XTB Broker Review: UK 2025

XTB is a global online broker, and a publicly-listed Polish conglomerate that has established itself as a top choice for trading Forex and CFDs. If you’re diving into the trading world, you might not have heard of XTB or might be wondering if it’s a good broker for you. But as with any broker, it’s essential to understand its features, pricing, and performance before committing.

In this review, I’ll break down everything you need to know about XTB, including its user interface, fees, range of instruments, and more.

We base our review on a qualitative-points-based scale, which is converted into a star rating to give you an accurate assessment. This review is designed to help you decide if XTB is the right broker for your trading needs.

Overall Rating – 4.5 / 5 stars

4.5 out of 5.0 starsSummary: XTB is a comprehensive trading platform for traders of all experience levels. It offers competitive fees, a wide range of assets to trade, comprehensive educational resources and excellent customer service. Whether you’re a beginner learning the ropes or a seasoned professional, XTB is a highly recommended CFD trading broker for UK traders.

After spending time on XTB’s platform and digging into its offerings, I found it to be an excellent fit for traders who focus on CFDs and Forex, with a strong educational foundation for newcomers.

Pros

- User-friendly trading platform with rich features

- Excellent educational resources and support

- No commission fees on certain trades

- Extensive range of CFDs and forex pairs

- FCA-regulated, ensuring high levels of security

Cons

- Proprietary trading platform; may not offer the flexibility for all traders

- No ability to automate trading strategies

- Limited options for trading traditional stocks

- High inactivity fees after 12 months

1. Trading Markets – 4 / 5 stars

4.0 out of 5.0 stars

XTB brings a fairly large selection of over 2,100 instruments, covering Forex, indices, commodities, stocks, and cryptocurrencies. However, keep in mind that XTB’s offerings lean heavily towards CFDs, which makes it better for traders focused on speculation rather than long-term investing.

- Forex: Over 50 currency pairs, including major, minor, and exotic pairs. Spreads on major pairs like EUR/USD start as low as 0.1 pips, making it highly competitive.

- Indices: Trade CFDs on popular global indices like the FTSE 100, DAX 30, and S&P 500, giving exposure to large markets without owning individual stocks.

- Commodities: Includes hard commodities like gold, silver, crude oil, as well as soft commodities like wheat, coffee, and corn.

- Cryptocurrencies: Trade CFDs on major cryptos like Bitcoin, Ethereum, and Litecoin. Due to regulatory restrictions, these assets are available only for professional traders under FCA regulations.

- Stocks and ETFs: XTB offers CFDs on stocks and ETFs, allowing you to trade price movements without owning the underlying assets. While traditional share trading isn’t available, the range of CFDs is extensive.

Verdict: XTB’s range is ideal for CFD and Forex traders who prioritize flexibility and diverse market exposure. However, if you’re looking to trade traditional stocks or ETFs directly, this platform may feel limited. However, for CFD and Forex traders, XTB’s wide range of offerings—including 50+ Forex pairs and major indices like the FTSE 100 and S&P 500—is more than enough.

XTB Markets Summary.

Over 2,000+ tradable assets with a focus on FX trading and CFD trading.

2. Fees – 4.5 / 5 stars

4.5 out of 5.0 stars

Now, let’s talk about something every trader cares about: fees. XTB’s pricing is pretty straightforward, which I appreciated—no hidden fees lurking around the corner. One of the most attractive aspects of XTB is its transparent and competitive fee structure. For those who appreciate clear-cut pricing without hidden charges, XTB’s cost setup is made for you. Here’s how it breaks down:

- Forex and CFD Spreads: XTB operates primarily on a spread-only model for Forex and most CFDs, meaning you won’t encounter extra commissions. Spreads start at a low 0.1 pips on EUR/USD and similar pairs, which is super competitive, especially compared to other brokers.

- Stock and ETF CFDs: For those interested in stock CFDs, there’s a commission starting at 0.08% per lot with a minimum charge of £8 per trade, a great rate – especially considering other costs from Vantage Markets or even Pepperstone – check out those reviews if you are interested..

- Inactivity Fee: After 12 months of inactivity, a £10 monthly fee kicks in, which can be avoided simply by logging in or placing a trade—nothing too arduous.

- No Deposit/Withdrawal Fees: XTB doesn’t charge for deposits or withdrawals (except for withdrawals below certain thresholds), so your transactions remain cost-efficient. However, your bank or third-party provider may still apply their own fees.

