FTMO Prop Firm Review for UK Traders

Over the past 3-5 years, I’ve heard a lot of buzz around FTMO, especially from traders here in the UK and for full transparency I’ve done about 5 challenges with them to date, some much earlier in around 2019 and more recently in 2024 so I’ve been a ‘fan’ of theirs for a while now but… Let’s dive into who they are, what they offer and how you could either start or scale up your trading with FTMO.

If you don’t know, FTMO is a proprietary trading firm based in Prague, and they’ve built a reputation for offering high funding potential, flexibility across trading platforms, and unique access to crypto trading—even for UK traders. If you’re looking to break into prop trading or just want to access larger capital, FTMO could be worth a look. I had to revisit some of my notes to really dig into their offerings, and here’s everything you need to know about FTMO, from account types to their scaling plan for UK traders.

Pros and Cons of FTMO

- Access to high capital funding with a path to $1 million via the scaling plan

- Crypto trading available for UK traders, a unique advantage among proprietary firms

- Flexible platform options, including MT4, MT5, and cTrader, ideal for different trading styles

- 80/20 profit split with potential to reach 90/10, one of the highest in the industry

- Allows automated trading with EAs, supporting algorithmic and hands-off strategies

- Well-defined evaluation process that prepares traders for professional standards

- Higher challenge fees, especially for larger accounts, with the top account costing around £1,000

- Strict drawdown rules that may be tough for newer traders to follow consistently

- No spread betting options so all profits will be subject to taxation

- Evaluation process is rigorous and may not suit traders looking for instant funding

What’s the FTMO Challenge All About?

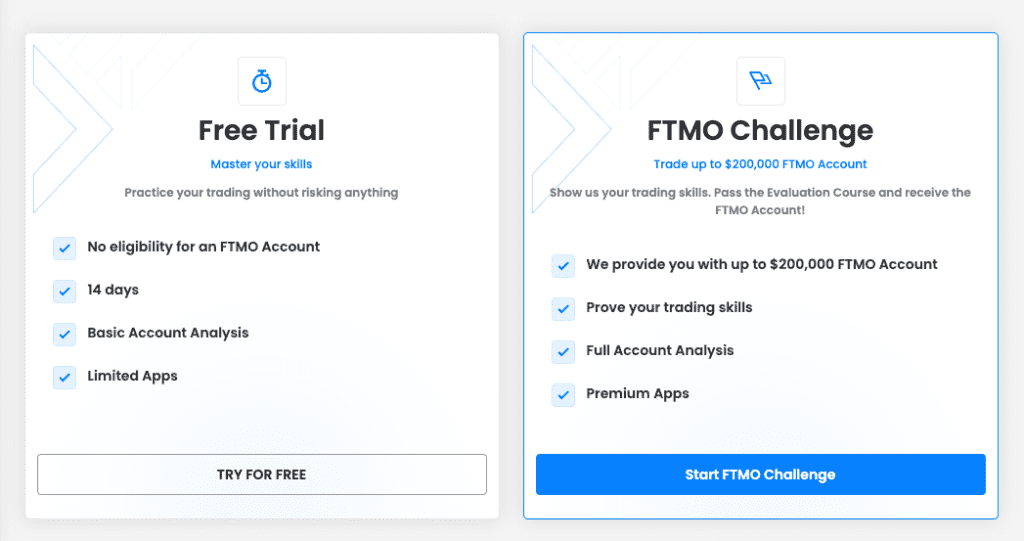

If you’re new to FTMO, the first thing to know is that they operate on an evaluation model called the FTMO Challenge. This isn’t a “free pass” to capital; you have to prove your skills and discipline before they hand over the keys.

