When choosing a broker, one of the crucial things to keep in mind is how much it’s going to cost you per trade, this is what’s called ‘the spread’. These 5 brokers are the 5 brokers that you can use for spread betting or CFD trading and offer the lowest spreads in the industry. Let’s dive in!

Who is the Broker with the Lowest Spread Betting Spreads?

1. Pepperstone – Ultra-Low Spreads for Active Traders

Minimum Spread: From 0.0 pips (Razor Account)

If you’re an active trader like me, Pepperstone‘s Razor Account is a really valuable. Spreads start as low as 0.0 pips, especially on forex majors, which is ideal if you’re working with tight profit margins or making frequent trades. Now, they do charge a small commission on the Razor Account, but in my experience, this is more than offset by the cost-saving on spreads. Their platform options – MT4, MT5, and cTrader are incredibly versatile, whether you’re an algo trader or just prefer manual trades. The no-dealing-desk model also means your trades hit the market fast, which is crucial if you’re scalping or day trading.

Plus, they’re FCA-regulated here in the UK, so you know you’re in safe hands. If you’re after high-speed execution and low costs, Pepperstone has nailed it

Pros

- Extremely low spreads, starting from 0.0 pips on Razor Account

- Multiple platform options, including MT4, MT5, and cTrader

- Fast execution speeds with No Dealing Desk (NDD) model

- Regulated by FCA, ASIC, and CySEC for strong oversight

- Comprehensive educational resources, webinars, and articles

Cons

- Commission charged on Razor Account trades

- No proprietary platform available

Here’s why Pepperstone stands out:

- Spread Options: On the Razor Account, traders can access spreads as low as 0.0 pips for major pairs like EUR/USD, GBP/USD, and USD/JPY. There’s a small commission, but for high-frequency or large trades, this setup can be more cost-effective.

- Platform Variety: Pepperstone is one of the few brokers that provides multiple platforms – MT4, MT5, and cTrader – allowing flexibility whether you’re using automated strategies or manual trades.

- Execution Speed: Thanks to its No Dealing Desk (NDD) model, Pepperstone boasts rapid order execution, especially critical for scalpers and day traders relying on low-latency trade entry.

For active forex traders, Pepperstone’s Razor Account offers excellent spread opportunities, and they back it with top-tier regulation by the FCA. If you’re interested in the lowest spreads with competitive execution, Pepperstone is hard to beat.

£500 Recommended Deposit

Best Overall

Pepperstone is a Melbourne-based broker that offers an excellent selection of trading instruments in the financial trading markets, including commodities, shares, ETFs and more.

75.5% of retail investor accounts lose money when trading on margin with this provider

2. ActivTrades – Best All-Around Value for Spread Bettors

Minimum Spread: From 0.5 pips on major forex pairs

ActivTrades hits that sweet spot between low costs and a great feature set. With spreads from 0.5 pips on forex majors and no extra commission, it’s great if you prefer a cleaner, all-inclusive pricing structure. O

ne thing I really like about ActivTrades is their proprietary platform, ActivTrader – it has useful tools like SmartOrder for managing trades and SmartLines for quick order adjustments. I’ve tried both their MT4 and ActivTrader setups, and each brings its own strengths. The added FCA regulation is a solid reassurance and ActivTrades also offers loads of educational content, from webinars to tutorials, which makes it a top pick for anyone just getting into spread betting.

Pros

- Low spreads with no additional trading commissions

- Offers ActivTrader platform, alongside MT4 and MT5

- Strong FCA regulation, ensuring client fund protection

- Advanced risk management tools, like negative balance protection

- Extensive educational materials and webinars

Cons

- Fewer account options than some competitors

- Smaller selection of assets compared to larger brokers

- Limited deposit and withdrawal methods

Here’s what makes ActivTrades one of our favourites:

- Proprietary Platform and MT4/MT5 Support: ActivTrades offers both MT4/MT5 and its proprietary ActivTrader, which has some unique tools like SmartOrder and SmartLines for order management.

- Risk Management: ActivTrades provides extra tools for risk management, including negative balance protection, which can be particularly useful in volatile markets.

- Educational Resources: They offer free webinars, tutorial videos, and regular market analysis, which makes them a good choice for beginners and intermediate traders.

£250 recommended deposit

Best for Forex

Founded in 2001, ActivTrades is a gloablly regulated and widely-recognised broker offering excellence in their proprietary platform.

