SpreadEx Spread Betting Broker Review: UK 2025

When you first come across SpreadEx, it might immediately stand out for its combination of financial spread betting and sports betting – a blend you don’t see with most brokers. Established in 1999 and regulated by the Financial Conduct Authority (FCA), SpreadEx offers a reliable and enjoyable trading experience, especially appealing for UK-based spread bettors. But how does it stack up as a trading platform? Let’s dive in and see if it lives up to the hype.

Overall Rating – 4.3 / 5 stars

4.3 out of 5.0 stars

In Summary: SpreadEx is a well-rounded platform for spread betting, offering both financial and sports betting in a secure environment. The trading interface is enjoyable and competitive spreads make it appealing to UK-based traders, though the lack of advanced trading platforms like MT4 or MT5 may be a drawback for some.

Pros

- Offers both sports betting and financial spread betting, bringing a unique blend of services.

- Regulated by the FCA, ensuring high security standards and reliability.

- Wide market variety including forex, shares, indices, and commodities.

- User-friendly platform suitable for beginners and more experienced traders alike.

- Competitive spreads and leverage that enhance trading opportunities.

Cons

- Lacks advanced trading platforms like MetaTrader, which may be limiting for some traders.

- Primarily UK-focused, limiting global availability.

- Does not support automated trading tools like Expert Advisors (EAs).

1. Trading Markets – 4 / 5 stars

4.0 out of 5.0 stars

One thing SpreadEx does well is variety. Their range of trading instruments is broad enough to satisfy the trading-itch in most bettors —a dual offering that few brokers can match. Here’s a look at what you’ll find on SpreadEx:

- Forex: SpreadEx provides over 50 currency pairs, covering major, minor, and even some exotic pairs. The spreads on major pairs like EUR/USD start from 0.6 pips, which is actually pretty competitive for a spread betting broker.

- Indices: They offer spread betting on popular global indices like the FTSE 100, DAX 30, and Dow Jones. This is a nice touch for those looking to speculate on broader market movements rather than individual stocks.

- Commodities: SpreadEx has a solid range of commodities for spread betting, including popular choices like gold, oil, and wheat. This variety is perfect if you’re looking to trade both hard and soft commodities.

- Shares: They offer a good selection of UK and US shares, allowing you to speculate on price movements without actual ownership. It’s a straightforward way to trade big names like Apple and Tesla.

- Sports Betting: Now, this is where SpreadEx stands out. If you enjoy sports as much as trading, SpreadEx allows you to bet on everything from football and rugby to tennis. This dual option is a rare find and could be a fun addition to your trading experience.

Verdict: Although SpreadEx doesn’t offer as many global financial instruments as some dedicated trading platforms, their selection of financial assets and sports markets is solid, making it a versatile platform for spread bettors.

SpreadEx Markets Summary.

Unlikely to find the minors & the widest range of instruments but overall decent range of tradable assets.

2. Fees – 4.2 / 5 stars

4.2 out of 5.0 starsWhen it comes to fees, SpreadEx keeps things simple, which is ideal for beginners. They work on a spread-only model for most trades, so you won’t be hit with hidden charges or commissions. Here’s how the fees break down:

- Forex Spreads: The spreads on major currency pairs like EUR/USD start from 0.6 pips, which is pretty competitive for a spread betting broker, though not the absolute tightest in the market.

- No Commission: SpreadEx doesn’t charge any commissions on financial spread bets, which is great for keeping costs down. All fees are integrated into the spread, so you know exactly what you’re paying upfront.

- Deposit Fee: They do charge a small £1 fee for deposits under £50, which is unusual among brokers. However, this is easy to avoid if you plan to deposit larger amounts.

- Inactivity Fee: After 12 months of inactivity, SpreadEx charges a small inactivity fee. While this isn’t uncommon among brokers, it’s something to be aware of if you’re not planning to trade regularly.

Verdict: In general, SpreadEx’s transparent fee structure and lack of commissions make it a cost-effective choice for casual and intermediate traders. The only minor downside is the small deposit fee for amounts under £50, but that’s easy to work around with larger deposits.

SpreadEx Fees Summary.

Inactivity fee, small deposit dee but no commission and tight spreads.

3. Trading Platforms – 4 / 5 stars

4.0 out of 5.0 stars

SpreadEx offers its own proprietary platform, which can be accessed via desktop or their Financial Trading App. I found the platform user-friendly, and although it might not have the same depth of features as MetaTrader 4/5 or cTrader, it’s intuitive enough for most retail traders. Some standout features include:

- Customizable Layout: You can arrange your trading screen to suit your style, which is helpful if you’re monitoring multiple markets at once.

- Charting Tools: The platform includes advanced charting tools with pattern recognition, pro-trend lines, and a range of technical indicators. While it’s not as powerful as TradingView, it’s more than sufficient for basic to intermediate analysis.

