A solid showing from the pioneer of spread betting itself, IG is a top spread betting broker in all respects offering the widest selection of tradable assets hands-down.

IG Spread Betting Review: UK 2025

IG is one of the pioneers of online trading & the company that actually ‘invented’ spread betting, and let me say, its reputation speaks volumes. Founded in 1974 (yes, long before the internet became mainstream!), IG has been shaping the trading industry for decades. It’s listed on the London Stock Exchange under IGG, a testament to its credibility and transparency. I’ve spent weeks diving into IG’s offerings, from its trading platforms to its customer service, and I have to admit, there’s a lot to unpack.

Let’s start with the basics: IG is regulated by multiple top-tier authorities, including the FCA in the UK, and offers one of the most extensive ranges of trading instruments I’ve ever encountered. But is it the best choice for you? Let’s explore.

Overall Rating – 4.8 / 5 stars

4.8 out of 5.0 starsIG is one of the pioneers of online trading, and let me say, its reputation speaks volumes. Founded in 1974 (yes, long before the internet became mainstream!), IG has been shaping the trading industry for decades. It’s listed on the London Stock Exchange under IGG, a testament to its credibility and transparency. I’ve spent weeks diving into IG’s offerings, from its trading platforms to its customer service, and I have to admit, there’s a lot to unpack.

Let’s start with the basics: IG is regulated by multiple top-tier authorities, including the FCA in the UK, and offers one of the most extensive ranges of trading instruments I’ve ever encountered. But is it the best choice for you? Let’s explore.

Is IG a Good Spread Betting Broker?

Yes, IG is an excellent spread betting platform with some of the widest trading instruments available out of any broker we’ve tested with over 17,000+ total trading instruments. Its vast selection of instruments, advanced platforms, and commitment to customer support make it one of the best in the game. But what really stood out to me during my testing was its combination of industry experience and adaptability. While many brokers falter in innovation, IG continues to evolve, offering features like fractional shares, integrated TradingView, and a clean mobile app.

Pros

- Access to over 17,000 tradable instruments, including forex, indices, shares, and ETFs

- Robust regulation by FCA, ASIC, and others

- Highly versatile proprietary trading platform, alongside MT4 and TradingView integration

- Comprehensive educational resources, from webinars to in-depth guides

- Excellent execution speeds with minimal slippage

Cons

- High minimum deposit for premium account tiers

- Inactivity fees apply after two years of no trading

- Spread costs are slightly higher for casual traders

1. Trading Markets – 5 / 5 stars

5.0 out of 5.0 stars

IG’s range of instruments blew me away. With over 17,000 markets, including forex, indices, commodities, shares, ETFs, and even options, it’s a treasure trove for traders. Here’s a closer look:

Forex

If you’re a currency trader, IG has you covered with 80+ forex pairs, ranging from major pairs like EUR/USD (spreads as low as 0.6 pips) and GBP/USD to lesser-known exotic pairs such as USD/TRY. While testing, I was impressed by how consistently competitive the spreads were compared to brokers like Pepperstone and City Index, particularly for the more liquid major pairs.

IG’s forex offering also integrates seamlessly with advanced tools like ProRealTime and MetaTrader 4, which makes it a great choice for both manual and algorithmic traders. Whether you’re hedging global exposure or targeting smaller volatility plays, the breadth of this lineup offers plenty of opportunities.

Indices

If you’re into indices, IG arguably has one of the broadest ranges of global indices. You can trade 70+ indices across major markets, including:

- FTSE 100 (UK)

- S&P 500 and NASDAQ 100 (US)

- DAX 30 (Germany)

- Nikkei 225 (Japan)

- HSI (Hong Kong)

The standout feature here is the tight spreads on indices, starting as low as 0.2 points on the FTSE 100 and S&P 500. For context, that’s in line with or better than what I’ve seen with other top-tier brokers like City Index. This, paired with reliable execution, makes IG a strong contender for day traders and scalpers focusing on index markets.

What’s even better? IG also offers weekend trading on indices like the FTSE 100 and Dow Jones, something that many brokers don’t provide. This is a game-changer for traders looking to capitalize on out-of-hours volatility.

Shares and ETFs

This is where IG really stands out. With access to 12,000+ shares and 1,500 ETFs, IG is truly the leader in this category. They cover everything from FTSE-listed stocks like Barclays and AstraZeneca to NASDAQ giants like Apple and Tesla.

