Pepperstone Spread Betting Review: UK 2025

Pepperstone, a broker that is probably the most well-known in the trading & spread betting world. They have built a reputation for low-cost trading, fast execution speeds, and a wide range of instruments so I decided to put all that to the test.

I tested its spread being prowess, automated trading strategy, the range of platforms it offered, and much much more. In this review, I’ll walk you through everything I’ve experienced while using Pepperstone, including fees, platform usability, execution speeds, and customer support. Let’s get into it!

Overall Rating – 4.8 / 5 stars

4.8 out of 5.0 stars

Pepperstone stands out for its tight spreads, multiple platform choices, and support for algorithmic trading. It’s especially suited for traders using scalping, hedging, and high-frequency trading strategies, which is exactly where this broker shines.

Pros

- Low-cost trading with tight spreads and competitive commission structures

- Advanced trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader

- Offers multiple account types including Razor and Standard accounts

- Access to over 1,200 financial instruments including Forex, CFDs, cryptocurrencies, and commodities

- Supports a wide range of trading strategies, including scalping, hedging, and algorithmic trading via Expert Advisors (EAs) and cBots

- Comprehensive educational resources and trading tools for traders of all levels

- Regulated by top-tier financial authorities including FCA (UK), ASIC (Australia), and CySEC (Cyprus)

- Free demo account with no time restrictions to practice trading

- Offers negative balance protection for retail traders

- Fast trade execution with low latency, ideal for high-frequency traders

Cons

- No proprietary trading platform; relies on third-party platforms like MT4, MT5, and cTrader

- Inactivity fees apply after 6 months of no trading

- Limited range of tradable stocks compared to some competitors

- No social trading features for copy trading

- Crypto CFDs are available only for professional traders in certain jurisdictions

1. Trading Markets – 4.5 / 5 stars

4.5 out of 5.0 starsOne of the standout aspects of Pepperstone for me is the diversity of instruments you can trade. They cover over 1,200 markets, including:

- Forex: Over 60 currency pairs, from majors like EUR/USD to exotics with spreads as low as 0.0 pips on the Razor account. which is essential for my FX strategy.

- Commodities: You’ll find the usual suspects here—Pepperstone offers CFDs on gold, silver, oil, and agricultural products like coffee and cocoa—but also more niche commodities like agriculture.

- Indices: They offer global favorites such as the S&P 500, FTSE 100, and DAX 30. For index traders, Pepperstone does a solid job.

- Cryptocurrencies: For professional traders, Pepperstone allows trading of Bitcoin, Ethereum, and Ripple.

- Shares CFDs: While not as extensive as some competitors, Pepperstone does offer a limited range of stock CFDs, focusing mainly on large-cap companies.

Verdict: Whilst 1,200+ assets is not most we’ve seen (see City Index) it is a huge range of tradable assets that allows you to enter pretty much whatever market you would like to trade and the breadth of assets lets you easily diversify your trades, whether you’re focused on shares, forex, or commodities.

Pepperstone Markets Summary.

Great selection of tradable assets. Not the widest we’ve seen but all the majors and minors are covered.

2. Fees – 4.5 / 5 stars

4.5 out of 5.0 starsPepperstone’s Razor account really shines in terms of cost efficiency. During my trades, I had spreads as low as 0.0 pips on the Razor account, which are ideal for scalping strategies. With a £7 commission per lot round turn, this setup is perfect for high-frequency traders or algo traders like myself who need minimal slippage and tight spreads to make the strategy work.

- Razor Account: Spreads as low as 0.0 pips with £7 per round turn commission on major pairs.

- Standard Account: Spread-only model with no commissions, starting at 1 pip.

Other fees to be aware of:

- Inactivity Fee: If your account is inactive for 6 months, you’ll be charged a fee, though I avoided this easily by staying active.

Verdict: Great to have a Razor account where spreads are really low and you are simply charged per round turn, it simplifies trading and you know what are getting with trading costs. However, there are cheaper commission-based Raw accounts from Vantage Markets.

