Vantage Markets Spread Betting Review: UK 2025

When I first tested Vantage Markets, a broker that has built a strong reputation since its founding in 2009, frankly I’d never heard of them. I consider myself a spread betting expert, and I’ve been around the block with spread betting & trading brokers, but I had never heard of Vantage – the spread betting & trading brokers you most often hear of are the Pepperstone‘s and even the ActivTrades‘ of the world but I was fortunate enough to discover and test their platform thoroughly and Vantage did not disappoint at all, quite the opposite! Here is how they performed in against our criteria:

Through this review, I’ll dive into how Vantage performs across key categories, including its suitability for both beginner and advanced traders, fees, platform usability, execution speed, and customer support.

Overall Rating – 4.5 / 5 stars

4.5 out of 5.0 starsIn Summary: Vantage Markets is a frankly incredible broker for intermediate to advanced traders, especially those keen on automated trading through MT4, MT5, and TradingView. With a strong emphasis on algorithmic trading tools and access to its VPS service, it positions itself as a solid option for those needing low-latency & algorithmic execution. However, it does lack some diversity in its trading platforms and API access.

Pros

- Low spreads and competitive commissions on Razor accounts

- Full integration with MetaTrader 4, MetaTrader 5, and TradingView

- Access to a free VPS service for qualifying traders

- Regulated by the FCA and ASIC, ensuring robust safety

- Comprehensive educational content and fast execution speeds

Cons

- No proprietary API or platform for custom AI/automated trading

- Limited selection of non-CFD assets like traditional stocks

- VPS only free for high-volume traders

1. Trading Markets – 4 / 5 stars

4.0 out of 5.0 stars

Vantage Markets offers over 1,000 tradable instruments, which is more than enough for most traders, though it’s not as extensive as some of the larger brokers like IG or Pepperstone. You can trade Forex, commodities, indices, and a range of cryptocurrency ETFs, but if you’re looking for individual stock trading or a wider variety of ETFs, you may feel somewhat restricted. Here’s what they have:

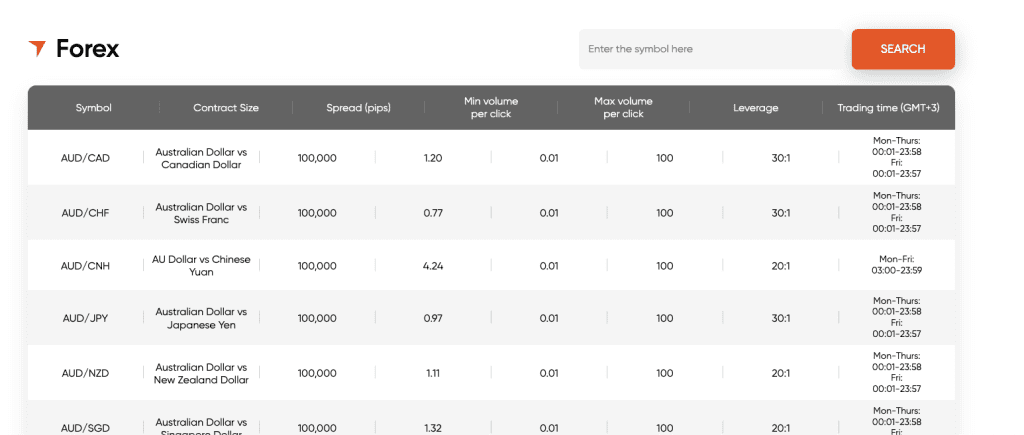

- Forex: Vantage Markets provides access to over 40 forex pairs, including majors like EUR/USD, GBP/USD, and exotic pairs for those looking to explore less commonly traded currencies. I found the spreads on majors to be tight, particularly on the Raw Spread account, which is perfect if you’re a high-frequency or scalping trader.

- Commodities: For commodity traders, Vantage offers key options such as gold, silver, oil, and a handful of soft commodities like coffee and wheat.

