TradeNation Spread Betting Review: UK 2025

We had the opportunity to thoroughly test TradeNation, a pure-play spread betting platform, it’s a broker that has gained traction in recent years for its simplicity and transparent pricing structure – namely its fixed spreads. We wanted to see whether it meets the standards of both beginner and advanced traders.

We evaluated the platform on several key aspects: trading instruments, fees, platform usability, execution speed, and customer support.

Overall Rating – 4.3 / 5 stars

4.3 out of 5.0 stars

When I first checked out TradeNation, it immediately struck me as a broker that’s laser-focused on simplicity, transparency, and making the trading experience approachable for all levels—especially beginners.

They’re known for offering fixed spreads, which means you always know exactly what you’re paying to trade, even when markets get choppy. This level of predictability is a rare find and could be a game-changer if you’re just starting out or prefer a no-surprises fee structure.. However, in terms of range of instruments and advanced trading features, some more experienced traders might find the offerings slightly limited.

Pros

- Simple and transparent pricing structure with fixed spreads, offering cost predictability

- No commission on trades, with tight spreads across major markets

- TradingView integration & great proprietary platform

- Excellent customer support, with a reputation for being helpful and responsive

- No minimum deposit requirement, making it accessible for all traders

Cons

- Limited range of available instruments compared to other brokers

- No access to MetaTrader platforms (MT4 or MT5), which may not appeal to advanced traders looking for these tools

- Trading features may feel basic for seasoned traders or those needing more advanced tools

- The platform is mainly focused on spread betting and CFDs, which might limit diversity for other investment strategies

1. Trading Markets – 4 / 5 stars

4.0 out of 5.0 starsSo, what can you actually trade on TradeNation? While the platform doesn’t boast the largest selection out there, it does focus on some key assets that keep trading straightforward and practical. This focus on high-demand instruments—like major indices, forex pairs, commodities, and shares—is one of the things I actually appreciated about TradeNation. You don’t have to wade through thousands of obscure assets; instead, you get a well-curated selection that’s ideal for those who want to stick to the essentials.

Here’s a closer look at the instruments TradeNation offers:

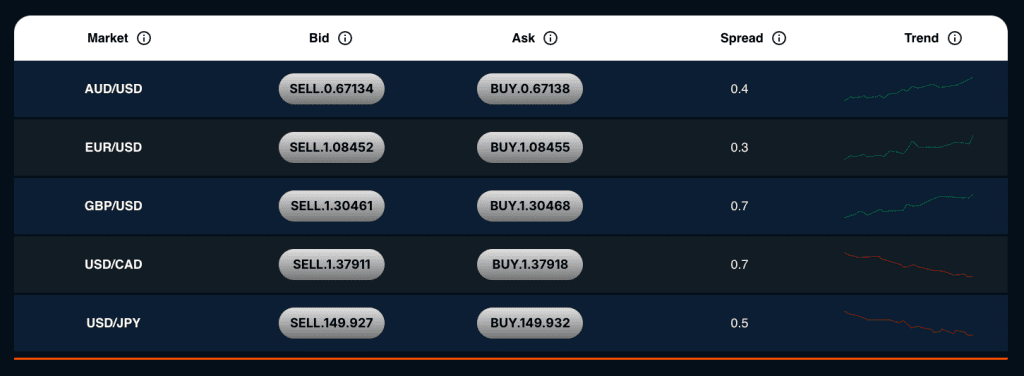

- Forex: If you’re into forex trading, you’ll find the big hitters here. TradeNation covers over 30 of the most popular currency pairs, including major pairs like EUR/USD, GBP/USD, and USD/JPY. The spreads are fixed, so for those who like consistency, this platform keeps things straightforward. For instance, I’ve seen the spread on EUR/USD hover around 0.6 pips, which, for a fixed-spread model, is quite competitive. If you’re trading in other major currency pairs, TradeNation has enough coverage to cater to most forex strategies without adding in too many exotic pairs that can clutter the platform and increase costs.