Verdict: XTB’s pricing structure is actually very, very good. It’s simple, straightforward, cost-effective, and among the best for casual to moderately active traders. If you’re a high-volume trader, it’s still worth comparing with other brokers to see if their spreads meet your expectations but XTB scores very highly here.

XTB Fees Summary.

Extremely competitive fees with great spreads, and low commissions per trade.

3. Trading Platforms – 4 / 5 stars

4.0 out of 5.0 stars

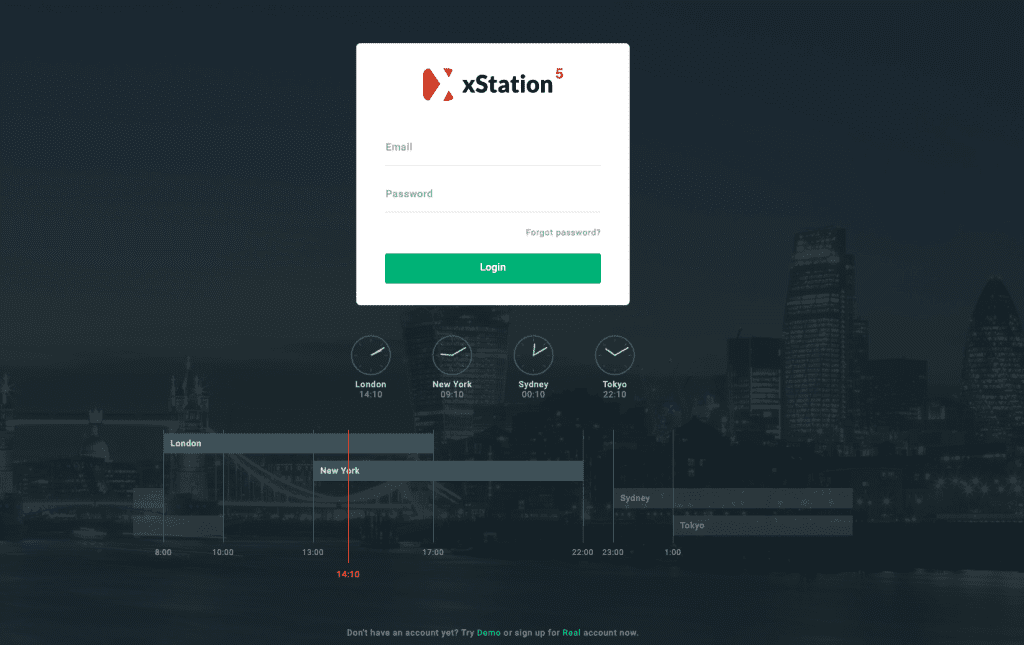

When it comes to usability, XTB’s xStation 5 platform is something they clearly put a lot of effort into. It’s not every day that you come across a proprietary platform that actually competes with the likes of MetaTrader, but xStation 5 does just that—and it might even surprise you with its ease and versatility. Here’s a look at what makes it tick:

Key Features of xStation 5:

- Fast Execution: XTB’s platform is fast—no lag, no fuss. Execution speed here is ideal if you’re a scalper or a day trader who can’t afford to lose time.

- Advanced Charting: xStation 5 is stacked with over 30 technical indicators and drawing tools, which is a dream for any technical analyst. It’s not overloaded with clutter, so even beginners can feel comfortable digging into the charts without getting lost.

- Trader’s Calculator: This is an underrated feature in my book. The calculator lets you see your potential profits and losses before placing a trade, which is super handy for risk management and adds an extra layer of precision to your trading.

- Market Sentiment Data: If you like to keep an eye on what the crowd is doing, you’ll appreciate the real-time sentiment data that xStation 5 provides. It’s a neat little feature to gauge market trends based on other traders’ moves.

The platform is available on both desktop and mobile, and it features:

- 30+ technical indicators.

- One-click trading.

- Economic calendar and news feeds.

- Trader’s calculator for managing risk and potential profits.

Whether you’re on desktop or mobile, the platform experience remains smooth and functional, mirroring each other almost seamlessly. The mobile version has all the main features, so you’re not sacrificing much if you need to step away from the desk.

It’s worth noting that you cannot connect TradingView to XTB and as of 15th March 2024, you can no longer use MT4 or MT5 with XTB, which might be a bit limiting to some traders.

Verdict: Personally, I found xStation 5 to be one of the more user-friendly platforms out there, though if you’re a die-hard MT4 or MT5 fan, you might miss the automation features those platforms offer.