- Price Alerts: You can set up alerts to be notified via text, email, or push notification, which is a convenient way to stay on top of market movements.

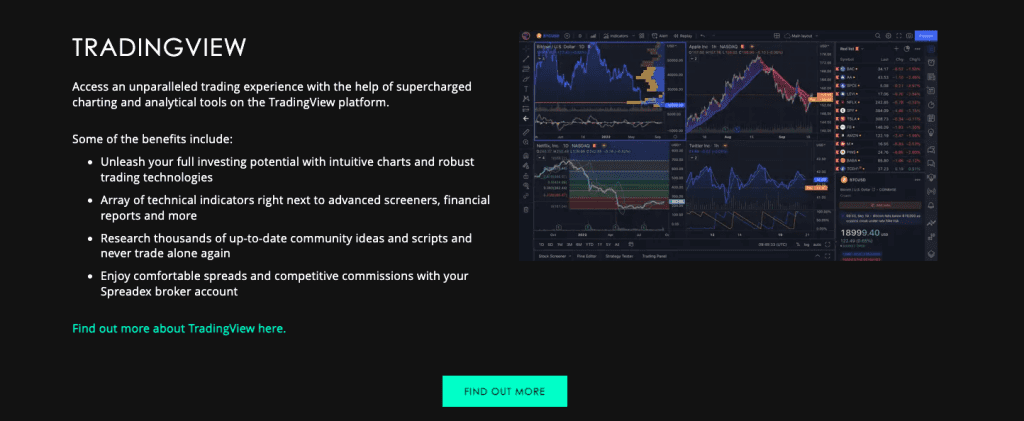

- TradingView Integration: For traders who prefer more advanced analytics, SpreadEx integrates with TradingView, allowing you to access better charting capabilities and even social trading features.

- Order Types: SpreadEx supports several order types, including Guaranteed Stop Losses and Force Opens. This gives you added flexibility and control, especially when managing risk.

If you’re an advanced trader looking for algorithmic or automated trading, SpreadEx might not meet your needs, as they don’t support Expert Advisors (EAs). But for manual traders and spread bettors, it’s a straightforward, easy-to-use platform that covers the essentials.

For those who prefer TradingView, SpreadEx also integrates with this platform, which offers advanced charting capabilities and social trading features, perfect for more experienced traders who want more detailed analytics and the ability to share their strategies.

Verdict: I like that SpreadEx has diversified with TradingView alongside their proprietary offering, it speaks to a broker that is ever evolving and growing with the market. SpreadEx seems to understand the market really well and that platform experience is a crucial part of this.

SpreadEx Trading Platform Summary.

Very good proprietary platform & TradingView integration.

4. Execution Speed – 4.5 / 5 stars

4.5 out of 5.0 starsOne thing that pleasantly surprised me about SpreadEx was its execution speed. Fast trade execution is crucial if you’re into short-term trading or scalping, and SpreadEx does a commendable job here.

- Quick Execution: Orders are processed efficiently, and I experienced minimal slippage on most trades, even during market hours with higher volatility. This level of execution is particularly beneficial for traders with quick turnaround strategies.

- Spread Widening During Volatility: Like most brokers, SpreadEx’s spreads can widen slightly during highly volatile periods, but this is pretty standard in the industry.

- Great for Beginners and Intermediates: SpreadEx’s execution speed and reliability make it an excellent choice for beginner and intermediate traders who may not need the ultra-fast execution speeds that advanced traders require.

Verdict: Overall, I found the speed and consistency of SpreadEx’s platform to be well-suited for most spread bettors. It may not offer VPS hosting or DMA for traders needing super low-latency environments, but that’s not what they are designed for and for the average user, SpreadEx’s performance is more than satisfactory.

SpreadEx Execution Speed Summary.

Good execution overall but not for the advanced trader or for deploying automated strategies.

5. Deposit & Withdrawal – 4 / 5 stars

4.0 out of 5.0 starsThe deposit and withdrawal process on SpreadEx is straightforward, though there are a few quirks to keep in mind:

- Deposit Methods: SpreadEx supports bank transfers, credit/debit cards, and e-wallets like PayPal, Skrill, and Neteller. Deposits are usually processed instantly, which is a plus if you’re looking to start trading quickly.

- Withdrawal Times: Withdrawals are generally processed within 1-3 business days. During my testing, I found that e-wallet withdrawals were often quicker than bank transfers and they actually deposited it just after 1 business day.

- Fees: While there are no fees for withdrawals, SpreadEx does charge a £1 fee for deposits under £50. This is a bit unusual and something to note if you’re planning on making smaller deposits. However, if you stick to deposits above £50, you can easily avoid this charge.