- Indices: For index traders, TradeNation offers the essentials, covering all the big-name indices you’d want access to. Think FTSE 100, S&P 500, NASDAQ 100, and the DAX 30. What really makes this offering appealing is that TradeNation’s fixed spreads on indices like the FTSE 100 and S&P 500 are remarkably tight, usually around 0.6 points. This is especially great if you’re trading these indices frequently and want a predictable cost structure without worrying about the spread widening during volatility. From my own experience, it’s ideal for those who enjoy trading on the overall economic performance rather than individual stocks.

- Commodities: For those looking to venture into commodities, TradeNation provides access to major commodities without overloading you with options. You’ll find gold, silver, oil (Brent and WTI), and a few other essentials. I found the spreads on commodities to be fairly competitive, and since they’re fixed, you won’t face drastic price jumps, which can often happen with variable spreads on other platforms. This simplicity in commodity options makes TradeNation suitable if you’re looking to keep your commodities trading straightforward.

- Shares: Now, if you’re into individual stock trading, TradeNation does offer access to popular UK and US shares, but the selection is more limited than some brokers that have thousands of equities. They cover large-cap stocks from the FTSE 100 and S&P 500—companies like Apple, BP, Microsoft, and Tesco. So if you’re after the household names and blue-chip stocks, you’re covered. However, if you’re hoping to trade smaller or more niche stocks, you might find the range a bit limiting. I found this lineup quite suitable for classic retail traders looking to trade reliable and well-known shares without getting bogged down by an overwhelming list.

Verdict: Overall, TradeNation’s lineup is purposefully designed for traders who prefer simplicity and want access to the most commonly traded assets. If you’re looking for diversity within a concentrated list of core assets—without all the extras that often create clutter—TradeNation’s selection should hit the mark. However, traders who are used to brokers like IG or Pepperstone, with extensive global markets and niche options, may find it somewhat streamlined.

TradeNation Markets Summary.

Not the largest selection of instruments but that’s the point.

2. Fees and Spreads – 5 / 5 stars

5.0 out of 5.0 stars

What I found particularly appealing about TradeNation is their fixed spreads. They have an incredibly transparent pricing model that revolves around fixed spreads, which makes budgeting for trades refreshingly easy. As someone who’s spent time with brokers offering variable spreads, I found the consistency here a nice change. With TradeNation, you know exactly what you’re paying up front—no surprises or sudden spread hikes during volatile sessions.

Here’s a more detailed look at their costs:

- Fixed Spreads: One of the standout features of TradeNation is its fixed spreads, even during times of market volatility. For example, on popular indices like the FTSE 100 and S&P 500, spreads are usually around 0.6 points, which remains steady no matter the time of day or market conditions. I found this fixed structure particularly beneficial when trading during big news events, as I didn’t have to worry about fluctuating spreads eating into profits or adding unexpected costs.

- No Commission Fees: TradeNation operates on a spread-only model, so there’s no added commission on trades. The price you see is what you pay, which is great for anyone who doesn’t want to deal with additional per-trade costs. This is especially beneficial for newer traders who may be cautious about fees or those who trade frequently and want to avoid stacking up commission charges.

- Forex Spreads: For major currency pairs like EUR/USD and GBP/USD, the spreads are competitive. Typically, EUR/USD spreads are fixed at about 0.6 pips, which is quite reasonable compared to many other brokers offering variable spreads. While other brokers might offer slightly lower spreads during low-volatility times, TradeNation’s fixed model can ultimately save you money when the market gets choppy.

- No Inactivity or Withdrawal Fees: Another refreshing aspect of TradeNation’s cost structure is the lack of inactivity fees. Many brokers charge monthly or quarterly fees if you don’t trade, but with TradeNation, you won’t face penalties for taking a break. Additionally, withdrawals are fee-free, which is another perk that adds to the overall cost savings here.

Verdict: The overall fee structure at TradeNation is ideal if you prefer a fixed-cost model where you can predict and plan around your trading costs. It’s designed to offer cost certainty, which is incredibly useful for budgeting and minimises the risk of unexpected costs eating into your gains.

TradeNation Fees Summary.

The standout is the fixed spreads model which offers traders a reliable forecast of their trading costs.