What’s unique here is the availability of fractional shares, which lets you trade high-priced stocks like Amazon or Alphabet without needing to shell out thousands of pounds. For long-term traders, this opens up opportunities to diversify across US tech and UK blue chips alike.

Spreads on shares were competitive during my testing. For example:

- UK shares: 0.1% commission per trade, with a minimum charge of £3.

- US shares: $0.02 per share, with a $15 minimum.

When compared to City Index’s minimum commission of £10 on UK stocks, IG edges out as the more cost-effective option for smaller trades.

Commodities

You can trade:

- Precious metals like gold and silver

- Energy products like Brent Crude and natural gas

- Agricultural products such as coffee and corn

The spreads are reasonable, with gold spreads starting at 0.3 points. While brokers like Pepperstone might offer slightly narrower spreads in this area, IG compensates by providing a broader array of agricultural commodities—a rarity in today’s trading platforms.

Cryptos

While limited to professional traders due to FCA regulations, IG offers CFDs on cryptos like Bitcoin and Ethereum.

Verdict: IG is unmatched and if variety is what you’re after, IG delivers in spades. Whether you’re trading forex, indices, commodities, or shares, there’s no shortage of opportunities. For me, the access to global indices, fractional shares, and niche commodities like corn was a standout. Whatever your strategy, IG ensures you won’t feel limited.

IG Markets Summary.

Huge range of trading instruments – over 17,000 – and relatively tight spreads even for retail traders.

2. Fees – 4 / 5 stars

4.0 out of 5.0 starsWhen it comes to fees, IG stands out for its transparency and competitive pricing across a variety of instruments. Here’s a detailed breakdown:

Forex Spreads

IG offers forex spreads starting as low as 0.6 pips on major currency pairs like EUR/USD. While this isn’t the absolute lowest in the industry, it’s highly competitive for standard retail accounts. What I appreciated was the consistency—spreads didn’t widen dramatically even during periods of higher volatility.

Indices

Spreads on indices like the FTSE 100 and S&P 500 are razor-thin, beginning at 0.2 points. This is particularly attractive for day traders and scalpers looking to take advantage of tight markets without incurring heavy fees.

Shares and ETFs

If you’re into share CFDs or ETFs, IG charges a 0.10% commission for UK shares with a £10 minimum, and 2 cents per share for US stocks with a $15 minimum. While these rates are slightly higher than brokers like XTB, the breadth of available markets makes it a fair trade-off.

Inactivity Fees

IG charges an inactivity fee of £12 per month after two years of no trading activity. While not uncommon, it’s worth noting if you’re not actively trading or plan to take a break.

Deposit and Withdrawal Fees

Deposits are free across all methods, and most withdrawal methods are also fee-free. However, international bank transfers may incur third-party fees. PayPal withdrawals are lightning-fast and convenient for smaller transactions.

Verdict: IG’s fee structure strikes a fine balance between cost-effectiveness and reliability. While there are other brokers offering slightly lower spreads, IG’s transparent pricing and lack of hidden fees make it an excellent choice for most retail and intermediate traders.

IG Fees Summary.

We wish we could rate it higher but with inactivity fees, high commissions per trade on shares it proves difficult but generally great spread costs.

3. Trading Platforms – 5 / 5 stars

5.0 out of 5.0 stars

IG’s platform lineup is one of the most versatile I’ve encountered. Whether you’re a beginner looking for simplicity or an advanced trader needing powerful tools, there’s something here for everyone. It can be quite overwhelming for the uninitiated so here are some key facts on IG’s platform offering for spread betting & CFD trading. Let’s start with IG’r proprietary platforms:

ProRealTime

I’ve always been a sucker for a well-designed charting tool, and ProRealTime did not disappoint. This web-based platform is tailored for traders who love diving deep into technical analysis. It comes packed with over 100 customizable indicators (like CCI, Moving Averages, and Chaikin Oscillators) and allows you to create your own custom indicators using its ProBuilder programming language. Honestly, this is incredible for anyone who thrives on data and building custome scripts for trading – see our PineScript review for a comparison.

Here are some standout features that caught my eye:

- ProRealTrend: This tool automatically draws and updates trendlines every five minutes. It’s useful for beginner traders or breakout trading and I didn’t realize how much I useful this feature was until I tried it! If you’re familiare with TradingView this is something you’ll really appreciate.