- Indices: Vantage gives you access to major indices such as the FTSE 100, S&P 500, DAX 30, and NASDAQ 100. The spreads on these indices are competitive.

Verdict: the core offering focuses on major Forex pairs, popular indices, and commodities, making it a solid choice for traders specialising in those areas. I liked the range of 40+ Forex pairs and the depth of tradable assets provided.

Vantage Markets Trading Assets Summary.

Over 1000+ tradable assets with a focus on FX trading, index trading and commodities.

2. Fees – 4 / 5 stars

4.0 out of 5.0 stars

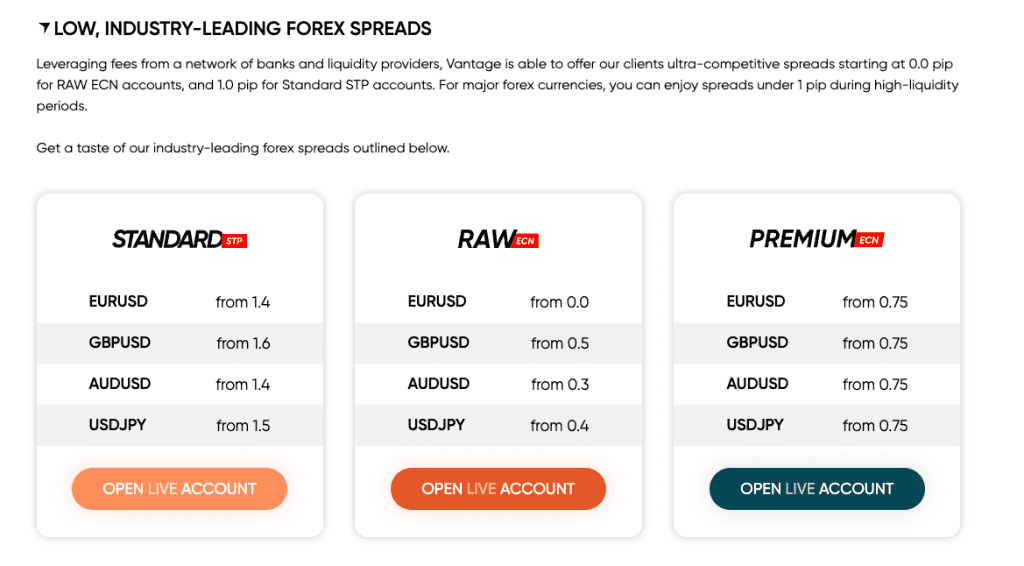

Vantage Markets is known for offering Raw accounts with highly competitive spreads and a transparent fee structure. Raw accounts start with spreads as low as 0.0 pips on major forex pairs such as EUR/USD. These accounts charge a £5 per lot round turn commission, making them ideal for scalpers and high-frequency traders looking for low-cost execution.

For Standard accounts, there are no commissions, but the spreads are slightly wider, starting from 1 pip on major pairs. This is better suited for beginner or intermediate traders who prefer the simplicity of commission-free trading and don’t mind paying a slightly higher spread.

Other Fees

Vantage charges an inactivity fee after 12 months of no trading activity, which is standard across most brokers. In addition, overnight swap rates apply to positions held overnight, particularly affecting margin traders. Swap rates are based on the interbank interest rates of the two currencies involved in the forex pair and can either be a cost or a credit, depending on the direction of your trade.

Verdict: The main reason Vantage is not our top rated broker is that the spreads are quite expensive on the standard account. They are more expensive than other brokers but the Raw accounts provide great pricing and cheap commissions.

Vantage Markets Fees Summary.

Over 1000+ tradable assets with a focus on FX trading, index trading and commodities.

3. Trading Platforms – 4.5 / 5 stars

4.5 out of 5.0 stars

I spent a significant amount of time on Vantage Markets’ supported platforms: MT4, MT5, and TradingView, all of which offer extensive charting tools, indicators, and automation capabilities. MetaTrader 4 and 5 are industry standards, especially for algorithmic trading, and I found the integration to be smooth.

