This is a super common question, and I couldn’t find an answer for UK traders anywhere so thought i’d answer it for anyone curious… Here’s the quick answer: You can trade some major US Stocks like: Tesla, Apple, Google, Meta, Pfizer, and Amazon. You can also trade international stocks like Alibaba and LVMH. The list is fairly limited – see below.

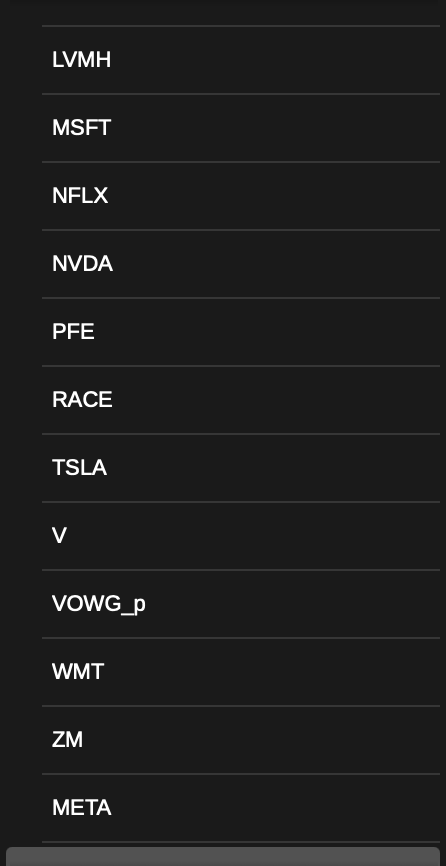

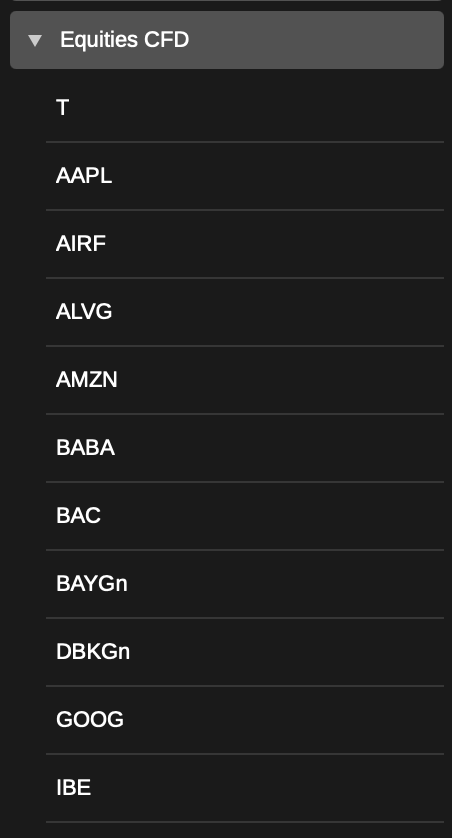

Here are the screenshots from my FTMO account. I trade in the UK so its based on CFD contracts but it’s not difficult to understand.

Here’s exactly what you can trade on the FTMO:

US Stocks Available on FTMO

FTMO currently (July 2025) allows trading on the following major US equities:

- Apple (AAPL)

- Amazon (AMZN)

- Google (GOOG) – see screenshot below

- Meta (META)

- Tesla (TSLA)

- Netflix (NFLX)

- Microsoft (MSFT)

- Pfizer (PFE)

- Bank of America (BAC)

- Visa (V)

- Walmart (WMT)

- Zoom (ZM)

These are highly liquid, large-cap names mostly drawn from the Nasdaq 100 and S&P 500. They include a mix of tech, healthcare, finance, and consumer retail. The liquidity and volatility make them suitable for intraday and swing traders.

Other Global & European Stocks on FTMO

FTMO also offers a few non-US equities that fall under global or European companies:

- Alibaba (BABA) – Chinese eCommerce giant

- LVMH (LVMH) – French luxury goods conglomerate

- Ferrari (RACE) – Iconic Italian automaker

- Air France (AIRF) – French airline

- Allianz (ALVG) – German insurer

- Bayer (BAYGn) – German pharmaceutical and chemical company

- Deutsche Bank (DBKGn) – German multinational bank

- Iberdrola (IBE) – Spanish utility

- Volkswagen (VOWG_p) – German car manufacturer

These are all available as CFDs and are traded in EUR or USD depending on the instrument. They offer some regional diversification but are not as widely traded as the US names.

Start your FTMO

If you are interested in trading stocks or forex via FTMO, you can access our link to get started or if you fancy trading properly and already know the advantages of spread betting you can start trading with Pepperstone – our preferred spread betting & trading broker in 2025.

A Few Notes About Trading Equities on FTMO

- The screenshots above are based on a UK £950 challenge account if this differs to what you see on US accounts or funded accounts, please et in touch and we will amend this list – it is useful to get a community going here.

- You can go long or short on these equities using CFDs

- You need to be mindful of dividend adjustments, overnight swap rates, and spread sizes, which can be higher than forex. I actually found the spread sizes to be huge when trading international stocks like LVMH so word of warning, be very, very careful here.

- Trading hours follow the respective exchange (e.g. US market open times).

Why the List is Limited

FTMO isn’t trying to be a full-service stock broker. Their equity offering is there for traders who want to incorporate a few high-volatility stocks into their trading strategy, not to trade obscure small caps. They seemingly ‘prefer’ traders to focus on forex & index trading vs stock trading.

If you’re an equities-only trader, this might feel limiting. But if you focus on quality setups across forex, indices, and a few recognisable names like AAPL or TSLA, FTMO gives you enough to work with.

Final Thoughts

You won’t find thousands of equities to choose from on FTMO, but you will find a handpicked list of some of the world’s most active and tradeable names. Whether you’re scalping Apple, shorting Tesla, or swing trading Visa, there’s enough here to fit into a diversified strategy but not for full-time stock traders…

FTMO allows you to trade a select number of equities via Contracts for Difference (CFDs), meaning you don’t own the stocks outright, but you can speculate on their price movements both up and down. While FTMO is best known for forex and indices, the platform does offer a focused list of equities too.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-450x338.jpg)

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)