When I first started spread betting, one of the terms that caught me off guard was ‘points’. Unlike traditional trading, where prices move in familiar currency units like pounds or dollars, spread betting introduced this whole new concept. If you’re new to this world, you might find points a little confusing, especially when you start comparing them to ‘pips’in Forex trading.

Understanding these terms is key to mastering your spread betting strategy. So, in this guide, we’re going to break it all down. We’ll explore what points mean in spread betting, how they’re different from pips in Forex, and we’ll walk through some practical examples to show you exactly what’s at risk when trading.

What are ‘Points’ in Spread Betting?

So, what exactly is a point in spread betting? Simply put, it’s the unit of measurement used to track price changes in the market. Unlike stocks, where a movement is measured in dollars, euros, or pounds, spread betting prices shift in points.

Let’s break it down: in spread betting, a point could represent a penny, a cent, or sometimes even a whole dollar or pound, depending on the asset. You bet on how much that price will move in points—either up or down—and the result is tied directly to the stake you choose.

For example, if you’re betting £5 per point, and the market moves 10 points in your favor, you’d make £50 (£5 x 10 points). But keep in mind, if the market moves against you by 10 points, you’d lose £50.

Understanding the Financial Implication of Points

The most critical thing to understand is how points translate into actual money. Your stake per point determines your profit or loss. Here’s how it works:

If you bet £10 per point and the market moves 20 points, you’ll either make or lose £200 (£10 x 20 points). This direct relationship makes points a vital part of spread betting strategies—get your predictions right, and you could see significant gains. However, an unfavorable market movement can lead to just as significant losses.

Spread Betting vs. Traditional Trading

Unlike traditional trading, where you buy an asset hoping its value rises, spread betting lets you speculate on price movements without owning the underlying asset. Instead of buying shares, you bet on whether the price will go up or down. Your profit or loss in spread betting comes from how accurate your predictions are and how much the price moves in points.

For example, in stock trading, if you buy 100 shares of a company at £10, and the price increases to £15, you’d make £500 (£5 profit per share x 100 shares). In spread betting, you’re simply betting on the number of points the price will move, making it easier to profit from both rising and falling markets.

What are ‘Pips’ in Forex Trading?

When you venture into Forex trading, you’ll come across pips. A pip stands for ‘percentage in point’ and represents the smallest movement a currency pair can make. Typically, this is a one-digit move in the fourth decimal place of a currency pair.

For instance, if GBP/USD moves from 1.3000 to 1.3001, that’s a one-pip move. While this might seem small, in Forex trading, even these tiny shifts can represent substantial gains or losses, especially if you’re trading in large volumes.

Points vs. Pips: The Key Differences

Now, you might be wondering: what’s the difference between points and pips? Let’s break it down:

- Market Application: Points are used across various financial markets in spread betting, from stocks to commodities. Pips, on the other hand, are specific to Forex trading.

- Value Representation: Points can represent movements of varying values (like pennies, cents, or dollars), while pips are always a fixed value in Forex, typically in the fourth decimal place.

- Use in Trading: In spread betting, points measure the total price movement of the asset, while pips in Forex measure very small fluctuations in exchange rates.

Example 1: Stock Market Spread Bet

Let’s look at a typical spread bet on the stock market:

Scenario: You place a spread bet on a stock priced at £100, betting £20 per point. The stock price increases by 50 points.

Calculation: You’ve bet £20 per point, so if the stock moves 50 points, your profit is £1000 (50 points x £20). Conversely, if the stock had fallen 50 points, your loss would have been £1000.

Example 2: Forex Market Spread Bet

Here’s an example from the Forex market:

Scenario: You bet on GBP/USD, expecting the price to rise, with a stake of £10 per point. The currency pair moves from 1.3000 to 1.3050, a movement of 50 pips.

Calculation: The move from 1.3000 to 1.3050 is 50 pips, which is also 50 points in spread betting terms. Your profit would be £500 (50 x £10). However, if the market had moved against you, that would have resulted in a £500 loss.