I also tested the TradingView ProTrader platform, which adds advanced charting and social features, ideal for traders looking to share and follow strategies. The absence of a proprietary platform might be a limitation for some, but the comprehensive integration with TradingView more than makes up for it, especially for technical traders.

One downside is the lack of custom API access, which advanced traders may miss when building proprietary trading systems. However, Vantage’s SmartTrader Tools adds features like enhanced risk management, making it more suitable for retail traders.

VPS Access

Vantage provides free VPS access for high-volume traders, which is crucial for running low-latency algorithmic strategies 24/7.

Verdict: Vantage’s ProTrader platform leveraging TradingView is a standout performer here but MT4 & MT5 support are an added bonus. There is no API access for more advanced traders but the VPS access is great for algo trading.

Vantage Markets Trading Platforms

Proprietary ProTrader platform is the highlight but MT4 / MT5 are nice to have.

4. Execution Speed – 4.5 / 5 stars

4.5 out of 5.0 stars

During my tests, I was impressed by Vantage Markets’ execution speed, particularly on the Razor accounts. Orders were executed almost instantly, thanks to their ECN-like environment and no-dealing desk model. For high-frequency traders and scalpers, this is essential.

For traders needing low-latency execution, Vantage Markets offers free VPS access for qualifying accounts. I tested this with my Expert Advisors (EAs), and the performance was excellent, with minimal slippage and downtime. However, you must meet the trading volume requirement to get the VPS for free, which may not suit smaller traders.

Verdict: Great execution speeds, low-latency execution, VPS access available. All-in-all, Vantage Markets is a platform built for execution speeds and a great trading experience.

Vantage Markets Execution Speed Summary.

Great execution speeds, VPS access and ECN environment.

5. Deposit & Withdrawal – 4.5 / 5 Stars

4.5 out of 5.0 starsVantage Markets offers a variety of deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets like PayPal and Skrill. Deposits were processed instantly, and withdrawals took around 1-3 business days during my testing, which is in line with industry standards.

What stood out is the absence of deposit and withdrawal fees, which adds significant value for traders like myself who prefer to keep transaction costs low. However, keep in mind that third-party fees from payment providers may still apply.

Vantage Markets supports a wide variety of deposit and withdrawal methods, including the following:

- Bank Wire Transfers – These may take 2–3 business days, depending on the banks involved.

- Credit and Debit Cards – Instant processing for Visa, Mastercard, and other major cards.

- E-wallets – Supported options include PayPal, Skrill, and Neteller, with instant deposit options for these methods.

All deposit methods are fee-free, while withdrawals may take 1–3 days depending on the payment provider. Bank transfers, in particular, may take slightly longer depending on the destination country, but for most major currencies, the process is smooth. E-wallet withdrawals are generally faster, with Skrill and Neteller often processed within 24 hours.

Verdict: Not the fastest withdrawal processes but e-wallets are accepted for faster payment processing.

Vantage Markets Deposit & Withdrawal Summary.

Not the fastest speeds for withdrawal but e-wallets accepted.

6. Regulation and Security – 4.5 / 5 stars

4.5 out of 5.0 starsVantage Markets is regulated by both FCA (Financial Conduct Authority) in the UK and ASIC (Australian Securities and Investments Commission), two of the most respected financial regulators globally. These regulators ensure that Vantage Markets operates under strict guidelines, including the segregation of client funds. This means that in the event of financial difficulty, your funds remain protected and separate from the company’s assets.

Additionally, Negative Balance Protection (NBP) ensures that retail traders will never lose more than the funds they have in their accounts, which is particularly important for those trading leveraged products.

Investor Compensation Schemes

As a regulated broker under FCA, Vantage Markets also participates in the FSCS (Financial Services Compensation Scheme), which protects client funds up to £85,000 in case the broker becomes insolvent. This is an important safety net for UK-based traders.