- ProScreener: This is perfect for finding trading opportunities that match your criteria. For instance, I set up ProScreener to alert me to stocks crossing their 50-day moving average, and it flagged a few opportunities throughout the day.

- Automated Trading: ProRealTime supports algorithmic trading, which is a massive win for anyone dabbling in automation. You can either build algorithms using their in-platform tools or import strategies you’ve developed elsewhere.

Now, let’s talk about costs. While ProRealTime is free for the first month, it incurs a £30 monthly fee thereafter. However, IG waives this fee if your trading generates over £15 in monthly spreads or commissions (e.g., trading four or more contracts). For the value it provides, I found think it’s a pretty good deal to be honest a fair trade-off, especially considering the price of TradingView as well as the automation and backtesting capabilities using 30 years of historical data.

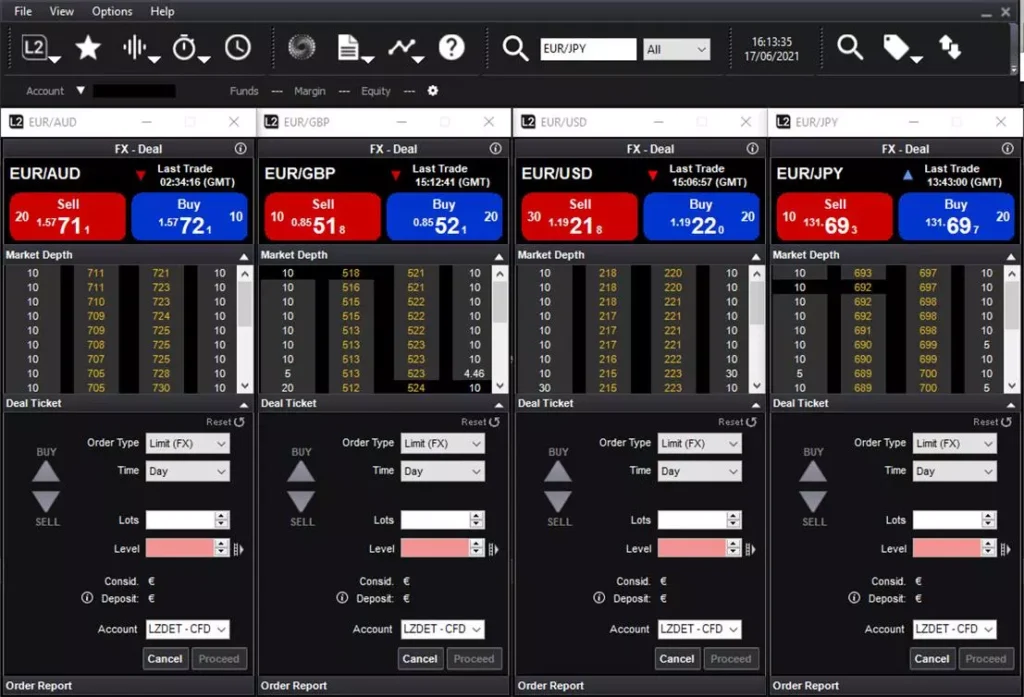

L2 Dealer

The L2 Dealer platform is where IG truly sets itself apart. Designed for professional traders, this platform provides Direct Market Access (DMA) to forex and share markets, letting you interact directly with the order books of exchanges like the London Stock Exchange (LSE).

What makes L2 Dealer special is its transparency. For instance, you can view the full market depth, including every bid and offer made, which is critical for timing entries and exits in volatile markets. Here’s what I appreciated most during my testing:

- DMA for Shares: Unlike standard trading platforms, L2 Dealer allows you to either trade share CFDs or invest in shares directly. This dual functionality is rare and a boon for traders who want to diversify their approach.

- DMA for Forex: Professional traders can access the Forex Direct feature, which connects you to liquidity pools of major banks and providers. This ensures razor-thin spreads and efficient execution. However, this feature is only available for professional accounts.

- Order Types and Anonymity: L2 Dealer supports advanced order types like iceberg orders, which allow you to slice large trades into smaller visible chunks, maintaining anonymity. This is a game-changer for high-volume traders like myself, as it reduces the market impact of larger trades.