3. Trading Platforms– 4 / 5 stars

4.0 out of 5.0 stars

One of the first things I noticed when using TradeNation is how straightforward the platform is. It’s not cluttered with advanced features, making it perfect for beginners or traders who prefer a simple, clean interface. The web-based platform and mobile app are intuitive and easy to navigate.

Here’s what I liked about TradeNation’s platform:

- Proprietary Web-Based Platform: TradeNation’s platform is web-based, so there’s no need to download or update software. It’s accessible from any device with a browser, which I found super convenient for checking trades on the go. The layout is clean, with easy-to-navigate menus and tools, making it straightforward to analyze charts, place trades, or set alerts.

- Fixed Spreads Display: The platform displays fixed spreads clearly, which is a great visual reminder of cost certainty when planning trades. The spread on each instrument remains visible, so you’re not caught off guard when calculating potential returns. This feature alone sets TradeNation apart from many brokers with variable spreads that fluctuate throughout the day.

- TradingView Integration: For those who like more detailed technical analysis, TradeNation’s integration with TradingView offers a nice upgrade. This feature lets you access advanced charting tools, technical indicators, and community insights from the TradingView platform, all while trading through TradeNation. For me, TradingView’s integration adds a level of sophistication that balances out the simplicity of the main platform, making it appealing to both beginner and experienced traders.

However, there are a few limitations here:

- No MT4/MT5 Support: TradeNation doesn’t support MetaTrader 4 or 5, which are popular among traders for their flexibility and compatibility with Expert Advisors (EAs). If you’re someone who relies on these platforms for automated trading or custom indicators, you might find TradeNation’s lack of MT4/MT5 limiting.

- Limited Advanced Features: For seasoned traders looking for a platform with custom indicators, automated strategies, or back-testing capabilities, TradeNation’s proprietary platform might feel a bit basic. It’s designed more for manual trading than for advanced algorithmic setups.

Verdict: Overall, TradeNation’s platform is user-friendly and offers essential features without overcomplicating things. While it might lack some of the depth found in platforms like MetaTrader, its TradingView integration compensates for that with robust charting tools, making it an ideal platform for manual trading and straightforward analysis.

TradeNation Trading Platforms Summary.

Proprietary platform & TradingView integration provides a solid foundation.

4. Execution Speed – 4 / 5 stars

4.0 out of 5.0 starsI tested out TradeNation’s execution speed during different times of the day and found it consistently reliable. While the platform doesn’t position itself as a top-tier, high-frequency trading option, it still delivered solid performance with minimal slippage on most trades, even during peak trading hours. For retail traders not relying on ultra-fast execution, TradeNation’s system should feel dependable.

Here’s what I noticed:

- Market Maker Model: TradeNation operates as a market maker rather than offering ECN or STP execution, meaning that they internally handle trades rather than routing them to external liquidity providers. This isn’t necessarily a drawback—especially for retail traders—since the platform still executes trades quickly without relying on external factors.

- Fixed Spreads with Fast Execution: I found that TradeNation’s fixed spreads didn’t slow down execution, even during volatile times. This is a definite advantage for day traders or short-term traders who want consistent costs without sacrificing execution speed.

- No Direct Market Access (DMA): For those looking for Direct Market Access, TradeNation might not be the best fit, as it doesn’t offer the speed boost of DMA execution. However, for general retail trading, the platform provides more than enough execution speed, and I didn’t notice any major delays when testing different assets.

Verdict: If you’re after dependable execution without ultra-high-frequency demands, TradeNation performs well across various conditions. For traders focusing on standard strategies and not ultra-fast scalping, it holds its own.

TradeNation Execution Speed Summary.

Market maker model but good overall speeds.

5. Deposit & Withdrawal – 5 / 5 stars

5.0 out of 5.0 starsWhen it comes to funding your account, TradeNation keeps things simple. They offer a variety of payment methods, including bank transfers, credit/debit cards, and PayPal. What impressed me the most was that there were no fees for deposits or withdrawals, which is a significant advantage over brokers that charge transaction fees.