Verdict: Both FCA & ASIC protection make Vantage markets a highly-regulated and secure trading broker.

Vantage Markets Regulation & Security Summary.

FCA & ASIC regulation provides adequate regulation-approval for UK & Australian traders.

7. Onboarding – 4.5 / 5 stars

4.5 out of 5.0 stars

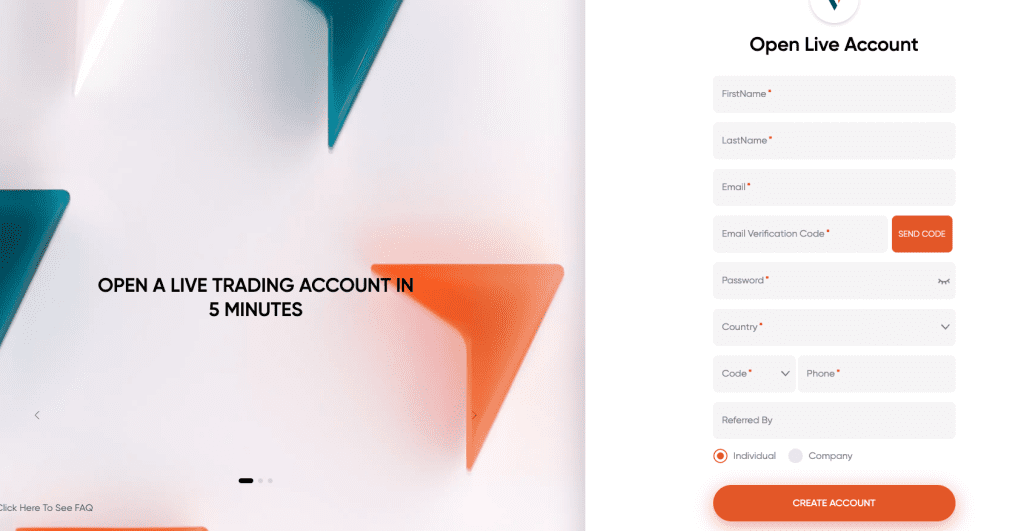

The onboarding process at Vantage Markets is intuitive, fast, and fully digital. New users can register within minutes by submitting the necessary identification documents and verifying their email address. After completing the KYC (Know Your Customer) process, most accounts are verified within 24 hours, allowing you to begin trading almost immediately.

Account Types

Vantage offers a variety of account types to suit different trading styles. In addition to the Raw and Standard accounts, Vantage also offers Pro accounts for traders with higher volumes, providing lower commissions and tighter spreads. For professional clients, leverage can go as high as 1:500, allowing for higher exposure with less margin.

For beginners, the demo account remains a highly recommended tool. It provides access to MT4/MT5 and offers real-time data without any risk, allowing new traders to familiarize themselves with the trading environment.

Minimum Deposit

The minimum deposit required is £100, which makes it accessible to beginner traders without sacrificing quality.

Maximum Leverage

Leverage of 1:30 is offered for retail clients in line with FCA regulations, and up to 1:500 is available for professional traders, providing opportunities for risk-tolerant traders to amplify their positions.

Account Types

Vantage Markets offers Standard and Raw accounts, with Razor accounts being tailored for lower spreads and high-frequency traders.

Vantage Markets Onboarding Summary.

FCA & ASIC regulation provides adequate regulation-approval for UK & Australian traders.