XTB Trading Platforms Summary.

Fantastic proprietary platform but MT4, MT5 & TradingView are noticeably absent.

4. Execution Speed – 5 / 5 stars

5.0 out of 5.0 starsSpeed is the name of the game here. XTB has really nailed the execution times—which is essential if you’re aiming to make fast moves on the market without worrying about lag or slippage. Here’s what stands out:

- Low-Latency Execution: XTB has built xStation 5 with speed at the forefront. I didn’t encounter any notable delays, and trades felt instant, even when markets were highly volatile. It’s great for scalpers, high-frequency traders, or anyone who needs reliable execution.

- Direct Market Access (DMA): XTB’s platform doesn’t just sit around—it’s actively seeking the best prices, so you’re not dealing with marked-up spreads. This feature is especially beneficial if you’re trading large volumes and want to avoid potential conflicts of interest with your broker.

While VPS access and algorithmic trading aren’t available on xStation 5 like they are on MT4 or MT5, XTB’s execution speeds make it more than capable for most trading strategies. If fast and accurate execution is a priority for you, xStation 5 definitely delivers.

Verdict: Top marks here. They are a NDD broker, not a market maker, and they are extremely quick at executing trades on their proprietary platform. Great job on execution speeds.

XTB Execution Speed Summary.

Great execution speeds from a NDD broker giving you a speedy seamless trading experience.

5. Deposit & Withdrawal – 4.5 / 5 stars

4.5 out of 5.0 starsXTB’s deposit and withdrawal process is refreshingly straightforward. Unlike some brokers that make it feel like pulling teeth just to get your funds, XTB keeps things simple:

- Payment Methods: You have a few options here, including bank transfers, credit/debit cards, and e-wallets like PayPal, Skrill, and Neteller. This range of methods offers flexibility, particularly if you prefer the ease of e-wallets.

- Minimum deposit: XTB has no minimum deposit, zilch, zip, nada, nothing at all. Brilliant for beginners looking to start trading.

- Processing Times: Deposits are processed almost instantly, which is ideal if you’re the kind of trader who likes to jump into the action without waiting around. Withdrawals typically take 1-3 business days, depending on your chosen method, and I found it reliable without any surprises.

- Fees: The good news is that XTB doesn’t charge deposit fees, which is surprisingly rare these days. For withdrawals, they’re mostly free too—just watch out for minimum withdrawal thresholds (there is currently a £50 threshold so you have to withdraw over £50 for it to be free), as there may be fees for withdrawals below certain amounts depending on the method.

Verdict: XTB has clearly put some thought into making deposits and withdrawals hassle-free. As someone who’s dealt with brokers who over-complicate this process, I genuinely appreciated the ease and speed here. Just be mindful of third-party fees from your bank or payment provider if applicable.

XTB Deposit & Withdrawal Summary.

No fuss, no hassle, just smooth all round.

6. Regulation and Security – 5 / 5 stars

5.0 out of 5.0 starsSecurity is crucial, and XTB checks all the right boxes here. Not only is XTB regulated by the Financial Conduct Authority (FCA) in the UK, which is one of the world’s most reputable financial regulators, but it’s also publicly listed on the Warsaw Stock Exchange. This combination adds an extra layer of transparency that many brokers don’t offer. Here’s what stood out to me about XTB’s safety features:

- FCA Regulation: Being FCA-regulated means that XTB has to adhere to strict guidelines regarding client fund segregation, financial reporting, and operational transparency. It’s a big reassurance, especially if you’re a UK trader who wants that extra layer of security.

- Negative Balance Protection: XTB offers negative balance protection, so you won’t end up owing more than your initial investment—even if the market takes a wild turn. This is a must-have feature, particularly for anyone trading leveraged products like CFDs.

- Publicly Traded Company: Because XTB is listed on a major stock exchange, it must adhere to stringent financial disclosures, which means you can trust that its financials are robust and public. It’s not often you find a broker that’s this transparent, and it certainly gives XTB an edge in credibility.

Verdict: In short, XTB’s security setup is top-notch. The combination of FCA regulation, negative balance protection, and the transparency of a publicly listed company makes XTB a safe and reliable choice.

XTB Regulation & Security Summary.

Publicly traded and FCA regulated is not a pair you get often with a broker so jump at it.