Pepperstone Fees Summary.

Good fees, starting from 0.0pips + commission on Razor accounts making it great for algorithmic strategies.

3. Trading Platforms – 5 / 5 stars

5.0 out of 5.0 stars

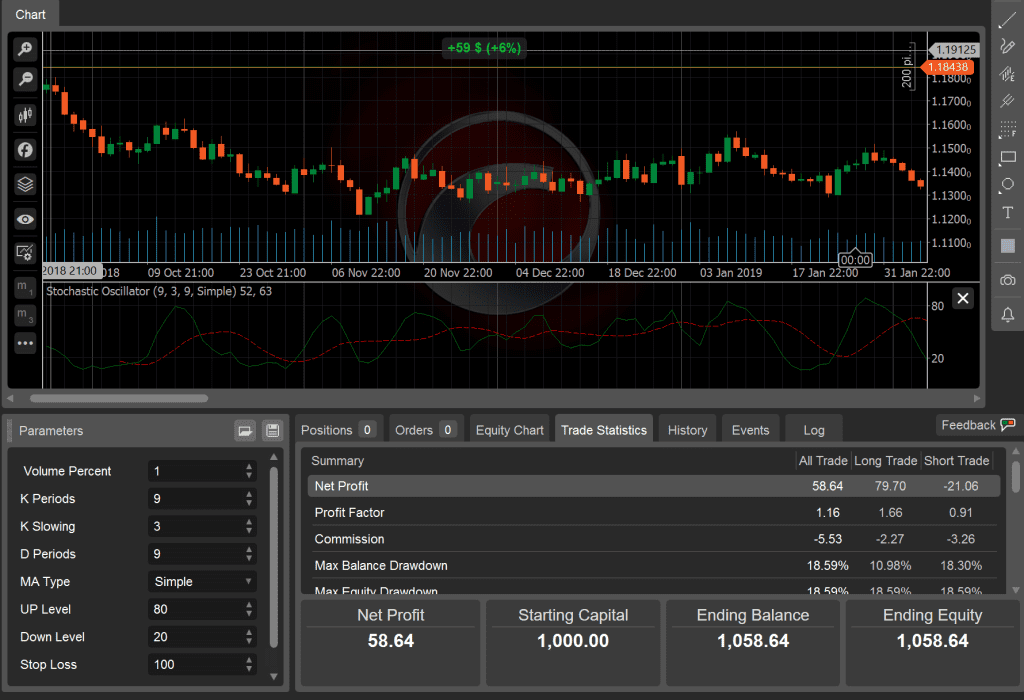

Pepperstone gives you the choice of MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader and even TradingView which is our most amount of platforms of any broker hands-down. I spent considerable time on each platform, but I found cTrader to be the best (obviously) for algorithmic trading and scalping strategies, thanks to its cAlgo bots and the ease with which you can set up automated strategies.

- MetaTrader 4/5: Both platforms support Expert Advisors (EAs) for automated trading, and I found them reliable for backtesting strategies.

- cTrader: Offers an intuitive interface, cAlgo for automated trading, and Level II pricing. It is ideal for traders who require direct market access (DMA). Great for manual traders and algo traders alike, with easy access to cBots.

It’s worth mentioning that, despite the lack of a proprietary platform, the powerful combination of MT4, MT5, and cTrader more than makes up for it.

Verdict: We often get questions about Pepperstone’s platforms so have dedicated a section below to answer some of the most commonly asked questions but yes, you can integrate with TradingView meaning Pinescript strategies will be executed from there. It has the widest selection of platforms of any broker but lacks it’s own proprietary platform which would be nice to see.

Pepperstone Trading Platforms Summary.