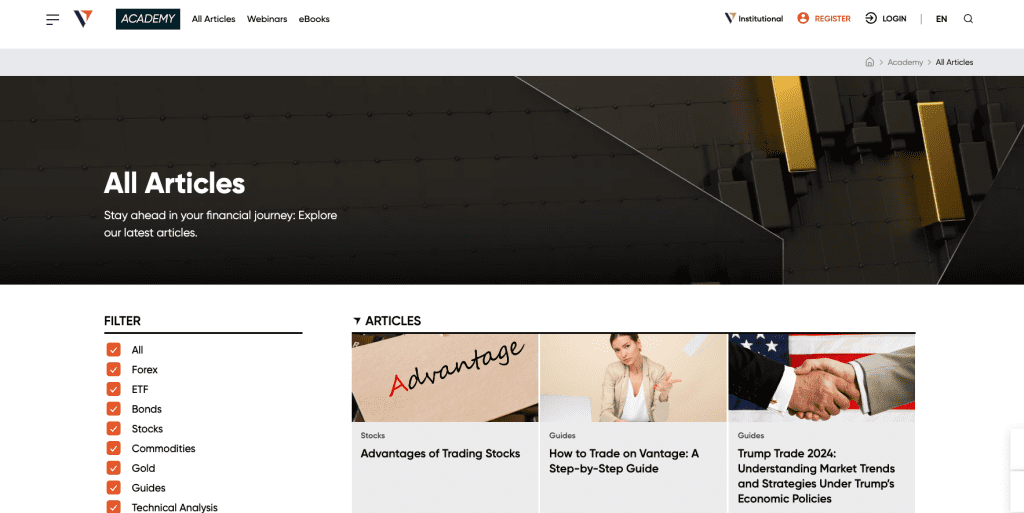

8. Education – 4.5 / 5 stars

4.5 out of 5.0 stars

Vantage Markets offers a wide range of educational content, including:

- Vantage Academy includes a range of video tutorials, market analysis, and webinars designed to improve trader skills and market understanding.

- Trading Tools – SmartTrader Tools is an additional package available on MT4/MT5, enhancing risk management and order execution capabilities.

- Daily Market Analysis – Vantage offers daily insights into major financial events, providing traders with up-to-date information that can influence market movements.

- Webinars and Trading Guides – Free webinars hosted by industry experts are regularly available to cover various trading topics, from beginner strategies to advanced technical analysis.

Verdict: Vantage offers deep and comprehensive educational materials including videos, webinars, relevant market analysis for traders and a range of detailed market analysis.

Vantage Markets Education Summary.

Solid educational offering & frequently updated.

Can You Spread Bet with Vantage Markets?

Yes, you can spread bet on Vantage Markets using their spread betting account. This is fantastic news for everyone looking to benefit from tax-free trading from a leading broker like Vantage – highly recommended.

Is Vantage Markets a Good Broker?

Yes, Vantage Markets is a well-rounded broker for spread betting and CFD trading that excels in algorithmic trading with its MT4/MT5 integration and VPS access. For traders using automated strategies or those who require a low-latency environment, Vantage Markets provides an optimal setup. However, its lack of proprietary platform or API access may limit some advanced users.

For those focusing on Forex and CFD trading, with the need for strong execution speeds and competitive spreads, Vantage Markets remains an excellent choice.

FAQs

1. Is Vantage Markets good for algorithmic trading?

Yes, Vantage Markets is suitable for algorithmic traders due to its support for MT4, MT5, TradingView, and VPS services.

2. Does Vantage offer a VPS?

Yes, Vantage Markets provides free VPS access for qualified traders, which is essential for running automated strategies without interruptions.

3. Is Vantage Markets regulated?

Yes, Vantage Markets is regulated by both the FCA (UK) and ASIC (Australia), offering a secure trading environment for its users.

3. Does Vantage Markets charge withdrawal fees?

No, Vantage does not charge for deposits or withdrawals, but third-party fees may apply depending on the payment method used.

5. Can You Spread Bet with Vantage Markets?

Yes, you can spread bet on Vantage Markets using their specialist spread betting account.

6. What account types are available at Vantage Markets?

Vantage Markets offers Standard, Raw Spread, and Pro accounts. The Raw Spread account is ideal for traders looking for low spreads with a £5 per lot commission.

7. Does Vantage Markets offer Islamic accounts?

Yes, Vantage Markets offers Islamic accounts for traders who need interest-free trading options, in compliance with Sharia law.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)