From the outset, I found it easy to move funds in and out of my account, with multiple options available to cater to various preferences. Plus, there’s no fuss around hidden fees, which is something I always appreciate in a broker.

Here’s what makes TradeNation’s deposit and withdrawal process stand out:

- Free Deposits and Withdrawals: TradeNation doesn’t charge fees for deposits or withdrawals, which is fantastic. I’ve come across many brokers who tack on transaction fees, but with TradeNation, you won’t see any surprise deductions in your account balance when transferring funds.

- Multiple Payment Methods: TradeNation supports bank transfers, credit/debit cards, and e-wallets like PayPal. This flexibility is a big plus if you prefer to keep things digital or need quick, reliable funding options. Deposits were processed almost instantly in my experience, and withdrawals took 1-3 business days depending on the method.

- Low Minimum Deposit: There’s no minimum deposit requirement, which is perfect for new traders or anyone wanting to start small. I personally found this welcoming, as it allows you to test the waters without feeling pressured to commit a large sum.

Verdict: If you’re looking for an easy, hassle-free way to manage your trading funds, TradeNation delivers. With no fees and a variety of options to suit your preferences, it’s straightforward and cost-effective, setting a high bar in this area.

TradeNation Deposit & Withdrawal Summary.

Quick easy and efficient to both withdrawal and deposit without fees.

6. Regulation and Security – 5 / 5 stars

5.0 out of 5.0 starsTradeNation is regulated by multiple authorities, including the Financial Conduct Authority (FCA) in the UK, ensuring a high level of security and compliance with industry standards. Here’s a breakdown of their security features:

- FCA Regulation: TradeNation is regulated by the Financial Conduct Authority (FCA) in the UK, which is one of the most respected regulatory bodies in the world. This regulation ensures TradeNation adheres to strict guidelines, including keeping client funds in segregated accounts and providing negative balance protection. This means you can’t lose more money than you deposit, a crucial safeguard in volatile markets.

- Negative Balance Protection: Negative balance protection is a significant feature that safeguards traders from owing more than their deposited funds. For anyone using leverage, this is invaluable. It’s a layer of security that reassures traders that they won’t incur debt from sudden market moves.

- Fund Segregation and Data Protection: TradeNation maintains client funds in segregated accounts, which means they are kept separate from the broker’s operational funds. Additionally, the platform employs encryption technology to protect user data. These measures ensure that your funds and personal information are kept safe.

Verdict: The fact that TradeNation is regulated by the FCA and adheres to these security measures is reassuring. For spread betting in the UK, this is enough regulatory approval needed.

TradeNation Regulation & Security Summary.

FCA regulation is sufficient for UK traders.

