ActivTrades Spread Betting Review: UK 2025

We recently took some time to explore ActivTrades, which is frankly a great broker that most people have likely never even heard of before, and a broker that I hadn’t really used until this review, but I was shocked by what they offered and it’s well worth considering as a top spread betting broker.

In Summary: they have a strong regulatory framework, competitive spreads, and advanced trading platforms and our one of our favourite spread betting brokers, full stop. I’ll dive into ActivTrades’ core strengths and areas for improvement (IMHO), based on my experience with its platforms, fees, and customer support.

Overall Rating – 4.5 / 5 stars

4.5 out of 5.0 stars

ActivTrades stands out due to its strong regulatory compliance, competitive spreads, and top-tier trading platforms like MetaTrader 4, MetaTrader 5, and their own proprietary platform: ActivTrader. The broker’s extensive educational resources and solid customer support are ideal for both beginners and advanced traders. ActivTrades remains a top contender in the world of forex, indices, and CFD trading.

Pros

- Advanced trading platforms including MetaTrader 4 and MetaTrader 5, plus ActivTrader

- Strong regulatory framework, regulated by the FCA in the UK and other jurisdictions

- Wide range of markets including Forex, commodities, indices, shares, and ETFs

- Competitive spreads and no commission on most trades

- Comprehensive educational resources and trading tools for traders of all levels

Cons

- Some account types and features might be restricted to certain jurisdictions

- May not offer as wide a range of cryptocurrencies as specialized crypto exchanges

- Customer support could have limited availability in certain languages

- Trading costs and fees may not be the lowest for high-volume traders compared to some other brokers

1. Trading Markets – 4.5 / 5 stars

4.5 out of 5.0 stars

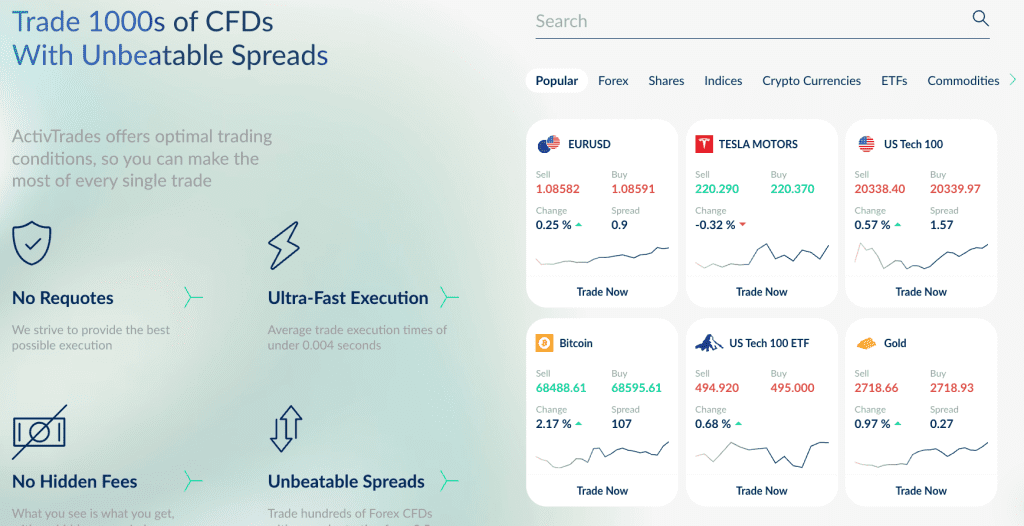

ActivTrades impressed me with a well-rounded selection of trading instruments, perfect for those looking to diversify their portfolios. While they may not offer as broad a range as some mega-brokers, their coverage of forex, indices, commodities, shares, ETFs, and even crypto (for pro clients) hits all the essentials with ease.

Here’s a rundown of what you can trade with ActivTrades:

- Forex: With over 50 currency pairs, including majors, minors, and exotics, ActivTrades offers enough variety to keep forex traders satisfied. I found spreads starting as low as 0.5 pips on major pairs like EUR/USD, which is competitive but not the lowest available. Whether you’re scalping or holding positions overnight, ActivTrades has plenty of forex action.

- Indices: ActivTrades provides access to popular global indices like the S&P 500, FTSE 100, and DAX 30, ideal for those who want to trade broader market movements without individual stock risk. The indices offering is solid, and the spreads are reasonable, making it a practical choice for index traders.