While L2 Dealer requires the Microsoft .NET Framework and is more complex than ProRealTime, it’s worth the learning curve if you’re serious about trading. I’d recommend it for anyone who values granular control and access to institutional-grade tools.

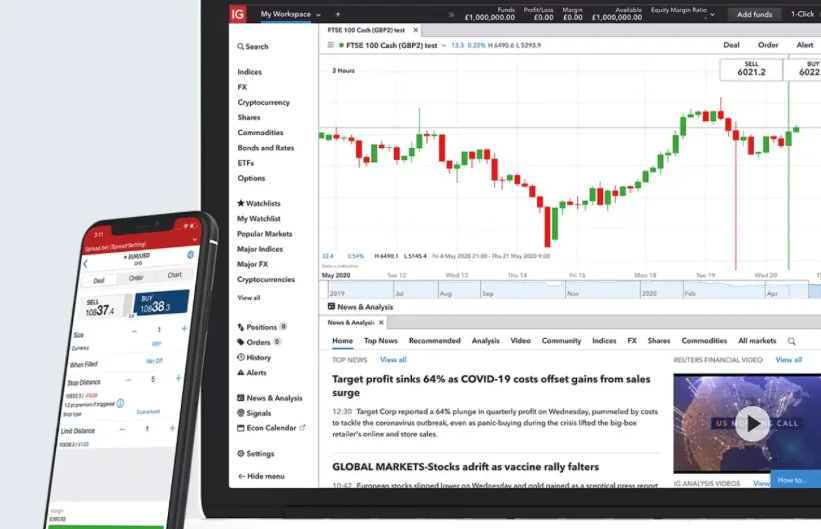

IG’s Proprietary Platform

When I first tried IG’s proprietary platform, I wasn’t expecting much. After all, broker-built platforms often lack the polish of third-party software. But IG’s web-based platform exceeded my expectations.

Here’s what I learnt:

- Ease of Use: The platform is intuitive and perfect for beginners. I had my layout customized within minutes, and everything from placing trades to setting alerts felt seamless.

- Charting Tools: While not as advanced as ProRealTime or TradingView, the built-in charting is more than sufficient for most retail traders.

- Integration: The platform works across devices—desktop, tablet, and mobile—so you can transition between them without missing a beat.

One drawback? It’s not as feature-rich as TradingView or ProRealTime. But for everyday trading and quick executions, it’s more than enough.

Verdict on IG’s Proprietary Platform:

This is the ideal starting point for new traders or those who don’t need advanced features. It’s intuitive, reliable, and integrated with IG’s broader ecosystem. While it won’t replace TradingView for heavy analysis, it’s a great all-rounder.

IG’s proprietary platform is a standout. It’s web-based, so there’s no software to download, and it’s incredibly intuitive. I loved how easy it was to customize the interface, and the charting tools are robust enough for technical analysis without feeling overwhelming.

MetaTrader 4 (MT4)

For those who prefer MetaTrader, IG offers full MT4 integration. As a trader, I’ve used MT4 extensively, and IG’s execution on this platform was smooth and reliable. Plus, you get access to Expert Advisors (EAs) for automated trading.

TradingView Integration

This was a pleasant surprise given that most of the edgier & ‘cooler’ brokers like EightCap offer this; I wasn’t expecting IG to do the same but yes, IG integrates with TradingView, which is a game-changer for charting enthusiasts. Trading directly from TradingView is seamless, and the range of custom indicators and social trading features adds a layer of interactivity that most brokers lack.

Mobile App

The IG mobile app is one of the best I’ve used. It’s responsive, user-friendly, and packed with features like price alerts, charting tools, and even integrated news updates. If you’re like me and trade on the go, this app is a must-have.

Which IG Platform should you use?

Each platform has its strengths, and IG’s offering caters to a wide range of traders. Here’s my personal breakdown:

- Use TradingView if you’re into charting, social trading, or building custom indicators.

- Use MetaTrader 4 if you’re a forex trader or want to automate your strategy with EAs.

- Use ProRealTime if you’re a serious technical trader looking for automation and backtesting.

- Use IG’s Proprietary Platform if you want simplicity and ease of use, particularly as a beginner.

- Use L2 Trader if you are looking for quick execution speed and are used to more advanced trading concepts.

