Spread betting on stocks allows you to speculate on the price movement of individual shares without actually owning them. You simply place a bet on whether the price of a company’s stock—like Apple, Amazon, or HSBC—will rise or fall. It’s a powerful tool for trading the markets, offering tax-free profits in the UK and eliminating commissions. Here’s how to get started with stock spread betting and make the most of its unique features.

Step-by-Step Guide to Spread Betting on Stocks

Step 1: Understanding Stock Spread Betting

Alright, so what exactly is stock spread betting? Think of it like a wager on a stock’s price direction. You’ll decide if you think the stock price is going up or down, then place your bet accordingly. No need to own the stock—just predict where it’s headed.

Here’s a quick breakdown of the essentials:

Sell Price (Bid): The price if you think it’ll drop.

Buy Price (Ask): The price if you’re betting the stock will rise.

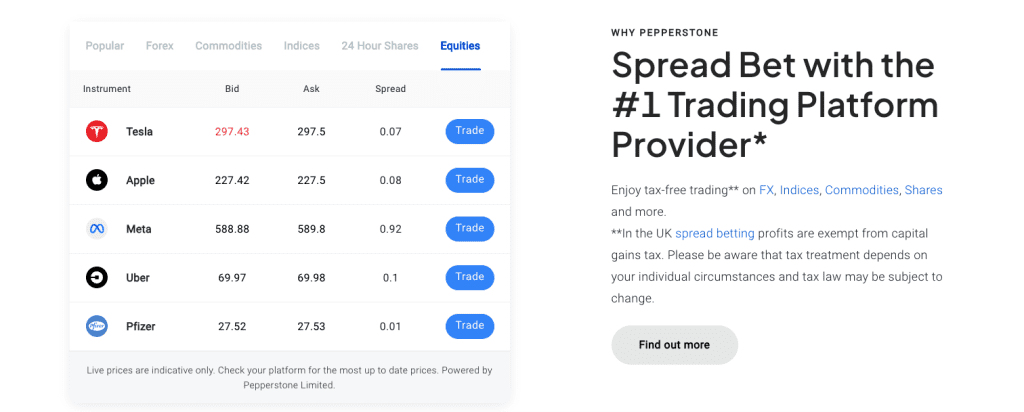

When you spread bet on stocks, you’re betting on a company’s share price movement. Each stock has a “buy” (ask) and “sell” (bid) price, representing what you’ll pay to enter the market. If you think the stock will go up, you’ll place a buy bet; if you think it will go down, you’ll place a sell bet. The difference between these prices is the “spread,” and this is where spread betting firms make their profit.

For example, if Apple shares are trading at 150/151, you can buy at 151 or sell at 150. You only pay the spread—no commissions—making it a straightforward cost structure.