- Commodities: If commodities are your thing, ActivTrades covers both hard and soft options, from gold and silverto oil and agricultural products. This is especially beneficial if you want to hedge against inflation or speculate on the energy and metal markets.

- Shares and ETFs: ActivTrades brings a decent range of global stocks through CFDs, letting you tap into the price movements of top companies without ownership hassles. For ETFs, they cover some key options, allowing you to trade broader sectors and themes with leverage.

- Cryptocurrencies: Here’s a heads-up — crypto trading is limited to professional clients due to UK regulations, which can be a downside if you’re retail and into crypto. But if you qualify as a professional trader, ActivTrades lets you trade key cryptos like Bitcoin, Ethereum, and Ripple, adding an extra asset class to diversify with.

Verdict: ActivTrades does a great job at covering core markets, making it ideal if you’re a forex or index-focused trader but want a bit of variety.

ActivTrades Markets Summary.

Very Good Range of Instruments and Spreads are Competitive.

2. Fees – 4.5 / 5 stars

4.5 out of 5.0 starsActivTrades has a competitive fee structure, particularly with no commissions on most trades. Their spreads start from 0.5 pips on major Forex pairs, which isn’t the tightest in the industry but still competitive enough. No inactivity fees and no deposit fees are a bonus. Here’s the fee structure:

- Forex Spreads:Spreads start from 0.5 pips on major currency pairs like EUR/USD. While you can find tighter spreads at some brokers, the lack of additional commission fees on these trades helps keep things simple. You’re not getting the rock-bottom spreads that you’d find in some pro-level accounts, but for most retail traders, this should feel pretty fair.

- Commissions: Now, here’s where there’s a tiny fee. If you’re trading shares or ETFs, you’ll face a small 0.1% commission per trade. This is minimal enough that it shouldn’t scare anyone off, even if you’re trading smaller amounts.

- Inactivity Fee: Like many brokers, ActivTrades charges an inactivity fee if your account is inactive for one year or more, so make sure to stay active. Honestly, though, if you’re logging in to check on your account every few months, this shouldn’t be an issue.

Overall, cost transparency is one of ActivTrades’ strong points. The spreads are in line with industry standards, and I didn’t find any hidden fees that would surprise traders.

Verdict: If you’re a high-volume trader, you might want to compare the costs with other brokers, as their fees might not be the lowest on the market. However, for the average retail trader, I found the pricing structure to be quite reasonable.

ActivTrades Fees Summary.

Competitive Fee Structure with Minimal Added Costs.

3. Trading Platforms – 4.8 / 5 stars

4.8 out of 5.0 stars

What I particularly enjoyed with ActivTrades is their platform flexibility. They offer MetaTrader 4 (MT4) and MetaTrader 5 (MT5), like many other top-tier brokers like Pepperstone, which are the go-to platforms for many traders. Both platforms are packed with advanced charting tools, Expert Advisor (EA) support for automated trading, and customizable layouts. MT5, in particular, takes it up a notch with more timeframes and analytical tools.

And then there’s their proprietary ActivTrader platform — I’ll be honest, I really liked the modern design and how easy it was to navigate. It’s fast, responsive, and includes features like smart order placement and advanced risk management. Whether you’re an experienced trader or a beginner, ActivTrader feels like a solid option that doesn’t skimp on functionality.

- MetaTrader 4 and 5: These are industry-leading platforms, known for their customizability, algorithmic trading features (Expert Advisors), and deep technical analysis tools. MT5 builds on MT4 with more order types, enhanced tools, and better execution features.

- ActivTrader: Now, let’s talk about the real star here. ActivTrader is ActivTrades’ own platform, and I honestly enjoyed the experience. The interface is smooth, modern, and feels intuitive. It’s packed with features like smart order placement and advanced risk management tools, making it a solid choice whether you’re a beginner or seasoned pro. One feature I loved is the market sentiment tool, which gives you real-time insights into what other traders are doing—a cool add-on that makes you feel a bit more plugged into the market.

- TradingView: And if you’re a charting enthusiast, you’re in luck—ActivTrades integrates with TradingView, meaning you can trade directly from those sleek, advanced TradingView charts. This feature alone is a game-changer for those who rely heavily on visuals and technical analysis.