The process is split into two main phases:

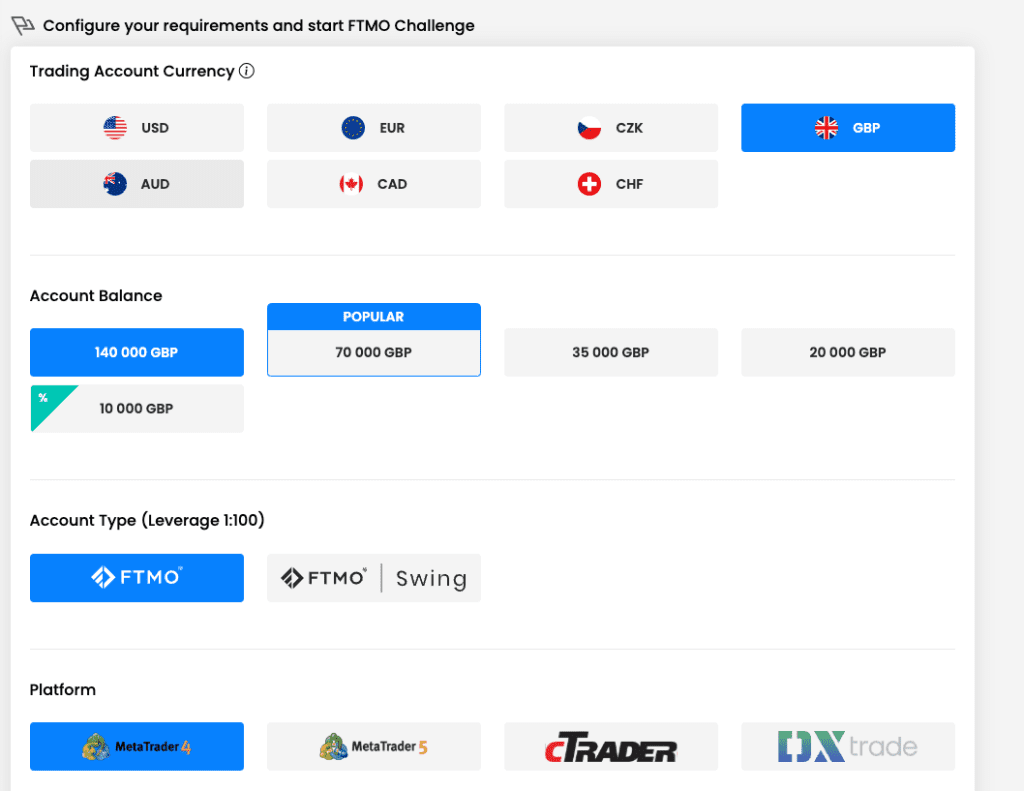

- FTMO Challenge: This is the initial test, where you need to meet a profit target , all while sticking to strict risk management rules. This stage is all about showing that you can trade profitably without exceeding FTMO’s max daily and total drawdown limits. For the top account size of $200,000 USD (~£160,000 GBP), the fee is around £1,000 GBP, which might seem steep, but it’s the price of accessing high capital.

- Verification: Pass the Challenge, and you move on to Verification. Here, the rules are a little more relaxed (the profit target is lower), but it’s still about proving consistency and discipline. Pass Verification, and you’ll get access to a funded account.

Quick note here: The FTMO used to have timed evaluations, giving you only 30-days to pass the challenge and a longer timeframe for the evaluation, but now, as of November 2024, they have removed this stipulation entirely.

If you’re serious about trading, you can actually take the FTMO Challenge twice. This would give you access to up to $400,000 USD (~£320,000 GBP), which is massive compared to other prop firms (as you will see later).

How Much Capital Can You Trade with FTMO?

FTMO has one of the highest funding limits in the industry, which is part of why it’s so appealing. They offer account sizes all the way up to $200,000 USD (~£160,000 GBP), and if you take two challenges simultaneously, you could access $400,000 in capital. But it doesn’t stop there.

The Scaling Plan: Your Path to $1 Million USD

For traders who show consistent profitability, FTMO has a scaling plan. Every four months, if you meet specific profit and risk metrics, they’ll increase your account by 25%. This scaling plan could take you all the way to a $1 million USD (~£800,000 GBP) account, which is practically unheard of in the industry. FTMO even offers the potential to work directly with their team in Prague if you show exceptional results.