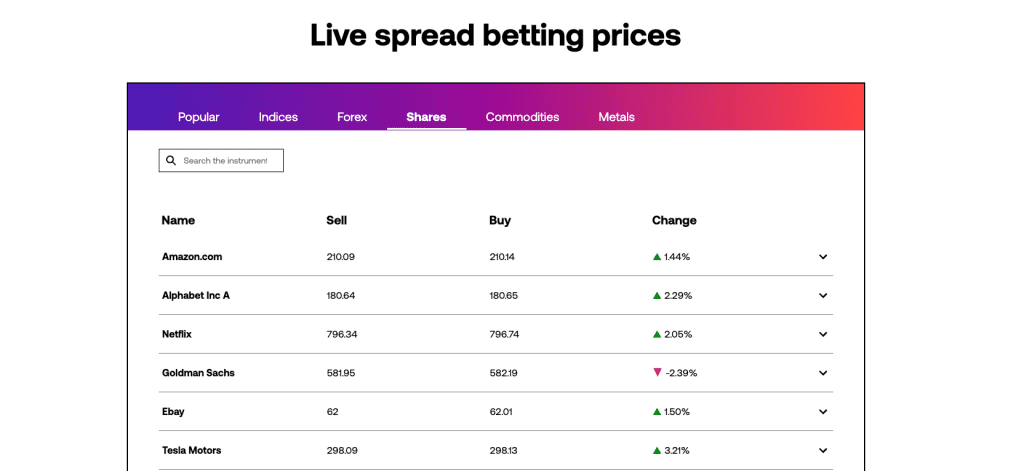

Step 2: Choosing a Stock to Bet On

With spread betting, you can access a whole buffet of stocks—from the giants of the FTSE 100 to the tech-heavy NASDAQ stars. Each stock has its own personality, volatility, and trends, so picking a stock that suits your style and market knowledge can make a big difference. Here’s a bit of guidance on where to start:

- Blue-Chip Stocks: These household names (like Apple, BP, or Coca-Cola) are known for their stability, often preferred by those looking for more consistent (though less dramatic) price changes.

- Growth Stocks: Risk-takers, this one’s for you! Stocks like Tesla and Shopify tend to show big price movements, meaning higher potential rewards and risks.

- Dividend Stocks: If you’re after regular payouts, stocks like Unilever or AT&T offer dividends, providing income and price movement to profit from.

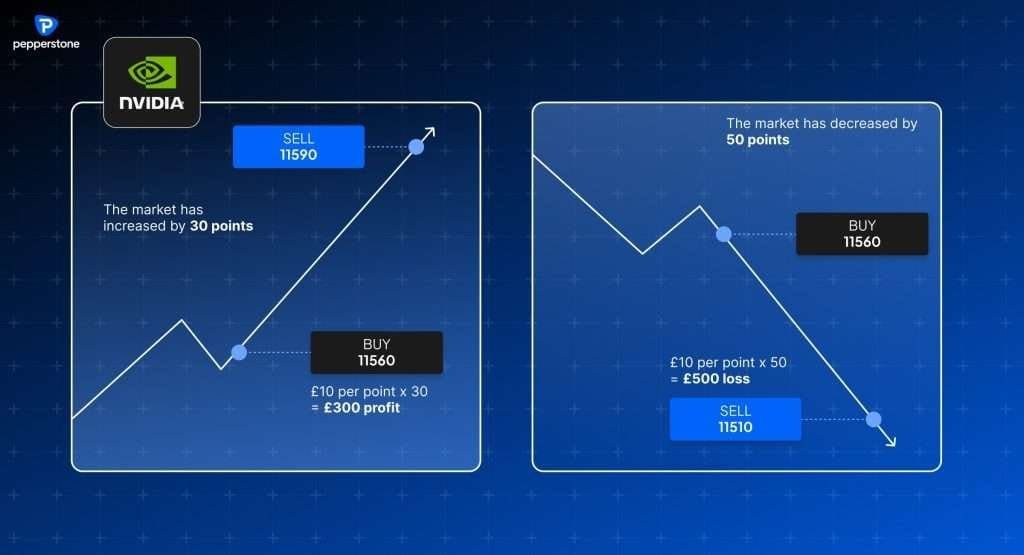

Step 3: Determine Your Stake per Point

Now for the nitty-gritty: determining how much you’ll bet per “point” or “penny” of movement. With stock spread betting, each point usually represents a 1p shift in the stock’s price.

Here’s an example:

Let’s say you bet £2 per point on Amazon at 3000p. If Amazon’s price rises to 3100p, you make: 100 points x £2 = £200 profit

But if it drops to 2900p? That same 100-point move would mean a £200 loss. So, choose your stake carefully.

It’s essential to choose a stake that aligns with your risk tolerance, especially since stocks can be more volatile than some other assets. As a beginner, it’s wise to start small—£1 or even £0.50 per point—to get the feel of things without overexposing your capital.

Step 4: Placing Your Stock Spread Bet

Once you’ve chosen your stock and stake size, it’s time to place the bet. Here’s how it works:

- Open Your Spread Betting Platform: Log into your platform and find the stock you want to trade.