Having access to all these platforms under one broker is what makes IG stand out. Personally, I switch between TradingView and ProRealTime for analysis and use MT4 for execution. It’s a setup that combines the best of all worlds, and IG has nailed it with its versatility.

IG Trading Platforms Summary.

Good range of both proprietary and third-party tools including MT$, TradingView and a mobile app that is one of the best in its class.

4. Execution Speed – 4 / 5 stars

4.0 out of 5.0 starsDMA Access & L2 Trader: A Quick Breakdown

IG offers Direct Market Access (DMA) primarily through its L2 Dealer platform, enabling traders to place orders directly onto the order books of major exchanges. This service is available for share CFDs and, for professional clients, forex trading via Forex Direct. The DMA model provides transparency and control over trade execution, allowing traders to view full market depth and interact directly with market liquidity.

IG’s standard trading platforms operate on an over-the-counter (OTC) basis, where IG acts as the counterparty to client trades. However, through the L2 Dealer platform’s DMA services, traders can access NDD execution, as orders are routed directly to the underlying market without dealer intervention.

It’s important to note that DMA and NDD services are not universally available across all of IG’s platforms. The L2 Dealer platform is specifically designed for DMA trading, offering advanced tools and functionalities tailored for experienced traders seeking direct market interaction. In contrast, IG’s proprietary platform and MetaTrader 4 (MT4) provide a more traditional trading experience with IG as the counterparty.

For traders interested in DMA and NDD models, utilizing the L2 Dealer platform is essential to access these services. Additionally, professional clients can benefit from DMA forex trading through Forex Direct, which is integrated into the L2 Dealer platform.

Forex Direct Platform

DMA access for professional traders trading key currencies and only available for professionals.

So, in summary, IG’s DMA and NDD offerings are primarily accessible via the L2 Dealer platform, catering to traders who require direct market access and transparent execution. Other platforms within IG’s suite operate on an OTC basis, with IG acting as the counterparty to trades.

IG’s DMA model ensures that trades are executed directly with liquidity providers, bypassing any dealing desk intervention. This results in near-instant trade execution and accurate market pricing, particularly valuable for scalpers and high-frequency traders. During my testing, IG delivered near-instant order execution, even during peak market hours.

Low Latency

Even without direct DMa access, when I tested IG’s execution with both market and limit orders, and the results were consistently fast. I was impressed by the minimal latency and negligible slippage. Even during major market events like NFP announcements, IG managed to execute trades with precision.

Advanced Tools for Scalpers

For scalpers, IG offers tick charts, which allow you to monitor price movements in real time. Combined with the low spreads, this makes IG an excellent choice for short-term trading strategies.

Verdict: IG’s execution speed is as good as it gets. However, for retail, non-professional traders, you will be dealing with OTC / counter-party trading that doesn’t affect the slippage, or execution speed quality although DMA access is only available on the L2 Dealer platform, which you can always apply for, if eligible.

IG Execution Speed Summary.

Great execution speeds with or without DMA access; but OTC / no NDD trading for retail traders is a drawback.

5. Deposit & Withdrawal – 4 / 5 stars

4.0 out of 5.0 stars

Depositing and withdrawing funds with IG is always smooth and transparent, although they are not the fastest at withdrawals for Bank Transfers we found although that comes from being one of, if not the largest UK broker.

Payment Methods

IG supports a wide range of payment options, including:

- Debit/Credit Cards – Instant processing.

- Bank Transfers – Typically 1–3 business days.

- PayPal – Fast and convenient for smaller transactions.

I found PayPal to be the quickest method during my testing, while bank transfers are ideal for larger amounts.

Processing Times

Withdrawals are processed within 1–2 business days, which is standard. However, the speed may vary depending on the method and your bank.

Fees

- Deposits: Free across all methods.

- Withdrawals: Free for UK bank transfers, but international transfers may incur small fees.

Verdict: IG’s deposit and withdrawal process is reliable and cost-effective. While it’s not the fastest out there, the variety of options and lack of hidden fees make it user-friendly.

IG Deposits & Withdrawal Summary.

Solid deposit & withdrawal options for most traders but e-wallet options or non-conventional deposit options that might excite some ‘edgier’ traders.

6. Regulation and Safety – 5 / 5 stars

5.0 out of 5.0 starsWhen it comes to safety, IG shines as one of the most secure brokers on the market. Regulation is a key factor I always evaluate when testing a broker, and IG has more than enough credentials! Not only as a publicly traded company but also a highly-regulated broker, this should inside confidence in even the most hardened sceptic.