83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

3. Vantage Markets – Best for High Leverage and Tight Spreads

Minimum Spread: From 0.0 pips (Raw Spread Account)

One thing I appreciate about Vantage is their ECN-like environment, which keeps execution smooth and fast – a lifesaver if you’re trading in volatile markets. They support MT4, MT5, and even TradingView integration, so if you’re big on technical analysis, they’ve got you covered.

Vantage’s FCA and ASIC regulation add an extra layer of security too, which is always a plus for those of us trading seriously.

Pros

- Raw Spread Account with spreads from 0.0 pips

- High leverage up to 1:500 for experienced traders

- ECN-like setup for fast execution and minimal slippage

- Supports MT4, MT5, and TradingView for advanced charting

- FCA and ASIC regulated, ensuring security and compliance

Cons

- Commission charged on the Raw Spread Account

- No proprietary trading platform offered

- Fewer educational resources compared to competitors

Vantage Markets caters to those who prioritize both low spreads and high leverage. Their Raw Spread Account offers spreads starting from 0.0 pips, with commissions factored in, making it ideal for high-frequency and high-leverage traders. Here’s a breakdown:

- Leverage Flexibility: Vantage Markets provides leverage up to 1:500 (for professional traders), allowing traders to maximize positions on small price moves, which can work well in tandem with their tight spread offerings.

- Execution Quality: With an ECN-like environment, Vantage Markets supports fast order execution with minimal slippage, a key feature for traders relying on tight spreads.

- Platform and Tools: They support MT4 and MT5 as well as TradingView integration, which is great for technical traders looking for advanced charting options.

With Vantage Markets, the combination of low spreads and high leverage makes them an attractive choice for spread bettors, especially those looking to optimize smaller moves.

£500 Recommended Deposit

Best All-Rounder

Vantage Markets in a seasoned provider of both CFD & Spread Betting tools with a range of over 1000+ instruments to trade

70.5% of retail investor accounts lose money when trading CFDs and Spread Bets with this provider.

4. SpreadEx – Low Spreads and No Minimum Deposit for Beginners

Minimum Spread: From 0.6 pips on major forex pairs

SpreadEx has made things really accessible for newcomers – no minimum deposit, straightforward pricing, and an intuitive platform. I think it’s perfect if you’re just getting your feet wet with spread betting; spreads start from 0.6 pips, and the proprietary platform is about as user-friendly as it gets. Unlike some brokers, SpreadEx doesn’t overload you with tools, which can be a blessing if you’re still learning the ropes. If you’re looking to keep things simple and avoid high upfront costs, SpreadEx is a great starting point.

Pros

- No minimum deposit requirement, ideal for beginners

- Offers both financial and sports spread betting

- Competitive spreads starting at 0.6 pips

- User-friendly proprietary platform

- FCA-regulated for security

Cons

- Limited selection of financial instruments

- No access to MT4 or MT5

- Basic trading features, lacking advanced tools

Here’s what sets SpreadEx apart:

- No Minimum Deposit: This broker has no minimum deposit requirement, which allows new traders to start with small stakes and build up as they gain experience.

- Simple Platform: SpreadEx doesn’t offer MT4 or MT5 but instead has an intuitive, user-friendly proprietary platform that’s easy to navigate. It’s perfect for beginners who may find advanced platforms overwhelming.

- Sports Spread Betting Option: Uniquely, SpreadEx combines financial and sports spread betting, so if you enjoy spread betting on sports, this broker offers a one-stop platform.

With spreads from 0.6 pips and an accessible setup, SpreadEx is ideal for those starting in financial spread betting or those looking for a dual sports-financial betting platform.

£250 recommended deposit

Best Service

Founded in 1999, one of the old-heads in the industry, SpreadEx has won multiple accolades for it's outstanding customer service and great range of markets.

64% of retail investors lose money when trading spread bets and CFDs with this provider.