Compared to firms like The 5%ers, FTMO’s funding and scaling options are much more aggressive, which is ideal if you’re looking to grow your capital rapidly.

What Assets Can You Trade on FTMO?

FTMO provides access to a wide variety of trading instruments although their variety of stocks you can trade might leave some people wanting more – unless of course, you happen to be a news-based trader who likes trading TESLA or other more volatile stocks. Here’s a breakdown of what you can trade on an FTMO account:

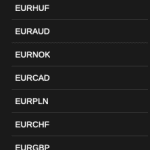

- Forex (Foreign Exchange)

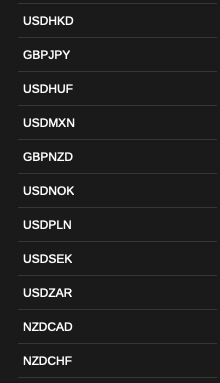

- Major Pairs: The most popular and liquid pairs such as EUR/USD, GBP/USD, USD/JPY, and USD/CHF are all available on FTMO. These pairs are favored by many traders for their high liquidity and generally lower spreads.

- Minor Pairs: These include pairs like EUR/GBP, AUD/NZD, and GBP/CAD. While less liquid than major pairs, they still offer decent trading opportunities and lower spreads compared to exotic pairs.

- Exotic Pairs: For traders looking for more volatility and wider price swings, FTMO also supports exotic pairs like USD/TRY (US Dollar/Turkish Lira) and USD/ZAR (US Dollar/South African Rand). These pairs typically have higher spreads but can offer significant profit potential.

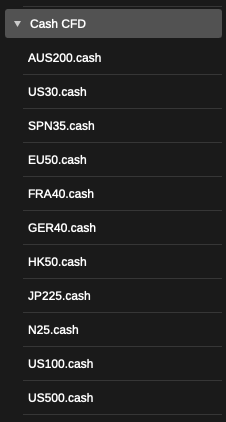

- Indices

- FTMO gives traders access to a broad selection of global indices, allowing you to speculate on the performance of major stock markets worldwide.

- Examples: Popular indices include the S&P 500 (US500), Dow Jones Industrial Average (US30), NASDAQ 100 (US100), DAX 40 (GER40), and FTSE 100 (UK100). These indices are attractive due to their high liquidity, especially during the hours when their respective markets are open.

- Regional Indices: FTMO also includes regional indices, allowing you to trade Asian markets like Japan’s Nikkei 225 (JP225) and Hong Kong’s Hang Seng Index (HK50), as well as other European and global markets.

- Commodities

- Precious Metals: You can trade gold (XAU/USD) and silver (XAG/USD), two of the most popular commodities among traders due to their safe-haven status and volatility.

- Energy Commodities: FTMO allows trading of crude oil (both WTI and Brent), which are heavily influenced by global supply-demand dynamics, political events, and economic data.

- Agricultural Commodities: While not as common in prop trading, you can trade commodities like coffee, corn, wheat and soybeans – just be careful of the spreads here, i’ve traded them myself and yeah I got enterest at wild prices.

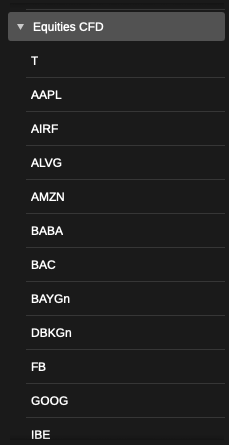

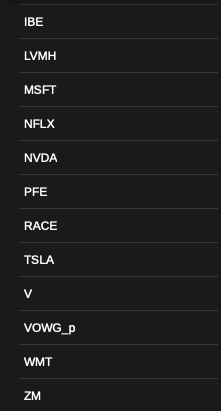

- Stocks and Shares

- Popular Stocks: Big names such as Apple (AAPL), Amazon (AMZN), Tesla (TSLA), and Microsoft (MSFT) are available. These stocks are popular due to their volatility and the vast amount of news and analysis available on them (you can also trade during these news events during the challenge but double check this on their website too…

- Industry-Specific Stocks: OK, so the FTMO doesn;t offer the widest array of stocks, and to be honest I wish they offered more, I found some that were interesting like Visa, Pfizer, Nike, Walmart but if you are looking to day trade stocks, like I know some people are, then you might be a bit disappointed with the range of stocks.