FCA Regulation

For UK traders, IG is regulated by the Financial Conduct Authority (FCA), a top-tier regulator that ensures the broker adheres to strict operational and financial guidelines. Knowing my funds were held in segregated accounts, as mandated by the FCA, gave me extra peace of mind during my testing.

International Oversight

IG isn’t just regulated in the UK; it’s also overseen by other major bodies like:

- ASIC (Australia)

- BaFin (Germany)

- CFTC (USA)

This global presence makes IG a reliable choice no matter where you’re trading from. For traders in regions like the USA, where broker options are limited, IG’s CFTC oversight is a big deal.

Negative Balance Protection

Another standout feature is negative balance protection, which ensures that you can’t lose more than your account balance. This is particularly important when trading leveraged instruments like CFDs and forex.

Financial Services Compensation Scheme (FSCS)

In the unlikely event of insolvency, IG clients in the UK are protected up to £85,000 under the FSCS. This added layer of security is invaluable for anyone serious about safeguarding their funds.

Verdict: IG’s regulatory framework is second to none. With oversight from multiple top-tier regulators and robust client protections, it’s one of the safest brokers you can choose.

IG Regulation & Safety Summary.

Solid deposit & withdrawal options but no Neteller or Skrill e-wallets.

7. Onboarding – 4.5 / 5 stars

4.5 out of 5.0 starsOpening an account with IG was a smooth / straightforward process, and it’s clear that they’ve invested in making this an efficient experience for traders.

Digital Registration Process

The entire registration process is online and takes about 10–15 minutes. You’ll need to provide basic personal information such as your name, address, and email, along with answers to some questions about your trading experience and financial knowledge. I found these questions to be less invasive compared to some other brokers while still adhering to regulatory requirements.

Once you’ve filled out the initial forms, you’ll need to verify your identity and address. IG allows you to upload scanned copies or clear photos of your ID (passport or driver’s license) and proof of address (a utility bill or bank statement). This part was seamless, and their system accepted my documents without requiring additional steps.

Verification Timeline

IG is quick to verify accounts—my account was approved within 24 hours, and I was ready to trade the next day. For non-UK residents, the process may take a little longer due to international verification checks. The platform also provides updates on the status of your application, which is a nice touch.

Minimum Deposit

One of the drawbacks of trading with IG is the £250 minimum deposit, which is pretty inaccessible for most first-time traders but it does show that IG is a platform for ‘serious traders & investors only’ and not really a place to dabble in trading or investing and a platform that you really have to commit to.

Account Types

IG offers a range of account types to cater to different trading styles and needs:

- Standard CFD Account

- Spread Betting Account

- Professional Account

- ISA and Share Dealing Accounts

Demo Account

If you’re new to IG or trading in general, I strongly recommend starting with their demo account. This account offers £10,000 in virtual funds, giving you a chance to explore the platform and test strategies without any risk. IG’s demo account mirrors the live trading environment closely, making it an excellent tool for both beginners and those transitioning to IG from another broker.

Verdict: IG’s onboarding process is one of the smoothest I’ve encountered. It’s well-designed for both new traders and experienced professionals, with a range of account types to suit various needs. The £250 minimum deposit is quite high but the digital registration process is quick and transparent.

IG Onboarding Summary.

Quick and easy verification for UK traders, might be a bit lengthier if you are non-UK.

8. Education – 5 / 5 stars

5.0 out of 5.0 stars

Education is one of IG’s strong suits, and I found their resources super comprehensive.

IG Academy

This is the centerpiece of IG’s educational offerings. The IG Academy app provides a structured learning experience, with courses covering everything from beginner basics to advanced trading strategies. I went through their technical analysis course, and it was impressively detailed without feeling overwhelming.

Webinars

IG regularly hosts live webinars on topics like market trends, risk management, and trading psychology. The presenters are knowledgeable and open to questions, making these sessions both educational and interactive.

Market Analysis

IG’s daily market analysis reports are top-notch. They provide actionable insights into major markets, complete with economic calendar updates and technical analysis. I found this particularly useful for planning trades around key events.

Learning Tools

- Interactive Quizzes: Great for testing your knowledge after completing a course.

- Video Tutorials: Short, engaging videos that cover a range of topics.