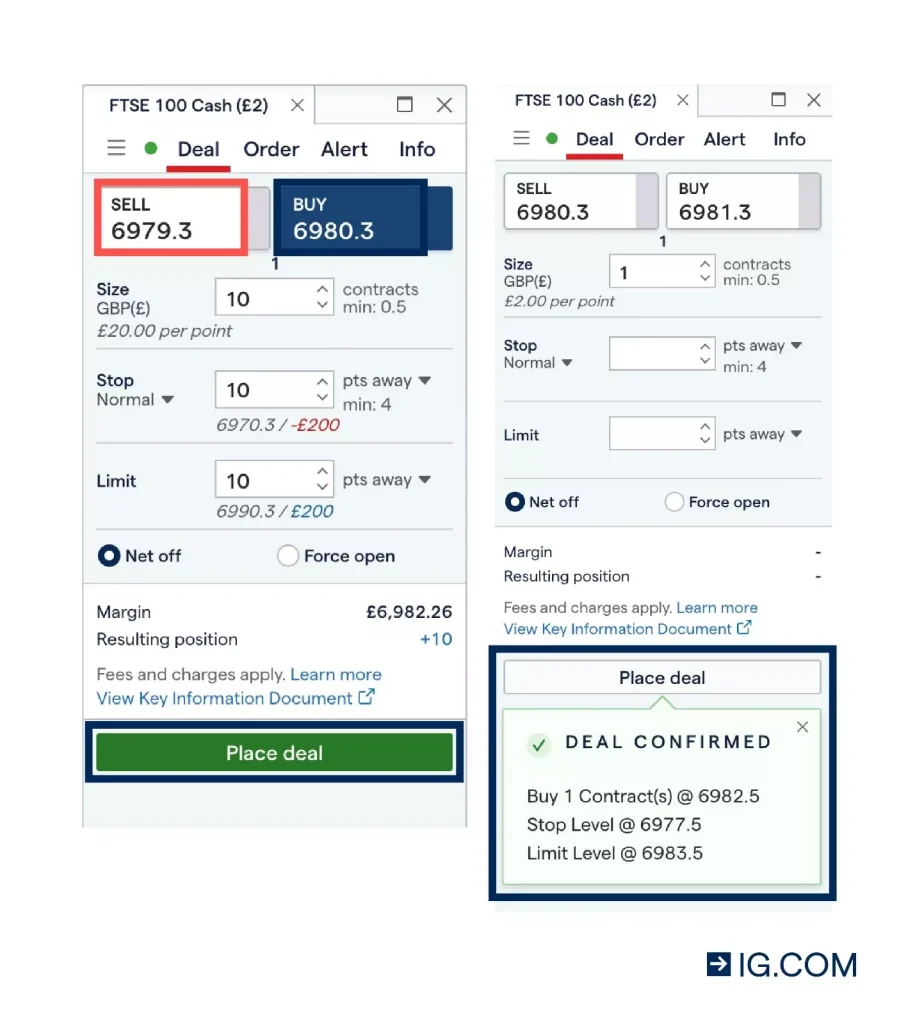

Risk Management in Spread Betting

If there’s one thing every spread bettor needs to take seriously, it’s risk management. Since you can lose more than your initial deposit in spread betting, tools like stop-loss orders are essential. A stop-loss order will automatically close your position if the market moves too far against you, helping to limit your losses.

Without risk management, it’s easy to let losses spiral out of control, especially if the market takes an unexpected turn. Always set clear limits on your trades and use these tools to safeguard your capital.

Conclusion

Understanding points in spread betting—and how they compare to pips in Forex trading—is critical for mastering the market. Whether you’re betting on stocks, forex, or commodities, knowing how much you stand to gain or lose per point of movement can make all the difference in your trading strategy.

By grasping these concepts and applying sound risk management, you can navigate spread betting with greater confidence. Just remember, spread betting offers the potential for significant rewards, but with that comes the potential for significant risk. Always trade responsibly.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.