While the deposit and withdrawal options are versatile enough for most users, the deposit fee for smaller amounts might be a minor inconvenience. Overall, SpreadEx’s approach to deposits and withdrawals is fair and straightforward, making it easy to manage funds without excessive charges.

That said, I was a bit disappointed to find that they charge a £1 fee for deposits under £50, which is unusual among brokers. However, the lack of fees on withdrawals is a plus, making it easier to manage your trading funds without worrying about additional charges.

Verdict: Super quick withdrawal process, the fee for smaller deposits isn’t great but the experience was actually compensated by the quicker withdrawal speeds.

SpreadEx Deposit & Withdrawal Summary.

Quick withdrawal, multiple deposit options but deposit fee unexpected.

6. Regulation and Security – 5 / 5 stars

5.0 out of 5.0 starsWhen it comes to security, SpreadEx checks all the boxes for UK-based traders. SpreadEx is regulated by the Financial Conduct Authority (FCA), meaning it has the following advantages:

- Client Fund Protection: As an FCA-regulated broker, SpreadEx is required to keep client funds in segregated accounts. This setup means that, in the unlikely event SpreadEx faces financial trouble, client funds remain separate from the company’s own operating funds, providing an extra layer of protection.

- Negative Balance Protection: Another major plus is SpreadEx’s negative balance protection for retail clients. Essentially, this ensures that you can’t lose more than your deposited funds, which is a crucial safeguard, especially for new traders who may be getting accustomed to the ups and downs of leveraged trading.

- FSCS Compensation Scheme: Additionally, SpreadEx clients are covered under the Financial Services Compensation Scheme (FSCS), which offers compensation of up to £85,000 in the event of broker insolvency. This is a standout feature as it means even if the broker were to go under, retail clients have financial protection are versatile enough for most users, the deposit fee for smaller amounts might be a minor inconvenience.

Verdict: Overall, SpreadEx’s FCA regulation offers a solid regulatory framework with strong protections that can give you peace of mind as you trade.

SpreadEx Regulation & Security Summary.

For UK-based spread bettors which is the target market here, it ticks all the boxes with FCA-compliance.

7. Onboarding – 4.5 / 5 stars

4.5 out of 5.0 starsThe onboarding process with SpreadEx was straightforward and seamless, designed to get you up and running without any complications. I found that I was able to complete registration within minutes by providing basic information and documentation for identity verification. The KYC (Know Your Customer) process was efficient, and my account was verified within 24 hours, which is a strong point, particularly for those eager to start trading quickly.

SpreadEx also offers a demo account, which is ideal for beginners wanting to familiarise themselves with the platform before committing real funds. This makes it accessible for both new and experienced traders who want to test strategies without the pressure of financial risk.

They’ve designed it to be as seamless as possible, which means you’re not jumping through endless hoops just to get started. Here’s some key facts:

- Quick and Easy Setup: All you need is a few standard documents like proof of ID and address, and you’re good to go.

- Fast Verification: For me, the account verification took less than 24 hours. SpreadEx’s team seems well-prepared to get new users up and running quickly, which is a definite plus.

- Demo Account: If you’re new to spread betting or simply want to test the waters, SpreadEx offers a demo account loaded with virtual funds. This is a fantastic option for beginners who want to familiarise themselves with the platform before committing real money.

- No Minimum Deposit: One standout feature is the zero minimum deposit requirement. You can start trading without a hefty initial deposit, making it accessible to a wide range of traders, especially beginners. But see my earlier note about low deposit fee…

Verdict: The smooth onboarding at SpreadEx makes it ideal for those who value a hassle-free start. I’d recommend using the demo account first to explore the platform without any financial risk—it’s a great feature that can boost your confidence before going live.

SpreadEx Onboarding Summary.

Quick and easy process to get up and running.

8. Education – 4.5 / 5 stars

4.5 out of 5.0 starsSpreadEx’s educational resources are more focused on helping traders understand the mechanics of spread betting. I found their ‘What is Spread Betting’ guide especially useful, with accompanying videos to help beginners get up to speed quickly. While they don’t offer a full trading academy like some other brokers, the educational content available is well-structured and accessible. Here’s what’s available:

- Comprehensive Guides: Their ‘What is Spread Betting’ guide is an excellent resource for beginners, walking you through the basics of spread betting. It’s clear, well-organized, and genuinely helpful for anyone new to this type of trading.

- Video Tutorials: SpreadEx offers a selection of video tutorials that break down complex topics into digestible pieces. This multimedia approach is useful if you’re a visual learner or simply want a more interactive learning experience.

- Market Analysis and Updates: For intermediate and advanced traders, SpreadEx also provides market insights and regular updates, which can help you make more informed trading decisions. Although they don’t have a full-scale trading academy like some other brokers, the content they do offer is relevant and high-quality.