Great variety of platforms offered including MT4, MT5, cTrader & TradingView but no proprietary platform

More about Pepperstone Platforms

1. Can I Use Automated Trading on Pepperstone?

Yes, you can use automated trading strategies on Pepperstone. Pepperstone offers full support for automated trading via its integration with popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms allow traders to create and deploy Expert Advisors (EAs) and cBots that can execute trades automatically based on predefined parameters.

2. Can I use MT4/MT5 and Algo Strategies on Pepperstone?

Both MetaTrader platforms (MT4 and MT5) support Expert Advisors (EAs), which are scripts that enable fully automated trading. With EAs, you can program strategies based on specific market conditions, such as price movement, technical indicators, or time-based triggers. This feature is especially beneficial for traders looking to trade around the clock or employ algorithmic strategies that rely on speed and precision.

3. Can I use cTrader and cAlgo to deploy bots on Pepperstone?

Yes, Pepperstone also supports cTrader, which integrates with cAlgo for automated trading. cBots are the automated trading algorithms for cTrader, written in C#, a powerful and versatile programming language. Traders can design their own bots or use pre-built bots from cTrader’s marketplace to automate trading strategies across different markets, including Forex, CFDs, and more. The platform also offers backtesting features, allowing traders to test their strategies on historical data before using them in live markets.

4. AI and Machine Learning Potential

For those interested in more advanced technology, Pepperstone’s platforms also provide the infrastructure for traders to experiment with AI and machine learning strategies. While MetaTrader and cTrader offer built-in automation features, advanced traders can integrate Python or other AI-driven models using APIs provided by Pepperstone, which allow for deeper learning capabilities and more adaptive trading strategies.

Automated and AI-driven trading strategies on Pepperstone can greatly enhance efficiency, remove emotional biases, and allow for continuous trading, making them powerful tools for any trader.

TradingView on Pepperstone

Trading through TradingView with Pepperstone combines the analytical power of TradingView’s charting and analysis tools with Pepperstone’s robust trading execution. This integration allows traders to benefit from the following key features:

- Direct Trading from Charts: Users can execute trades directly within TradingView’s platform when connected to a Pepperstone trading account. This seamless integration ensures that traders can act quickly on TradingView’s comprehensive market analysis without switching platforms.

- Comprehensive Market Analysis Tools: TradingView offers an extensive range of charting tools, technical indicators, and drawing tools, enabling traders to conduct in-depth market analysis. When trading with Pepperstone, this means traders can make informed decisions based on real-time data and advanced charting capabilities.

- Access to Pepperstone’s Trading Conditions: Traders using TradingView with Pepperstone enjoy access to Pepperstone’s competitive spreads, low latency execution, and a wide range of financial instruments, including Forex, CFDs on indices, commodities, cryptocurrencies, and stocks.

- Social Trading Features: TradingView is known for its social network for traders, where users can share trading ideas, strategies, and insights. Integrating with Pepperstone allows traders to not only share their insights but also act on them directly through their brokerage account.

- Customizable Trading Experience: Users can customize their TradingView platform with preferred indicators, tools, and charts, and then directly trade with those setups through their Pepperstone account. This customization extends to alerts and notifications that can be set up based on specific market conditions or indicators.

- Ease of Use: The integration is designed to be straightforward, allowing for easy connection of Pepperstone accounts with TradingView. This ease of use ensures that traders of all levels can take advantage of TradingView’s analytical tools and execute trades with Pepperstone’s reliable execution.

Pepperstone has even been awarded the Social Trading Champion in 2023.

4. Execution Speed – 4.5 / 5 stars

4.5 out of 5.0 starsPepperstone’s Razor account provides fast execution with low latency, making it ideal for scalping and algorithmic trading. The broker operates a no-dealing desk (NDD) model, ensuring that trades are executed directly in the market without intervention.

VPS Access: Pepperstone offers free VPS (Virtual Private Server) for qualifying traders, ensuring low-latency trading for automated strategies.

Verdict: As a NDD broker you can expect quick and reliable execution but you may find wider spreads than normal. If you are looking for cheap spreads this might not be the broker for you but execution wise it’s dependable and fast.