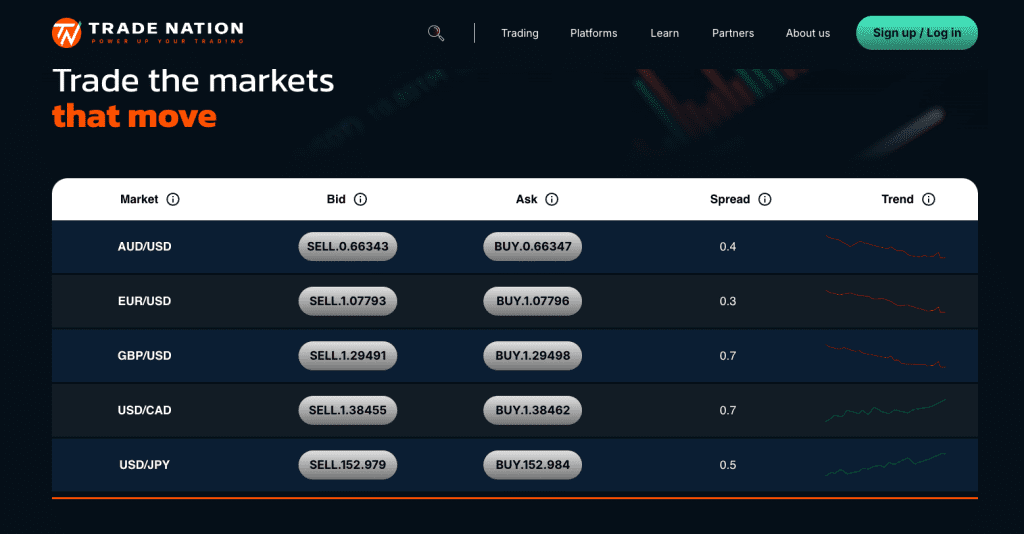

5. TradeNation – Transparent Fixed Spreads for Beginners and Casual Traders

Minimum Spread: Fixed spreads from 0.6 pips

TradeNation’s fixed spreads are a godsend if you want stability. I always find it appealing for newer traders or those who like predictability in their trading costs. Spreads are fixed from 0.6 pips, so no matter the market conditions, your trading costs are straightforward. Plus, there’s no commission to worry about – everything’s included, which can be helpful if you’re watching every penny. The platform is clean and easy to navigate, making it an excellent choice if you’re not ready for the bells and whistles of MT4 or MT5. They also have fantastic customer support, so if you’re new to spread betting and want quick answers, TradeNation has you covered.

Pros

- Fixed spread structure for predictable trading costs

- No commission on trades

- Beginner-friendly, straightforward proprietary platform

- No minimum deposit requirement

- Excellent customer support

Cons

- Limited asset range compared to major brokers

- Lacks MT4 or MT5 access

- Simplistic tools that may not suit advanced traders

Here’s why they’re worth considering:

- Transparent Pricing: TradeNation’s fixed spreads mean no fluctuations based on market conditions, so traders always know their exact costs.

- No Commission: TradeNation’s all-inclusive pricing model appeals to casual traders who want straightforward cost structures.

- Beginner-Friendly Platform: Although they don’t offer MT4 or MT5, TradeNation’s platform is simple and well-designed, making it accessible for new traders. They also provide excellent customer support, which is ideal for those still learning.

TradeNation’s fixed spreads and easy-to-navigate platform make them a solid choice for those looking to start spread betting without the complexities of varying spreads and commissions.

£250 Recommended Deposit

Best for Beginners

TradeNation offers a proprietary trading platform with fixed spreads resulting in an easy, reliable trading environment for those just getting started.

Top Brokers with the Lowest Spread Betting Spreads

| Broker | Minimum Spread | Account Type | Platform Options | Leverage | Regulation |

|---|---|---|---|---|---|

| Pepperstone | 0.0 pips | Razor Account | MT4, MT5, cTrader | Up to 1:30 | FCA |

| ActivTrades | 0.5 pips | Standard Account | MT4, MT5, ActivTrader | Up to 1:30 | FCA |

| Vantage Markets | 0.0 pips | Raw Spread Account | MT4, MT5, TradingView | Up to 1:500 | FCA, ASIC |

| SpreadEx | 0.6 pips | Spread Betting | Proprietary | Up to 1:30 | FCA |

| TradeNation | 0.6 pips (fixed) | Fixed Spread Account | Proprietary | Up to 1:30 | FCA |

Final Thoughts: Choosing the Best Low-Spread Broker for You

If you’re serious about reducing trading costs, Pepperstone and Vantage Markets lead the pack with the lowest spreads in the market with spreads as low as 0.0 pips on specific accounts. For beginner traders, SpreadEx and TradeNation offer simple setups with predictable, low spreads, making them easier to get started with spread betting.

- Active and High-Frequency Traders: For those trading frequently, Pepperstone’s Razor Account offers some of the tightest spreads available. Meanwhile, Vantage Markets gives high leverage options and tight spreads ideal for forex-focused strategies.

- Beginners and Casual Traders: SpreadEx and TradeNation cater to those who want simple, low-cost trading without the need for complex platforms.

By considering your trading style and how much spread you’re comfortable paying, you can choose the broker best suited to your needs. Remember, spreads are only part of the equation – platform usability, customer support, and educational resources can also make a big difference in your trading experience.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-450x338.jpg)

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)