7. Onboarding – 5 / 5 stars

5.0 out of 5.0 stars

Opening an account with XTB is an absolute breeze. The entire process can be completed online within minutes. You’ll need to provide standard information like your name, address, and proof of identity. Once your documents are verified (which usually takes less than a day), you’re ready to start trading.

XTB also offers a free demo account, which allows you to practice trading with virtual funds. It’s a great way for beginners to familiarize themselves with the platform without any financial risk.

Minimum Deposit

As we mentioned, XTB requires no minimum deposit for opening an account, which makes it even more accessible for beginners and traders who wish to start small. This is a significant advantage over brokers like Pepperstone, which require a minimum deposit of around £100. For traders with limited initial capital, this feature makes XTB a more flexible choice.

Maximum Leverage

The maximum leverage offered by XTB for retail clients in the UK is 1:30, in line with FCA regulations. This is the standard leverage cap for forex and CFD trading for retail clients under European Securities and Markets Authority (ESMA) rules, providing adequate risk control for most traders.

Minimum Trade Volume

With XTB, you can start trading with a minimum trade volume of 0.01 lots, similar to other brokers like Pepperstone. This low minimum trade volume is ideal for traders who prefer to manage their risk exposure more carefully.

Margin Call and Stop Out Levels

XTB applies a margin call level of 80% and a stop-out level of 50%. This is slightly different from other brokers, which might have lower stop-out levels. These thresholds help protect traders from incurring excessive losses and ensure that traders are aware when their account margin is running low.

Commission

XTB operates mainly on a spread-only model for most assets, including forex and indices, meaning there are no commission fees for most trades. However, for CFDs on stocks and ETFs, a small commission applies—starting at 0.08% per lot, with a minimum charge of £8 per trade.

Spread Type

XTB offers variable spreads, which adjust based on market conditions. Spreads on major currency pairs like EUR/USD start as low as 0.1 pips, which is competitive compared to other brokers.

Account Currencies

XTB supports a variety of account currencies including GBP, EUR, USD, and PLN. This makes it flexible for traders in different regions to avoid currency conversion fees when funding their accounts.

Verdict: Quick and easy to open an account at XTB, there is a demo account for those who want to give it a go themselves before committing and as mentioned, there is no minimum deposit so you can get started super quickly and easily.

XTB Onboarding Summary.

Smooth process with the same requirements as other brokers but no minimum deposit.

8. Education – 4.5 / 5 stars

4.5 out of 5.0 stars

XTB’s educational offerings are nothing short of impressive. Their Trading Academy is genuinely one of the most comprehensive I’ve seen, with resources that cater to all levels of traders. Here’s what makes it stand out:

- Trading Academy: XTB’s Trading Academy has a structured curriculum with videos, tutorials, articles, and webinarsthat cover everything from basic trading concepts to advanced strategies. I was impressed by how in-depth the materials are, especially the video tutorials that explain technical analysis and risk management in a way that’s easy to follow.

- Webinars: They host regular webinars that dive into market trends, trading psychology, and platform tips. These sessions are led by experienced traders and analysts, which is great if you want real-time insights from professionals.

- Daily Market Analysis: XTB’s market analysis section is updated daily, offering insights and forecasts on major market events. It’s a useful feature for staying on top of news that might affect your trades.

- Content for All Levels: Whether you’re a beginner or an advanced trader, XTB has tailored content for every skill level. They make it easy to navigate through different topics, so you’re not left feeling overwhelmed.

One thing to note: some of the advanced content is gated, so you’ll need to sign up for an account to access it. But overall, XTB’s educational resources are among the best, making it a solid choice if you’re serious about developing your trading skills.

Verdict: E-books, white papers, market updates, educational articles, XTB has a wealth of educational content for all kinds of traders from beginners to more advanced, they publish frequently and in-depth. One of the best brokers we’ve seen in terms of their educational offering.

XTB Education Summary.

XTB functions almost as a news organisation in its own right, with an incredible depth of content.

9. Customer Service – 5 / 5 stars

5.0 out of 5.0 stars

When it comes to customer service, XTB shines. I’ve tested many brokers over the years, and XTB’s support team is genuinely one of the best out there. Here’s what you can expect:

- Availability: XTB offers support 24/5, which covers all major trading hours. Whether you’re trading on the European session or late into the U.S. markets, help is just a click or call away.

- Responsive Live Chat: I tried out the live chat feature, and my queries were answered within minutes. There’s nothing more frustrating than waiting around for a response when you’re in the middle of a trade, so this is a huge plus. The chat agents were knowledgeable and didn’t give me the “copy-paste” answers you sometimes get.