7. Onboarding – 4.5 / 5 stars

4.5 out of 5.0 stars

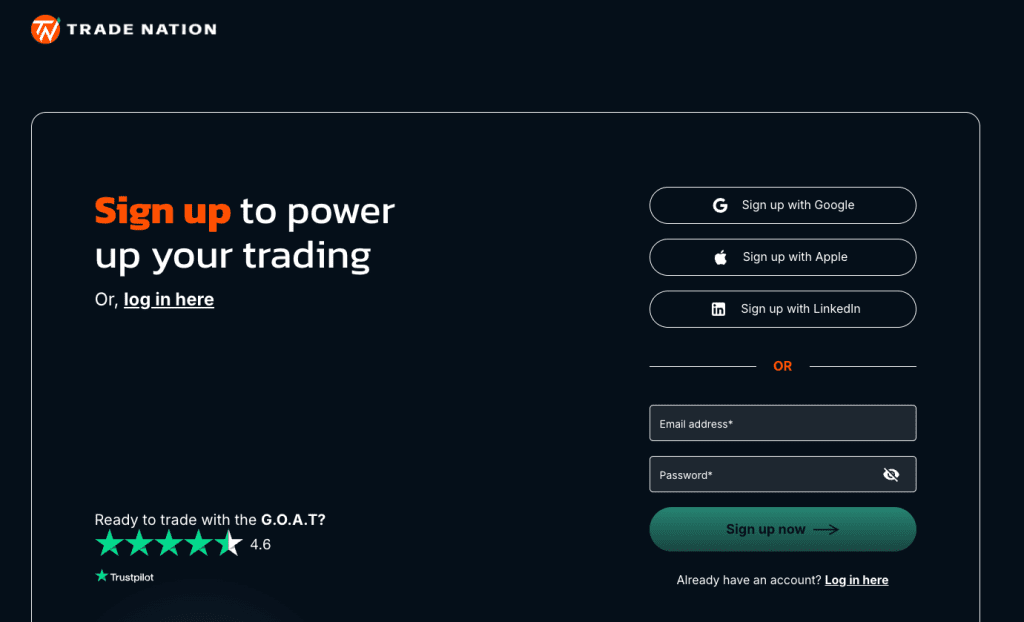

The onboarding process with TradeNation is straightforward. It was easy to register and provide necessary verification documents, which were processed relatively quickly. My account was approved within 24 hours, which is pretty quick! While some brokers offer faster onboarding processes, TradeNation was still efficient in terms of account creation and verification.

Here’s what the onboarding experience looked like:

- Digital Registration: The entire registration process is conducted online. I was able to fill out basic information and upload verification documents within minutes. TradeNation’s registration form is intuitive, and I didn’t feel bogged down with unnecessary details.

- Quick Verification: TradeNation’s verification process was relatively quick—my account was verified within 24 hours, which is impressive. This fast turnaround time is ideal for traders who want to jump into the markets.

- No Minimum Deposit Requirement: One aspect I appreciated was the lack of a minimum deposit. This means that traders can start with any amount they’re comfortable with, making TradeNation accessible to a wide range of trading budgets.

- Demo Account Availability: For newcomers, TradeNation offers a demo account to practice on. This feature is great for getting familiar with the platform without risking real funds. However, the demo account is limited in some of its features compared to other brokers, so it’s more of a taste of the real thing rather than a full-featured practice environment.

Verdict: TradeNation’s onboarding process is efficient and low-pressure, allowing you to start small and explore the platform at your own pace. While it doesn’t have the flashy features of some other brokers, it’s ideal for those who prefer a straightforward, accessible start.

TradeNation Onboarding Summary.

Onboarding process is super quick and easy for beginners.

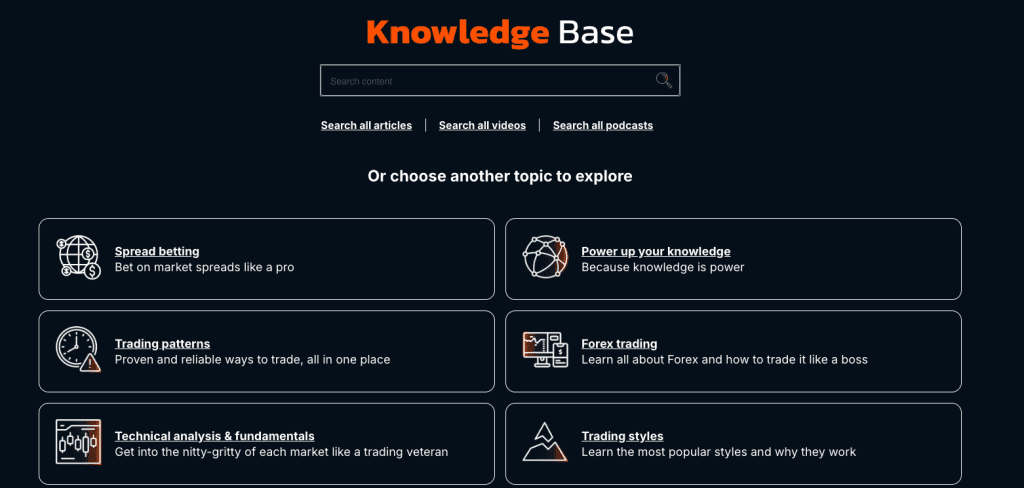

8. Educational Resources – 3 / 5 stars

3.0 out of 5.0 stars

TradeNation provides a range of basic educational resources, including articles, tutorials, and market insights. However, compared to other brokers like XTB, which offers more comprehensive webinars, video tutorials, and in-depth analysis, TradeNation’s educational offerings are somewhat limited.