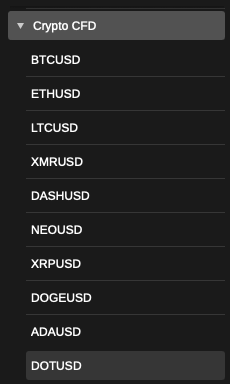

- Cryptocurrencies

- Popular Pairs: Cryptocurrencies like Bitcoin (BTC/USD), Ethereum (ETH/USD), Litecoin (LTC/USD) and Ripple (XRP/USD) are available.

If you’re looking for variety, FTMO offers a far broader range than firms like The 5%ers, making it a good fit if you want to diversify your trades. UK traders will find FTMO’s crypto trading a unique draw, especially given we are effectively locked out of trading crypto through our conventional retail trader accounts.

Platforms and Tools: Where Can You Trade?

FTMO supports three major trading platforms:

- MetaTrader 4 (MT4): The classic platform, known for its simplicity and reliability. If you prefer automated trading, MT4 is a solid option as it supports Expert Advisors (EAs).

- MetaTrader 5 (MT5): This is a step up from MT4, with additional order types and analytical tools. MT5 also supports EAs, which is great for traders who like automation.

- cTrader: For those who want more advanced charting tools and customization options (like me if you haven’t noticed yet), cTrader is a top choice.

Can You Use EAs or Automated Strategies on FTMO?

Yes, FTMO is flexible with automated trading. You can use EAs (Expert Advisors) on both MT4 and MT5, so if you’re running an algo-based strategy, you’ll be fine.

Can I spread bet with FTMO?

No, FTMO does not support spread betting; it’s focused on forex and CFD trading.

How much is the biggest FTMO challenge?

The highest account size available is $200,000 USD (~£160,000 GBP) with an approximate cost of £1,000.

Account Types: What Options Do You Have?

FTMO keeps things pretty straightforward. They offer one main account type but with different funding options:

- Retail Account: For most traders, this account follows the standard leverage and risk limits.

- Professional Account: If you meet specific criteria (passing two challenge accounts + 4 months at time of writing…) you can apply for a professional account with better terms like a 90% profit split.

FTMO’s account model is straightforward, but it offers a unique refund policy: if you pass both the Challenge and Verification, they’ll refund your entry fee. This is a standout feature that’s rare among proprietary firms, providing extra incentive to meet their requirements

They also offer a free demo account which is super useful if you just want to test your strategy to see if it all works as expected given the spreads etc.

Fees and Profit Split: How Does FTMO Make Money?

Let’s talk about the costs. FTMO’s fees are upfront, and there aren’t any hidden surprises:

- Challenge Fees: These range from around £150 GBP for smaller accounts to approximately £1,000 GBP for the $200,000 USD account. This is a one-time fee, and it’s fully refundable if you pass both stages and start trading a funded account.

- Profit Split: FTMO has a pretty generous 80/20 profit split, meaning you keep 80% of your profits. And with the scaling plan, this can increase to a 90/10 split, which is one of the most competitive splits in the industry.

For comparison, The 5%ers offer a 50/50 split, so FTMO is more attractive if you want to maximize your earnings. FTMO’s 80/20 profit split, which can scale up to 90/10, is among the most competitive in the industry.

For traders with consistent performance, this means a larger portion of the profits stays with you.