Pepperstone Execution Speed Summary.

Good execution speeds under testing but spreads widen and slippage to be expected

5. Deposit & Withdrawal – 4.5 / 5 stars

4.5 out of 5.0 starsPepperstone offers a wide range of deposit and withdrawal options. I was able to deposit funds instantly using PayPal, and withdrawals were processed within 1-3 business days. No deposit fees are charged, which is a huge plus, but we found under testing that the processing speeds were actually quite a long time, after processing on Friday AM we got our withdrawal on Wednesday PM which you might say is nit-picking but we did expect Monday or at least Tuesday. Overall it’s within the limits but it felt like a very long wait! We’ve found that e-wallets are often processed quicker.

Here are the supported deposit and withdrawal methods:

- Bank transfers

- Credit/Debit cards

- E-wallets (e.g., PayPal, Skrill, Neteller)

Although third-party fees may apply, Pepperstone itself doesn’t charge any fees for deposits or withdrawals.

Verdict: Pepperstone offers multiple deposit methods and it is easy & fast to get your money in but we found under testing that often processing times do in fact take the full 3 business days to process which might be too slow for some.

Pepperstone Deposit & Withdrawal Summary.

Overall good times within a working week but slow over weekends.

6. Regulation and Security – 5 / 5 stars

5.0 out of 5.0 stars

Pepperstone is regulated by top-tier financial authorities & awarded by multiple agencies, Pepperstone is one of the safest brokers there is. The regulations include the FCA (UK), ASIC (Australia), and CySEC (Cyprus). The FCA regulation gives me peace of mind, knowing that my funds are segregated and that I’m protected under Negative Balance Protection.

These regulatory bodies ensure that client funds are segregated and that the broker adheres to strict financial standards. Negative balance protection is available for retail traders, ensuring that you cannot lose more than your deposited funds.

Verdict: There is absolutely noting to complain about with Pepperstone’s regulatory approval and licenses. They are licensed by the FCA, ASIC & CySec to name a few. They are one of the most trust-worthy brokers and well-respected in the reading world having won multiple awards from various organisations and publications so for regulation and safety it’s top marks.

Pepperstone Regulation & Safety Summary.

Great protections for traders all-round

7. Onboarding – 4.5 / 5 stars

4.5 out of 5.0 stars

The onboarding process at Pepperstone is smooth and fully digital. I signed up and had my account verified within 24 hours, and it took just a few minutes to upload my documents. Pepperstone also offers a demo account for traders to practice without risking real funds.

- Minimum Deposit: £100

- Maximum Leverage: 1:30 for retail clients, up to 1:500 for professional clients

- Minimum Trade Volume: 0.01 lots, allowing for careful risk management.

- Margin Call and Stop Out Levels: Pepperstone has set a margin call level at 90% and a stop-out level at 20%, designed to protect traders from negative balance risks.

- Commission: A commission of 10 USD is charged on certain accounts and instruments, which is competitive within the industry.

- Spread Type: Pepperstone offers variable spreads, ensuring traders get the best available prices without significant markups.

- Account Currencies: A wide range of account currencies is supported, including CAD, HKD, NZD, SGD, AUD, CHF, JPY, GBP, EUR, and USD, providing flexibility for traders worldwide.

Verdict: Onboarding is quick and simple. The demo account is very useful, especially given you can open them with different account styles, for example, you can open a spread betting standard account demo and a Razor account demo to test both and see which you prefer – very useful for traders wanting to test the spreads.

Pepperstone Onboarding Summary.

Demo account availability, multiple deposit currencies, 24h verification

8. Education – 4.5 / 5 stars

4.5 out of 5.0 stars

Pepperstone provides a thorough and comprehensive suite of educational resources for traders of all levels. This includes:

- Webinars

- Tutorial videos

- Market analysis

- Trading guides

These resources are designed to enhance trader skills and provide insights into market conditions. The broker’s educational offering is robust, though not as extensive as brokers like XTB but they certainly give you insights into the market that is worth a watch / listen.