Here’s what’s available:

- Trading Basics: TradeNation has a range of articles and tutorials explaining core trading concepts, like leverage, risk management, and market analysis. These are ideal if you’re new to trading and want a foundational understanding.

- Market Insights: They also provide daily market insights and analysis on key economic events. This helps you stay informed, although I found these updates to be more high-level rather than offering detailed, actionable insights.

- Video Tutorials and FAQs: The platform includes video tutorials and an FAQ section to guide users through platform navigation and common questions. While helpful, these resources focus mainly on platform basics, which is great for getting started but doesn’t dive into advanced trading strategies.

- Lack of Advanced Webinars or Trading Courses: Unlike some other brokers, TradeNation doesn’t offer webinars or live trading sessions. Advanced traders who prefer a hands-on approach to learning or deeper technical analysis resources may find this limiting.

Verdict: Overall, TradeNation’s educational content is straightforward and geared towards beginners. If you’re new to trading, it provides enough to help you get started. However, for more advanced traders or those looking to deepen their understanding of the markets, this might not be sufficient. This lack of extensive educational materials makes TradeNation more suited to those who already have trading experience rather than complete beginners.

TradeNation Education Summary.

Unfortunately very thin on the ground and aimed towards beginners only.

7. Customer Support – 4.5 / 5 stars

4.5 out of 5.0 starsWhen I reached out to TradeNation’s customer service team (more just to test it to be honest!), I was impressed with their responsiveness. The support is available 24/5 via live chat, phone, and email, and I found their representatives to be knowledgeable and helpful. Whether you’re facing a technical issue or have questions about your account, their team is pretty quick to assist.

Here’s a rundown of my experience with their support:

- Availability: TradeNation’s support is available 24/5, which aligns with typical trading hours. While they don’t offer 24/7 support, I found that their team is accessible whenever the markets are open, which covers most traders’ needs.

- Responsive Live Chat: The live chat feature is fast and efficient. Each time I reached out, a representative was available within moments, providing clear answers to my questions about the platform and trading specifics. It’s an excellent first point of contact if you need quick assistance.

- Phone and Email Support: For more complex inquiries, I tried their phone support and found it to be just as responsive. Their representatives were well-informed, providing detailed guidance, especially on account management and platform features.

- No Multilingual Support: One area for improvement would be offering multilingual support, especially given the global nature of trading. Currently, TradeNation’s support is primarily available in English, which may limit accessibility for non-English-speaking traders.

Verdict: In short, TradeNation’s customer support team was professional, friendly, and knowledgeable. Their support options cater well to English-speaking clients, but expanding language options would enhance accessibility for a broader audience.

TradeNation Customer Service Summary.

Generally great customer service, friendly, knowledgeable and willing to help.

FAQ’s

1. What platforms does TradeNation use?

TradeNation primarily offers its proprietary trading platform, which is known for its simplicity and ease of use. The platform is web-based and does not support third-party platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which may be a drawback for traders looking for advanced trading features like algorithmic trading and Expert Advisors (EAs). The platform is optimized for both desktop and mobile devices, but it lacks the extensive charting tools and flexibility that more global platforms offer.

2. Does TradeNation offer Islamic accounts?

No, TradeNation does not offer Islamic accounts. This can be limiting for traders following Sharia law who require interest-free trading environments. Many other brokers, such as EightCap or Pepperstone, provide Islamic accounts to accommodate these needs.

3. Does TradeNation offer a VPS?

TradeNation does not provide VPS (Virtual Private Server) access. VPS is a common feature for brokers that support algorithmic and automated trading strategies, as it allows for 24/7 trading with low latency. The absence of VPS services makes TradeNation less suited for traders who rely on high-speed execution and automated systems.

4. What account types are available at TradeNation?

TradeNation offers a single account type for spread betting and CFD trading, which simplifies the trading experience but limits flexibility. There are no separate account tiers like Standard, Raw Spread, or Pro accounts, nor does TradeNation offer Islamic accounts. This could be a disadvantage for more experienced traders or those looking for tighter spreads with commissions.

