It can feel intimidating when you’re starting with a small spread betting account. Many traders worry about how to make meaningful profits while managing the risks of trading with limited capital. The good news is that it’s entirely possible to grow a small account through spread betting — if you use the right strategies, risk management, and broker.

In this guide, we’ll cover everything you need to know about spread betting with a small account, including the minimum capital required, smart strategies, risk management, and why Pepperstone is the best broker for traders looking for low-cost spreads.

How Much Do I Need to Start Spread Betting?

The minimum amount required for spread betting varies by broker, but generally, you can start with as little as £100–£200. However, starting with a small amount requires more careful planning and disciplined risk management because smaller accounts are more vulnerable to drawdowns.

How much do I need to spread bet?

You can start spread betting with £100–£200, but to manage risk effectively, it’s recommended to have at least £500 to avoid over-leveraging your positions.

While it’s possible to start with a small account, it’s important to keep in mind that the smaller your account, the less flexibility you have. You’ll need to avoid risking too much capital on any single trade, which is why proper risk management is essential.

Is Spread Betting with a Small Account Risky?

Yes, spread betting is inherently risky due to the leverage involved. However, the risks can be managed effectively if you follow a disciplined approach to trading.

Key Risks for Small Accounts

- Leverage: Leverage amplifies both potential profits and losses. With a small account, even a minor adverse price movement can wipe out a significant portion of your capital. For example, with a £100 account and 1:30 leverage, a 5% market move against you can cause a substantial loss.

- Spread Costs: The spread is the difference between the buying and selling price of an asset, and these small differences add up. If you’re trading with a small account, high spreads can erode your profits quickly.

- Over-Leveraging: A common mistake for small account traders is using too much leverage, leading to rapid losses. A prudent approach is to use minimal leverage — just enough to maintain flexibility without putting your entire account at risk.

Strategies for Spread Betting with a Small Account

1. Focus on High-Liquidity Markets

When spread betting with a small account, it’s crucial to focus on high-liquidity markets like major forex pairs (e.g., EUR/USD, GBP/USD) and major indices (e.g., FTSE 100, S&P 500). These markets tend to have lower spreads, which is essential for small accounts, as every pip counts when your capital is limited.

2. Use Tight Risk Management

One of the most important factors in successfully growing a small account is using tight risk management rules. A commonly followed rule is the 1% risk rule: never risk more than 1% of your account on a single trade. For example, if you have £200 in your account, you should risk no more than £2 on any one position.

3. Trade with Tight Spreads

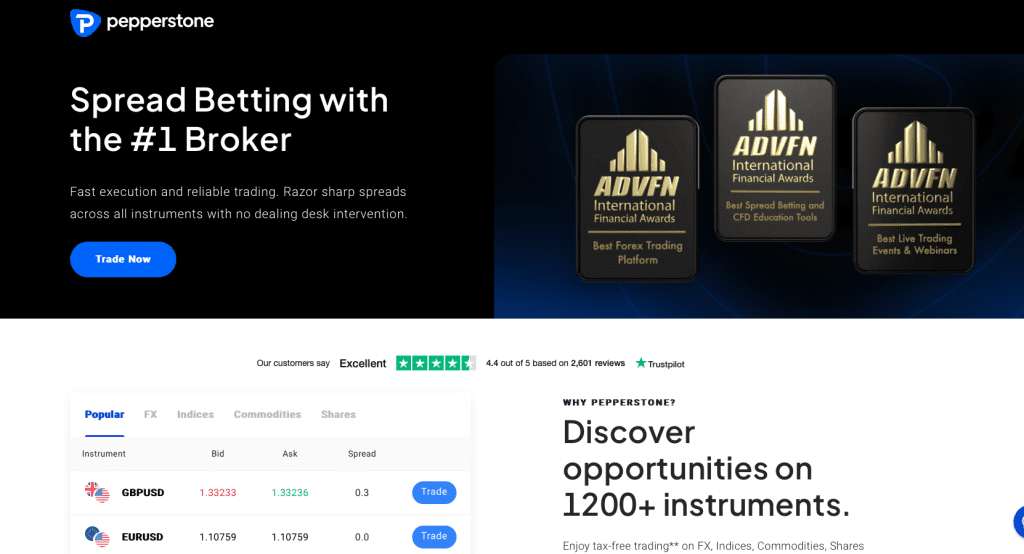

When you have a small account, spread costs can eat into your profits. This is why it’s essential to choose a broker that offers tight spreads. This brings us to Pepperstone, which is widely regarded as one of the best brokers for spread betting due to its Razor Account.