Verdict: SpreadEx has built a practical educational resource hub, ideal for beginners and those looking to sharpen their spread betting skills. While a bit more advanced content would be a welcome addition, what’s available here covers the essentials and sets you up for a solid start.

SpreadEx Education Summary.

Decent, practical tips and strategies but nothing to write home about.

9. Customer Support – 5 / 5 stars

4.8 out of 5.0 stars

From my personal experience, customer support at SpreadEx is top-notch. The live chat, email, and phone support are responsive and well-trained. The customer service team was friendly, professional, and able to answer all my queries promptly. This was especially helpful when I had some questions regarding the platform’s more advanced features.

However…and I might be picky but isn’t the UI a bit dated nowadays? Anyway, minor point but might need to have a more interactive and attractive UI.

Here’s what they offer:

- Responsive and Knowledgeable Team: I tested their live chat and phone support multiple times, and each interaction was prompt and helpful. The support team is clearly well-trained, and they seemed genuinely interested in solving my issues—no canned responses here!

- Availability: SpreadEx’s support team is available 24/5 via live chat, email, and phone. This range of options makes it easy to get assistance in the way that suits you best, though I do wish they’d consider 24/7 support for those late-night trading moments.

- Friendly and Professional: Every representative I spoke with was polite, professional, and well-informed about the platform’s features and policies. If you’re new to SpreadEx and have questions about your account or how to navigate the platform, rest assured that their team will be there to help.

Customer support is an often overlooked part of the trading experience, but SpreadEx has clearly invested in making sure it’s a priority. I’d give them high marks for the quality and accessibility of their support—it’s genuinely refreshing.

SpreadEx Customer Service Summary.

Their standout feature is just how darn nice everyone is and how eager to help you they all are.

Is SpreadEx a Good Broker?

SpreadEx is a solid platform that offers a unique combination of financial and sports spread betting and is an excellent choice for beginner spread bettors. While its trading platform may lack some of the advanced features found on MetaTrader or cTrader, it’s user-friendly and offers a comprehensive range of tools for both financial and sports betting markets.

While advanced traders might find the lack of tools like MetaTrader 4 or 5 or any algorithmic trading limitations, SpreadEx more than makes up for it with tight spreads, a low entry barrier, and a smooth trading experience across both their proprietary platform and TradingView integration. Plus, the customer support team is stellar—ideal for new traders who may have questions along the way.

In my view, SpreadEx is a well-rounded platform that offers a safe and engaging trading experience. If you’re keen on spread betting in a secure, FCA-regulated environment and enjoy the option to wager on sports events, SpreadEx has all the right ingredients to make your trading experience unique and enjoyable.

FAQ’s

1.Is SpreadEx suitable for beginners?

Yes, SpreadEx has built its platform with beginners in mind. The user-friendly interface, lack of minimum deposit requirements, and a helpful demo account make it accessible and easy to navigate for those new to trading. Plus, they offer a solid range of educational resources that help simplify spread betting basics, making it a strong choice for beginners.

2. Can you automate trading on SpreadEx?

Unfortunately, no. SpreadEx doesn’t support automated trading features like Expert Advisors (EAs) that you might find on MetaTrader platforms. This means that if you’re looking to rely on algorithmic or automated strategies, SpreadEx may feel a bit limiting. However, the TradingView integration does allow for some advanced charting and analysis features.

3. What is the minimum deposit at SpreadEx?

Good news: there’s no minimum deposit requirement at SpreadEx, so you can start trading with as much or as little as you’re comfortable with. Just note that deposits under £50 incur a small £1 fee, but anything above that is fee-free.

4. Does SpreadEx offer Islamic accounts?

Yes, SpreadEx does provide Sharia-compliant accounts for clients who require interest-free trading options. These accounts are designed in line with Islamic finance principles, making SpreadEx an accessible option for Muslim traders.

5. Is SpreadEx regulated?

Yes, SpreadEx is fully regulated by the Financial Conduct Authority (FCA) in the UK, which ensures that it adheres to strict financial standards. This includes segregated client funds and negative balance protection—both crucial for maintaining a safe trading environment.

Final Thoughts: Is SpreadEx the Right Broker for You?

SpreadEx brings a distinctive mix of financial and sports spread betting, creating a one-of-a-kind experience in the trading world. It’s FCA-regulated, which reassures traders about their funds’ safety, and the platform is remarkably intuitive, catering especially to beginner and intermediate traders in the UK.

While advanced traders may crave the capabilities found in MT4 or MT5, SpreadEx excels in offering a straightforward, user-friendly platform that covers all the essentials and then some. The tight spreads, low cost of entry, and stellar customer support make it a worthwhile choice if you’re starting out or simply seeking a more straightforward platform.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)