to your phone or email via TradingView’s alert system.

Example:

//@version=5

indicator("Crossover Alert", overlay=true)

fastMA = ta.sma(close, 10)

slowMA = ta.sma(close, 30)

plot(fastMA, color=color.green)

plot(slowMA, color=color.red)

if ta.crossover(fastMA, slowMA)

alert("Fast MA crossed above Slow MA", alert.freq_once_per_bar_close)

3. Risk Management Tools

You can integrate risk management directly into your strategies. For example, setting a fixed percentage of your equity as a stop-loss or take-profit level ensures consistency in your trades.

Example:

//@version=5

strategy("Risk Management Example", overlay=true)

entryPrice = strategy.position_avg_price

stopLossLevel = entryPrice * 0.98 // 2% stop loss

takeProfitLevel = entryPrice * 1.02 // 2% take profit

if ta.crossover(ta.sma(close, 10), ta.sma(close, 30))

strategy.entry("Buy", strategy.long)

strategy.exit("Exit", from_entry="Buy", stop=stopLossLevel, limit=takeProfitLevel)

Optimizing PineScript Strategies

Creating a profitable strategy is just the first step. Optimization ensures that your script performs well across different market conditions. Here are some tips to refine your PineScript strategies:

1. Use Parameter Inputs

Make your script adaptable by adding inputs for key variables like moving average lengths, RSI thresholds, or stop-loss levels. This lets you adjust parameters easily during backtesting.

Example:

//@version=5

strategy("Optimisable Strategy", overlay=true)

fastLength = input.int(10, minval=1, title="Fast MA Length")

slowLength = input.int(30, minval=1, title="Slow MA Length")

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

plot(fastMA, color=color.green)

plot(slowMA, color=color.red)

if ta.crossover(fastMA, slowMA)

strategy.entry("Buy", strategy.long)

2. Analyze Key Metrics

When backtesting, pay attention to metrics like win/loss ratio, profit factor, and maximum drawdown. These give you a deeper understanding of your strategy’s strengths and weaknesses.

3. Test Across Multiple Markets

Don’t limit your testing to a single asset. A robust strategy should perform well across various markets, such as forex, indices, and commodities. TradingView makes this simple by allowing you to test scripts on any instrument.

Is TradingView any good for UK or US Traders?

If you’re trading in the UK or the USA, TradingView is frankly unmatched in its versatility and user experience. I honestly don’t know what I’d do without TradingView in my life, this site certainly wouldn’t exist (!) Comparing it to MetaTrader in particular and the difference is in accessibility & ease-of-use for beginners was staggering. Here’s why it’s good for UK traders & beginners in particular:

1. User-Friendly Interface

Unlike the sometimes clunky UI of MT4/MT5, TradingView’s interface is sleek, modern, and highly intuitive. Whether you’re creating a PineScript strategy or just charting, the platform feels seamless.

2. Cross-Platform Accessibility

TradingView works well on web browsers, desktop apps, and mobile devices. You can access your charts and scripts anywhere, which is invaluable for traders on the go.

3. Community and Sharing

The TradingView community is unparalleled. You can publish your scripts to share with others, browse the extensive library of user-generated indicators, or follow top traders for insights.

4. Integration with Top Brokers

TradingView connects directly to brokers like Pepperstone and EightCap, allowing you to execute trades without leaving the platform. This integration streamlines the trading experience, especially for those who rely on PineScript for automation.

Which Broker is best for PineScript / TradingView?

Both Pepperstone and EightCap are excellent choices for TradingView users. Here’s why:

- Pepperstone offers competitive spreads, robust execution speeds, and full TradingView integration. Their Razor account is particularly suited for high-frequency traders.

- EightCap stands out for its wide range of CFD instruments, including cryptocurrencies, and seamless TradingView compatibility.

These brokers enhance TradingView’s capabilities, making them the go-to choices for traders in the UK and USA.

£500 Recommended Deposit

Best Overall

Pepperstone is a Melbourne-based broker that offers an excellent selection of trading instruments in the financial trading markets, including commodities, shares, ETFs and more.

75.5% of retail investor accounts lose money when trading on margin with this provider

Is PineScript Actually Any Good for Automated Trading?

So, in summary, and to answer the question in this article. Yes, PineScript is fantastic for automated trading, even stacked up against fierce competitors like cTrader & MT4/MT5. it’s clear that PineScript has a unique niche in the world of automated trading and is especially beginner friendly for those wanting to get up-and-running with automated strategies quickly and efficiently.

Where PineScript works well

- Ease of Use: PineScript’s streamlined code structure and TradingView integration make it accessible for those new to coding and trading.

- Visualization: Strategies and indicators are visually displayed on the charts, helping traders fine-tune their setups.

- Community: TradingView’s strong community provides a wealth of shared scripts and collaborative opportunities.

Limitations of PineScript

- Execution: While PineScript strategies can automate trading, they rely on TradingView-compatible brokers like EightCap and Pepperstone. This limits its flexibility compared to MT4/MT5.

- Complexity: PineScript doesn’t support real-time intrabar data without workarounds like

security(), which can make high-frequency trading challenging. - Lack of Native VPS Support: For fully automated, latency-sensitive strategies, PineScript lacks direct VPS integration.

- TradingView Pricing: Can sometimes be super inaccessible for the more advanced plans necessary for automated trading and for those starting out (see below).

Resources for Further Learning

To deepen your understanding of PineScript and TradingView, here are some valuable resources:

- TradingView Pine Script Documentation

Official Documentation

The best place to start learning the syntax, functions, and capabilities of PineScript. - TradingView Community Scripts

Community Library

Explore thousands of shared PineScripts for inspiration or direct use. - TradingView Broker Reviews

Pepperstone Review

EightCap Review

These reviews provide detailed insights into brokers that integrate with TradingView. - YouTube Tutorials

Search for “PineScript for Beginners” or “Automated Trading with PineScript” to find step-by-step guides. - Forums and Community Discussions

Join the TradingView Forum to ask questions and learn from other traders. - Demo Accounts for Practice

Open a demo account with EightCap or Pepperstone to test PineScript strategies in a risk-free environment.

Final Thoughts

If you’re looking for a tool that balances simplicity with powerful automation features, PineScript is an excellent choice.you can’t really go wrong with TradingView & broker integration on one of the most robust platforms available. For UK traders, both EightCap & Pepperstone are the best trading brokers for TradingView offering super low trading costs & spreads.

With a bit of learning and experimentation, PineScript can elevate your trading game, whether you’re starting as a manual trader or venturing into automation.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-450x338.jpg)

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)