Verdict: In Pepperstone’s case, the materials are often more ‘market updates’ or interesting news vs trading guides and beginner spread betting information, so this is really aimed at the intermediate trader rather than the beginner trader. If you are new to trading it might be worth checking out other broker materials but there are some useful pieces for you here to if you dig around.

Pepperstone Education Summary.

Good, solid educational content that mixes more intermediate level trading with beginner content

9. Customer Service – 4 / 5 stars

4.0 out of 5.0 starsPepperstone offers 24/5 customer support via phone and email. Under testing we found that to be completely accurate, the support team were quick to respond and super knowledgeable.

However, and it’s a big however… there doesn’t seem to be any live chat on the website itself, nor is there any actual engagement, it seems Pepperstone prefer traders to explore the platform itself and might find live chat annoying in the ‘pre-deposit’ stage. Now I think this is a bit of an oversight given that their team is super friendly and they could also have a ‘basic query bot’ like ActivTrades or some or their competitors.

Verdict: Pepperstone has a great team but it’s rather difficult to firstly find the information to contact them and then reach out to do so. A chatbot or some kind of live chat functionality would massively improve ROI or at least bump them up in some people’s eyes.

Pepperstone Customer Service.

Great team, super knowledgable and friendly. However, no live chat on the website = missed opportunity.

Is Pepperstone a Good Spread Betting Broker?

Yes, Pepperstone is one of the best spread betting brokers & CFD trading brokers available in the UK. They offer great low-spread razor accounts for trading as well as deep educational content and great customer support.

My time with Pepperstone was an eye-opener in terms of how a broker can blend speed, flexibility, and user experience into one package. As someone who appreciates fast execution and low-latency trading, I was really impressed with how well the Razor account handled even high-frequency trades. The fact that you can automate trading through platforms like cTrader or MetaTrader 5 adds another layer of sophistication for traders like me who enjoy experimenting with algorithmic strategies.

What really stood out was how seamless the overall experience was—from setting up an account to getting trades executed with virtually no slippage. Sure, it lacks a proprietary platform, but honestly, with MT4, MT5, and cTrader in the mix, I never felt like I was missing out on anything.

For anyone who values speed, reliability, and a solid regulatory framework, Pepperstone is hard to beat. It’s a broker that doesn’t overwhelm you with complexity but gives you all the tools you need to trade smartly.

FAQs

1. Can I Spread Bet on Pepperstone?

Yes, you can spread bet on Pepperstone. Pepperstone offers spread betting as one of its core trading products, specifically for UK and Ireland residents. Spread betting on Pepperstone allows you to speculate on the price movement of various financial instruments, such as forex, indices, commodities, and shares, without owning the underlying asset. This form of trading is also tax-efficient for UK residents since profits from spread betting are exempt from Capital Gains Tax (CGT).

2. Does Pepperstone support automated trading?

Absolutely. Pepperstone fully supports automated trading via MT4/MT5 and cTrader, allowing the use of Expert Advisors (EAs) and cBots.

3. Is Pepperstone safe to use?

Yes, Pepperstone is regulated by FCA, ASIC, and CySEC, and offers negative balance protection for retail clients.

4. What fees does Pepperstone charge?

Pepperstone’s Razor account offers spreads as low as 0.0 pips with a £7 commission per lot. The Standard accounthas no commissions but wider spreads.

5. Does Pepperstone offer Islamic accounts?

Yes, Islamic accounts are available, ensuring compliance with Sharia law through interest-free trading.

6. What platforms can I use on Pepperstone?

Pepperstone supports MT4, MT5, cTrader & TradingView with robust features for manual and automated trading.

7. How fast is Pepperstone’s execution speed?

Pepperstone offers low-latency execution on the Razor account, perfect for scalping and high-frequency trading.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)