FTMO’s Customer Support and Educational Resources

FTMO’s customer service is available 24/5, and I found their support team responsive and knowledgeable. They also offer a good selection of educational resources, including:

- Webinars and Workshops: Regular sessions covering topics from trading psychology to market analysis.

- Trading Guides and Videos: Great for brushing up on the basics or exploring more advanced concepts.

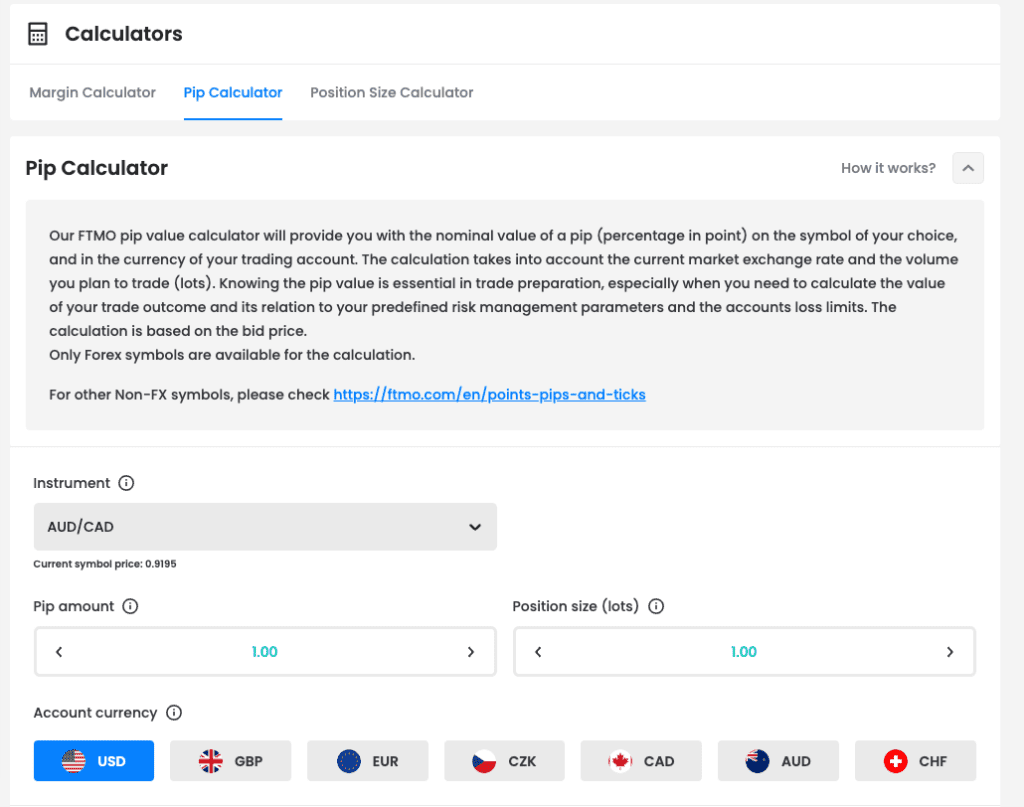

- Trading Tools: They also have a bunch of free calculators and tools if you are still exploring trading and wondering what pips, lots, margin requirements all mean in the context of the challenge.

FTMO’s educational resources aren’t as extensive as some dedicated trading education platforms, but they’re useful, especially if you’re new to prop trading.

Competitor Comparison Table

How FTMO Compares to Competitors

| Feature | FTMO | The 5%ers | MyForexFunds | TopStepFX |

|---|---|---|---|---|

| Max Funding | $400,000 (up to $1 million via scaling) | $400,000 (scaling available) | $300,000 | $200,000 |

| Profit Split | 80/20 (up to 90/10 with scaling) | 50/50 (scaling to 60/40) | 85/15 | 80/20 |

| Funding Model | Challenge (2-phase) | Instant Funding & Challenge | Challenge (3-phase) | Challenge (2-phase) |

| Platforms Supported | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5 | MT4 |