Verdict: IG goes above and beyond with its educational resources. Whether you’re a beginner or a seasoned trader, their learning tools are designed to help you succeed. I’d recommend downloading the IG Academy app—it’s one of the best broker-provided learning platforms I’ve used.

IG Education Summary.

Brilliant educational resources, thorough and comprehensive.

9. Customer Support – 4.5 / 5 stars

4.5 out of 5.0 starsGood customer support can make or break your trading experience, and IG does a great job here.

Availability

IG offers 24/5 support, which covers you during all major trading hours. You can reach them via:

- Live Chat: My preferred method, with response times under 2 minutes.

- Phone: Ideal for more complex queries.

- Email: Slower but useful for detailed questions.

Response Quality

I tested their support team with a mix of beginner and advanced questions, and they handled both easily. They were professional, patient, and didn’t rush me, which I appreciated.

Multilingual Support

For international traders, IG offers multilingual support, making it accessible to a broader audience. This is particularly helpful if English isn’t your first language.

Verdict: IG’s support team is reliable and knowledgeable, though extending availability to 24/7 would make it perfect. For most traders, their current setup will be more than sufficient.

IG Customer Service Summary.

Solid customer service, responsive and detail-orientated.

FAQs

1. Can You Spread Bet with IG?

Yes, IG offers spread betting accounts for UK residents, allowing traders to benefit from tax-free profits. This makes it an attractive option for those who want to trade forex, indices, commodities, or shares without worrying about capital gains tax.

2. What Platforms Does IG Offer?

IG supports an impressive range of platforms to cater to different trading styles:

- MetaTrader 4 (MT4): Ideal for forex traders who rely on expert advisors (EAs) and customisable indicators although no MT5 as of time of writing (November 2024)

- ProRealTime: Perfect for advanced technical analysis and automated trading.

- L2 Dealer: Tailored for professional traders requiring direct market access.

- Mobile App: A responsive and intuitive app that’s perfect for trading on the go.

- Web Trader: IG’s proprietary platform for seamless browser-based trading.

With this variety, IG ensures you have the tools you need, whether you’re a beginner or a seasoned pro.

3. Does IG Offer Islamic Accounts?

Yes, IG provides Islamic accounts that comply with Sharia law. These accounts are swap-free, meaning no interest is charged on overnight positions. This makes IG a great choice for Muslim traders seeking a compliant trading environment.

4. Is IG Regulated?

Yes, IG is regulated by multiple top-tier authorities, including:

- FCA (UK): Ensuring fund segregation and negative balance protection.

- ASIC (Australia): Overseeing operations for Australian clients.

- CFTC (USA): Providing access to US traders with strict compliance standards.

This regulatory framework makes IG one of the most trusted brokers in the industry.

5. Does IG Charge Withdrawal Fees?

No, IG does not charge fees for most withdrawal methods, including bank transfers and debit/credit cards. However, international transfers might incur third-party fees. Withdrawals are typically processed within 1-2 business days.

6. Is IG Good for Beginners?

Yes, IG is beginner-friendly thanks to its demo account, comprehensive educational resources, and intuitive platforms like Web Trader. The IG Academy is particularly useful for new traders looking to learn the basics.

7. Can You Use Automated Trading on IG?

Yes, IG supports automated trading through platforms like MT4 and ProRealTime. These platforms allow you to create or import algorithms for hands-free trading.

8. How Competitive Are IG’s Fees?

IG offers a transparent fee structure although it might not be the most competitive spreads start at 0.6 pips on major forex pairs. While IG may not have the absolute lowest spreads in the market, the lack of hidden fees and overall reliability make it a competitive choice.

Is IG a Good Broker?

After thoroughly testing IG’s platforms, features, and services, it’s clear why this broker has earned such a stellar reputation. IG combines a robust regulatory framework with an unparalleled range of trading instruments and platforms. From beginners learning through the IG Academy to professionals utilising the L2 Dealer platform, IG caters to every level of trader.

With over 17,000 instruments, a variety of advanced trading tools, and strong FCA regulation, IG is a versatile and trustworthy broker. While the minimum deposit is relatively high, IG’s features, security, and user-friendly experience make it a worthwhile investment.

Bottom Line: IG is an excellent choice for traders seeking a broker that balances reliability, innovation, and versatility across trading styles and strategies.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)