Verdict: Across all platforms, execution is fast, with low latency, making it great for scalpers and high-frequency traders (just maybe watch the fees(!). The range of platforms makes ActivTrades accessible to traders who value algorithmic trading as well as those who prefer manual trading.

ActivTrades Trading Platforms Summary.

Great Range of Platforms including Proprietary Platform.

4. Execution Speed – 4.5 / 5 stars

4.5 out of 5.0 starsThroughout my experience, ActivTrades delivered fast trade execution with minimal slippage. Whether you’re using MT4, MT5, or ActivTrader, the response time is impressively quick.This matters a lot if you’re trading forex or indices, where even minor slippage can impact profitability. I tested it across different times of day, and trades were executed almost instantaneously, with minimal slippage even during busier periods.

ActivTrades also provides Direct Market Access (DMA) for some assets, which helps to ensure you’re getting fair pricing on trades without the added markup you might find with other brokers.

Verdict: this setup is ideal for traders who prioritise precision and timing, especially those using strategies like scalping, where every second counts.

ActivTrades Execution Speed Summary.

Great Speeds & DMA Access.

5. Deposit & Withdrawal – 4.5 / 5 stars

4.5 out of 5.0 starsActivTrades supports a wide variety of payment methods, making it easy to deposit and withdraw funds.

- Payment Methods: You can fund your account via Visa, Mastercard, and bank transfer, along with popular e-wallets like Skrill and Neteller. This variety is convenient, particularly if you prefer e-wallets for faster access to funds.

- Processing Time: Deposits are generally instant, which is great when you want to jump into a trade quickly. Withdrawals, on the other hand, typically take 1–3 business days depending on the method, which is in line with industry standards.

- Fees: There are no deposit fees with ActivTrades, which is always a nice perk. For withdrawals, they charge a £9 fee if you want same-day processing, so be mindful if you’re frequently moving funds out.

Depositing funds into my ActivTrades account was straightforward — I used my Visa, and it processed instantly. They also support bank transfers and e-wallets like Skrill and Neteller. While the process is smooth, the fee on expedited withdrawals may not be ideal for those who frequently move funds in and out.

Verdict: ActivTrades has a fairly standard and reliable process for deposits and withdrawals, with enough flexibility in payment methods to keep things convenient.

ActivTrades Deposit & Withdrawals Summary.

No surprises & convenient for UK Traders

6. Regulation and Safety – 4.5 / 5 stars

4.5 out of 5.0 starsActivTrades is regulated by reputable financial authorities including the FCA, SCB,& CSSF ensuring a high degree of trust and safety. The broker employs stringent security measures, including segregated client accounts and enhanced transaction encryption.

ActivTrades also offers negative balance protection—a vital feature that ensures you can’t lose more money than you have in your account. This is particularly important for high-volatility markets, where sudden movements could otherwise lead to significant losses. They also keep client funds in segregated accounts as required by the FCA, adding an extra layer of security to your trading capital.

In terms of awards, as you might expect, ActivTrades is highly decorated with the most recent award being the Best UK Spread Betting Broker 2023 – awarded by International Investor Magazine – I mean… who are we to argue against that!

Verdict: All things considered, ActivTrades provides a solid level of safety and trustworthiness, making it a reliable choice for both new and experienced traders alike.

ActivTrades Regulation & Security

Highly Regulated & Secure.

7. Onboarding – 4.5 / 5 stars

4.5 out of 5.0 starsI found the onboarding process at ActivTrades to be very user-friendly. The entire registration process was digital, and I could open my account in under 10 minutes. Verification was pretty quick as well, and I had access to my trading dashboard within 24 hours.

- Minimum Deposit: ActivTrades has no minimum deposit requirement, making it highly accessible for new traders. However, I would suggest starting with at least £250-£500 to make the most of your trading experience.

- Maximum Leverage: Leverage for retail clients is capped at 1:30, adhering to FCA regulations. Professional clients, however, can access leverage of up to 1:400.

- Account Types: ActivTrades offers various account types, including Individual, Professional, and Islamic accounts, catering to different trading needs and styles.

- Stop Out Level: Set at 30%, ensuring additional risk management.

- Spread Type: Variable Spread, adapting to market conditions to offer competitive pricing.