| Crypto Trading | Yes (available in the UK) | No | Yes | No |

| Scaling Plan | Yes (25% every 4 months) | Yes | Yes | Yes |

| Fee for Highest Account | ~£1,000 GBP | $900 USD | $1,000 USD | $600 USD |

| Automated Strategies | Allowed | Allowed | Allowed | Restricted |

| Customer Support | 24/5 | 24/5 | 24/7 | 24/7 |

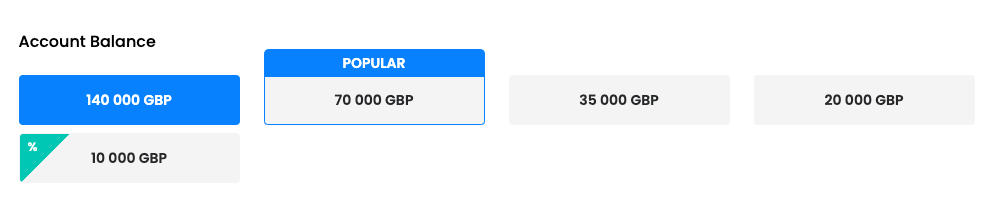

What Size FTMO Challenge Should You Take?

While I can’t directly tell you which size challenge is best for you, I can offer a general rule of thumb to help you decide. Ultimately, your choice will depend on your experience, trading confidence, and financial comfort level. Here are some suggestions to guide you:

If You’re New to Trading or Still Gaining Consistency (0-1 Years)

- Recommended Challenge Size: $10,000 – $25,000 USD (~£8,000 – £20,000 GBP)

- Why: Starting smaller gives you room to make mistakes without as much pressure. If you’re still refining your strategy and haven’t consistently turned a profit, a lower-cost challenge will allow you to experience FTMO’s evaluation process without risking a large entry fee.

If You’ve Been Trading Consistently for 1+ Years

- Recommended Challenge Size: $50,000 – $100,000 USD (~£40,000 – £80,000 GBP)

- Why: If you’re confident in your risk management and have shown consistent results, moving up to a mid-sized challenge gives you more capital to work with, which can lead to more substantial profits. This size allows you to access larger profits while keeping the challenge fee manageable.

If You’re an Experienced Trader with 3+ Years of Profitability

- Recommended Challenge Size: $100,000 – $200,000 USD (~£80,000 – £160,000 GBP)

- Why: Seasoned traders who’ve successfully navigated different market conditions can benefit from a larger challenge size. The $200,000 USD challenge (around £160,000 GBP) is FTMO’s largest option and gives the highest potential profit. For those comfortable with higher capital, this size can significantly enhance your earning potential through FTMO’s scaling plan.

For Traders Interested in Scaling up to the Maximum $1 Million

- Recommended Approach: Consider taking two $200,000 USD challenges if you’re ready for serious capital and plan to leverage FTMO’s scaling plan.

- Why: This gives you a clear path to FTMO’s maximum $1 million funding. Passing the largest challenge twice not only maximizes your initial funding but also sets you up for the most significant growth potential in the scaling program.

Ultimately, the challenge size you choose should reflect both your current skill level and your comfort with risk. If you’re newer to prop trading or the FTMO model, start smaller and work your way up. More experienced traders may find that going big from the start aligns better with their goals.

Final Verdict: Is FTMO Right for You?

After years of using them and really diving into it again for this review here, I’d say FTMO is an ideal choice for disciplined, ambitious traders looking to access significant capital. With options to trade crypto and a clear path to scaling your account up to $1 million USD, FTMO stands out from the competition. They’re challenging, no doubt about it, but for the right trader, the rewards can be substantial.

My recommendation? If you’re serious about trading, FTMO is definitely worth considering. The combination of high funding, flexibility in trading platforms, and a generous profit split makes it one of the best choices for prop trading. Just remember to approach the Challenge with a solid strategy and an understanding of their risk parameters.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)