5. What are the spreads and commissions at TradeNation?

TradeNation offers commission-free trading with fixed spreads. The spreads tend to be wider compared to brokers that provide raw spread accounts with commissions, such as Pepperstone or EightCap. While this can be beneficial for beginners, traders looking for tight spreads for scalping or high-frequency trading may find the spreads less competitive than those at other brokers.

6. Does TradeNation support automated trading and copy trading?

No, TradeNation does not support automated trading or copy trading features. Its proprietary platform focuses on manual trading. For traders looking to use Expert Advisors (EAs) or engage in copy trading, other brokers like EightCap or Vantage Markets offer better options.

7. How fast is TradeNation’s execution speed?

TradeNation is a market maker broker, meaning that it handles trades internally rather than routing them directly to liquidity providers. As a result, its execution speed is not as fast as brokers offering an ECN or STP execution model. While this may not affect the majority of retail traders, those involved in high-frequency trading or scalping may experience more slippage compared to brokers like Pepperstone or EightCap, which provide faster execution through no-dealing-desk models.

8. What educational resources are available at TradeNation?

TradeNation provides a range of basic educational resources, including articles, tutorials, and market insights. However, compared to other brokers like EightCap, which offers more comprehensive webinars, video tutorials, and in-depth analysis, TradeNation’s educational offerings are more limited. This could be a drawback for beginner traders looking to deepen their understanding of the markets.

9. What is TradeNation’s customer support like?

TradeNation offers 24/5 customer support via live chat, email, and phone. The support team is available during regular trading hours and is generally responsive. However, TradeNation’s customer support lacks multilingual support, making it more geared toward English-speaking markets, specifically the UK. Brokers like EightCap, which provide multilingual support, are better suited for global traders.

10. What are the deposit and withdrawal options at TradeNation?

TradeNation offers free deposits and withdrawals with no minimum deposit requirement, making it accessible for all traders. Available payment methods include credit/debit cards, bank transfers, and e-wallets like Skrill. Withdrawals are processed relatively quickly, usually within 1-3 business days. However, the range of deposit options is more limited compared to global brokers like EightCap, which offer more international payment methods.

11. Is TradeNation regulated?

Yes, TradeNation is regulated by the Financial Conduct Authority (FCA) in the UK. This regulation provides a high level of security and trustworthiness, ensuring that clients’ funds are protected through measures like segregated client accounts and negative balance protection. However, unlike some brokers that operate in multiple jurisdictions under different regulators, TradeNation’s operations are largely focused on the UK market.

Is TradeNation a Good Broker?

Yes, TradeNation is one of the best spread betting brokers for beginners. It excels in offering a simple, transparent, and user-friendly trading environment, making it a strong contender for traders who prioritise fixed spreads, predictable costs, and ease of use. The platform is straightforward, with a focus on spread betting and CFDs, and it’s regulated by the FCA, which adds an essential layer of trust and security.

Who It’s Best For:

- Beginners: TradeNation’s no-frills approach and educational content make it a welcoming platform for beginners. With fixed spreads and no minimum deposit requirement, newcomers can ease into trading without the pressure of complex fee structures or large initial commitments.

- Traders Seeking Predictability: The fixed spreads provide cost certainty, a significant advantage for anyone wary of sudden cost spikes during volatile market conditions.

Who Might Find It Limited:

- Advanced Traders: If you’re an advanced trader who relies on automated trading strategies or sophisticated analysis tools, the absence of MetaTrader platforms, VPS access, and advanced educational resources may feel limiting.

- Diversified Investors: TradeNation’s focus on spread betting and CFDs might not be ideal for those looking to trade a broader range of assets like physical stocks or bonds.

Bottom Line: TradeNation is a solid choice for traders in the UK who want simplicity, transparency, and a user-friendly experience. Its fixed spreads, responsive support, and FCA regulation make it reliable and predictable. However, more advanced traders may find other platforms better suited to their needs, especially if they require more robust trading features or tools.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)