- Multilingual Support: For a global broker, multilingual support is essential, and XTB nails it. The team is fluent in multiple languages, so if English isn’t your first language, you’re still covered. This is particularly helpful for international clients who might feel more comfortable discussing complex trading queries in their native tongue.

- Phone and Email: If live chat isn’t your thing, XTB also offers phone and email support. I found the phone line response to be quick, and emails were generally answered within a day.

Verdict: XTB’s customer support team is genuinely helpful, responsive, and professional. For me, this adds a lot of value, especially if you’re a beginner and might need guidance as you navigate the trading world.

XTB Customer Service Summary.

Great, friendly customer service, no complaints and live chat button right on the website.

Can You Spread Bet on XTB?

No, unfortunately not. While XTB is a highly reputable broker offering a wide range of CFDs (Contracts for Difference) across various asset classes, it does not support spread betting.

For traders specifically looking to engage in spread betting, other brokers like Pepperstone offer this feature, along with competitive spreads and advanced trading platforms.

While XTB excels in CFD trading, those interested in spread betting will need to consider alternatives.

Is XTB the Best Broker for CFD Trading?

XTB is a solid broker that delivers an excellent trading experience. Whilst you aren’t able to spread bet on XTB in the UK, with competitive fees, a user-friendly platform, and a wide range of CFDs to trade, it’s easy to see why it’s a popular choice.

If you’re a CFD or forex trader, XTB’s xStation 5 platform will likely meet all your needs. However, for those looking for a broader range of traditional assets like stocks or ETFs, you might find the platform’s offerings somewhat limited.

In conclusion, XTB is perfect for traders who want to focus on CFD and forex trading, backed by top-notch tools, educational resources, and stellar customer support.

FAQs

1. Is XTB good for beginners?

Yes, XTB is highly beginner-friendly, thanks to its easy onboarding process, free demo account, and comprehensive educational materials.

2. What fees does XTB charge?

XXTB operates mainly on a spread-only model for Forex and CFD trades, with no commissions on most trades. A commission is charged on stock and ETF CFDs, starting at 0.08% per lot. XTB also charges an inactivity fee after 12 months of no trading activity.

3. Is XTB safe to use?

Yes, XTB is highly secure and regulated by the FCA in the UK and KNF in Poland. XTB is also listed on the Warsaw Stock Exchange, providing transparency through public financial reporting. The platform also offers Negative Balance Protection (NBP) for retail clients.

4. Can I use MetaTrader on XTB?

No, XTB uses its proprietary platform xStation 5, which is available on both desktop and mobile. While it doesn’t support MetaTrader 4 or 5, xStation 5 provides advanced trading tools and automation options.

5. Does XTB support automated trading?

Yes, xStation 5 allows traders to automate strategies through its platform, similar to Expert Advisors (EAs) on MetaTrader. Although not as extensive as MetaTrader’s automation features, it is a suitable option for most traders.

6. Does XTB offer Islamic accounts?

Yes, XTB offers Islamic accounts, which are Sharia-compliant. These accounts allow Muslim traders to trade without incurring interest on overnight positions, in line with Islamic finance principles.

7. What account types are available at XTB?

XTB offers a Standard account with no minimum deposit, making it accessible for beginners and experienced traders alike. The platform supports various account currencies, including GBP, EUR, USD, and PLN.

8. Does XTB charge for withdrawals?

XTB does not charge for most deposits or withdrawals, but there may be fees for withdrawals below certain thresholds, depending on the payment method.

9. How fast is XTB’s execution speed?

XTB offers low-latency execution across its platform, ideal for traders utilizing scalping or other short-term strategies. Though there’s no VPS option, xStation 5 delivers reliable execution for retail traders.

Is XTB a Good Broker?

After spending significant time on XTB, I’d say it’s an impressive platform with a lot to offer. xStation 5 is sleek, fast, and user-friendly, making it ideal for traders who appreciate advanced charting and efficient execution. While XTB doesn’t support spread betting or MetaTrader, its educational resources, transparent fees, and strong regulatory oversight make it a solid choice, especially for Forex and CFD traders.

Whether you’re a complete beginner or a seasoned trader, XTB provides a secure and reliable trading experience with a platform that’s easy to navigate and packed with features. With its competitive pricing and commitment to customer service, XTB is a broker that genuinely puts traders first.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)