For beginners, I’d highly recommend starting with their demo account. It’s loaded with £10,000 in virtual funds, and it’s available for 30 days, giving you ample time to explore their platforms and hone your trading skills.

Verdict: No issues here, very quick and easy to get an account started.

ActivTrades Onboarding Summary.

Quick verification, easy-to-use and fully digital.

8. Education – 4.5 / 5 stars

4.5 out of 5.0 stars

The educational resources at ActivTrades are genuinely impressive, with content to suit every level, whether you’re just starting out or looking to refine your strategies. Here’s a snapshot of what they offer:

- Weekly Webinars both focused on price action & indicators. The webinars are interactive, so you can ask questions and get real-time answers, which is a fantastic resource for learning

- Daily Market Analysis with roughly 1-3 articles published EVERY day which is pretty impressive. These are not just generic summaries; they’re well-researched and concise, covering the essential trends and events that might impact your trades.

- Weekly Outlook – which you would image is more of an editorial take on the markets but is in fact straight to the point, succinct and of really good quality.

- Youtube – they post regularly to YouTube making pretty good content there as well.

For traders at every skill level, the ActivTrades Academy is a valuable resource, offering articles, tutorials, and detailed guides. I really liked the weekly outlook reports personally as they were actually detailed and were written professionally.

Verdict: Whether you’re a total beginner or a seasoned trader, there’s something here for you.

ActivTrades Education Summary.

Brilliant range of educational content all-in-all, both for beginners and intermediate level traders.

9. Customer Support – 4.5 / 5 stars

4.5 out of 5.0 stars

I reached out to ActivTrades’ customer support via live chat, and the response was prompt and helpful. Whether you reach out through email or phone, the support was professional and efficient.

Support Channels: You can reach them through live chat, phone, or email, and they even offer multilingual support. This is a big plus if English isn’t your first language or if you feel more comfortable discussing technical questions in another language.

ActivTrades Customer Support Summary.

Helpful team with multilingual support.

FAQ’s

1. Can you Spread bet through ActivTrades?

Yes, you can spread bet with ActivTrades. ActivTrades is a UK-based broker regulated by the Financial Conduct Authority (FCA) and offers both CFD trading and spread betting services. ActivTrades allows clients to spread bet across a variety of asset classes, including forex, indices, commodities, and shares. This makes it an excellent option for traders in the UK who are looking for the flexibility and tax advantages of spread betting.

2. What Platforms Does ActivTrades Offer?

ActivTrades provides several trading platforms, including:

- MetaTrader 4 (MT4): Known for its customizability and Expert Advisors (EAs) for automated trading.

- MetaTrader 5 (MT5): An advanced version of MT4 with additional features such as more order types and technical tools.

- ActivTrader: Their proprietary platform offering modern charting tools, advanced risk management, and direct market access.

- TradingView: For advanced charting and social trading.

3. Does ActivTrades Offer Islamic Accounts?

Yes, Islamic accounts are available for traders who require swap-free trading in compliance with Sharia law. These accounts avoid interest on overnight positions, making them suitable for Muslim traders.

4. Does ActivTrades Support Automated Trading?

Yes, ActivTrades fully supports automated trading via MT4, MT5, and ActivTrader. Traders can use Expert Advisors (EAs) to implement algorithmic trading strategies, and the ActivTrader platform also allows access to advanced risk management tools for automated strategies.

5. What Fees Does ActivTrades Charge?

ActivTrades is competitive in its fee structure:

- Forex: Spreads start from 0.5 pips on major currency pairs.

- Shares and ETFs: A commission of 0.1% per trade, with a minimum of £1.

- Inactivity Fee: Charged after 12 months of no trading activity.

6. Is ActivTrades Regulated?

Yes, ActivTrades is regulated by top-tier financial authorities, including the FCA (UK) and the SCB (Bahamas). This ensures a high level of client protection, including segregated client funds and negative balance protection.

Is ActivTrades a Good Broker?

We can definitively say: yes. ActivTrades is an excellent broker with a fantastic proprietary trading platform, great execution speeds and.a wealth of educational materials for spread betting or trading. It is one of the top rated brokers on our site and for good reason. It favours the more ‘intermediate’ trader / spread bettor, but beginner’s will find it easy-to-use and more advanced traders might find some features lacking given the lack of automation opportunities but all-round it’s a more than decent broker.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)