Why Pepperstone is the Best Broker for Small Accounts

Pepperstone is one of the top brokers for spread betting, especially if you’re starting with a small account. Their Razor Account is designed for traders who want to minimize spread costs, making it ideal for those with limited capital.

What is the Pepperstone Razor Account?

The Razor Account offers razor-thin spreads starting from 0.0 pips on major currency pairs. While there is a small commission on trades, this often ends up being cheaper than brokers who offer commission-free trading but with wider spreads.

Advantages of Pepperstone for Small Accounts:

- Low Spread Costs: The Razor Account ensures you enter and exit trades with minimal spread costs, which is vital for small accounts where every pip matters.

- Fast Execution: Pepperstone is known for its low-latency execution, ensuring your trades are executed quickly, even in fast-moving markets.

- Automated Trading: Pepperstone supports automated trading via MetaTrader (MT4/MT5) and cTrader, allowing you to test different strategies. However, if you’re trading with a small account, it’s advisable to focus on refining your manual strategies first before exploring automation.

- Risk Management Tools: Pepperstone provides tools like stop-loss orders and negative balance protection to help you manage your risk.

Get Started with Pepperstone today

You can get started with Pepperstone today here.

Razor Account vs Standard CFD Account

Pepperstone offers two main types of accounts: the Razor Account and the Standard Account. Let’s compare how they work for small account traders:

- Razor Account: This is ideal for spread betting with a small account because of the tight spreads. However, you’ll pay a small commission, typically around £5 per round turn per lot.

- Standard Account: The Standard Account has no commissions but comes with wider spreads. For traders with small accounts, this can be less ideal because wider spreads mean you need more price movement to break even.

In my personal experience, when spread betting with a small account, the Razor Account is the clear winner because even though there’s a commission, the tight spreads often result in lower overall costs.

Should I Use Automated Trading with a Small Account?

While automated trading can be highly effective, I wouldn’t recommend using automation with a small account unless you’ve already developed and tested a successful manual trading strategy.

Why?

- Automation requires capital: Automated trading systems like cAlgo for cTrader or Expert Advisors (EAs) for MetaTrader are excellent tools, but they work best with larger accounts that can withstand small drawdowns and continuous trades.

- Fine-tune your strategy first: With a small account, it’s crucial to focus on getting your trading strategy right. Once you’re consistently profitable manually, then you can consider automating your strategy using tools like ChatGPT or cAlgo.

Risk Management for Small Accounts

Proper risk management is crucial, especially when dealing with small capital. Here are some tips to manage your risk effectively:

- Use Stop-Loss Orders: Always set a stop-loss to limit your losses. With a small account, a single bad trade can wipe out your entire balance if you don’t have a stop-loss in place.

- Don’t Over-Leverage: Although leverage allows you to control larger positions, avoid over-leveraging your account. With small accounts, it’s tempting to use high leverage to maximize profits, but this also amplifies your losses.

- Negative Balance Protection: Pepperstone offers negative balance protection for retail traders, which ensures you cannot lose more than your initial deposit. This is especially useful when trading with a small account.

Conclusion

Spread betting with a small account is possible, but it requires discipline, patience, and a well-thought-out strategy. Managing your risk is crucial, and focusing on high-liquidity markets with low spreads will give you the best chance of success.

While automation can be a powerful tool, it’s not recommended for small accounts until you’ve perfected your strategy manually. Once you’re ready, Pepperstone offers the tools you need, from automated trading via cAlgo to the tight spreads offered through the Razor Account.

By choosing the right broker and following a disciplined trading approach, you can grow your small account steadily and minimize risks.

Sources to Review

Here’s a list of sources on trading with small accounts, offering expert advice on strategies, risk management, and broker recommendations:

- Investopedia

How Much Money Do You Need to Start Trading?

Investopedia provides insights into capital requirements and essential strategies for managing small accounts, including the effective use of leverage and risk management. - BabyPips

Small Trading Accounts: What Are The Risks?

BabyPips explains the risks associated with trading small accounts, emphasizing the importance of using proper risk management techniques like stop-losses and avoiding over-leveraging. - Learn to Trade the Market

How to Trade Successfully with a Small Trading Account

This article offers tips on growing small trading accounts through discipline, proper risk management, and focusing on high-probability trades. - CMC Markets

How to Start Trading With Small Capital

CMC Markets discusses strategies for starting with small capital, focusing on minimizing costs and maximizing return potential with the right tools and markets. - Daily Forex

5 Best Forex Brokers with Micro Accounts

Daily Forex lists top brokers for micro accounts, ideal for traders with small capital, highlighting their features and tools to help manage small trades effectively.

These resources offer valuable strategies, insights, and broker recommendations for those looking to grow small trading accounts while managing risk effectively.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-450x338.jpg)

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)