- Choose Your Direction:

- Going long (buy): If you think the price will rise.

- Going short (sell): If you think the price will fall.

- Set Stop-Loss and Take-Profit Levels: Stop-loss orders help manage risk, and take-profit levels lock in gains when the price hits your target.

- Confirm the Bet: Review your choices and hit “Place Bet.” Your bet is now live, and you’re officially trading!

Step 5: Monitor and Adjust Your Position

Once you’re in, the markets can be fast-moving, especially around earnings reports or breaking news. You can see your running profit or loss right on the platform—so make adjustments as needed. Many traders use a trailing stop-loss, which moves up with the stock price to lock in gains.

Let’s say you’re betting £2 per point on HSBC, and the stock price is steadily rising. Adjusting your stop-loss higher can help capture profit without constantly monitoring the screen. And if the market moves against you, your stop-loss keeps your downside in check.

Step 6: Close Your Position

Pretty self-explanatory, when the price reaches your target, or if you’re ready to exit, you can close your position. Simply click the “Close Bet” button on your platform. The profit or loss is then added or deducted from your account balance.

Key Concepts in Stock Spread Betting

1. Points and Stake

With stock spread betting, each point usually represents a 1p movement in the stock price. If you’re betting £1 per point on Amazon, and it moves 100p in your favor, you make £100.

2. Leverage and Margin

Leverage lets you control a large position with a smaller deposit. A leverage of 1:5 means you can place a £500 bet with only £100 of capital. This leverage can significantly increase profits, but it also magnifies losses, so use it carefully.

3. Bid-Ask Spread

The spread is the gap between the buy (ask) and sell (bid) price. A tighter spread is ideal, as you’ll break even sooner after placing your bet. For example, if Apple has a 1-point spread, you’re just 1 point from profit when the stock moves in your favor.

4. Risk Management

Risk management is vital in spread betting. Stop-loss orders can automatically close your position if it moves against you, limiting your potential loss. Take-profit orders work similarly, closing the position once your target is hit. Both tools help protect your account from the unpredictability of the stock market.

Advantages of Spread Betting on Stocks

So why do this in the first place? Well there are several key advantages to spread betting stocks if you are based in the UK:

- Tax-Free Profits

Spread betting profits are free from capital gains tax for UK residents, making it a tax-efficient way to trade. - Commission-Free Trading

In spread betting, you only pay the spread—there’s no commission, unlike traditional stock trading. - Currency Conversion Savings

If you’re trading international stocks, you can bet in GBP, eliminating the need for currency conversion fees.

Risks of Stock Spread Betting

Whilst there are benefits, here are some of the risks associated with spread betting stocks:

- Market Volatility

Stock prices can fluctuate rapidly, especially around earnings releases or major economic events. These price swings can be advantageous but also risky. - Leverage Amplifies Losses

Leverage increases both potential gains and losses. A small price movement can lead to significant losses, so it’s crucial to use appropriate risk management.

Stock Spread Betting vs. Traditional Stock Trading

OK, now this all sounds fine, you might be thinking, but why don’t I just buy stocks instead of spread betting, surely that’s better right? Well, there are some key differences you should be aware of for both spread betting stocks and trading them traditionally:

1. Ownership of Shares

Spread betting is purely speculative; you don’t own the shares, which can simplify transactions and reduce costs.

2. Leverage Differences

Spread betting typically provides higher leverage than traditional trading, allowing you to gain more exposure with less capital but at greater risk.

3. Tax Efficiency

Spread betting profits are exempt from capital gains tax in the UK, while traditional share profits are taxable.

4. Cost Structure

Spread betting is commission-free, with only the spread to cover. Traditional share trading often incurs both spread and commission fees.

Tips for Successful Stock Spread Betting

If you are just getting started and looking to explore spread betting stocks to benefit from tax-free profits with leverage, there are some important things to be aware of and some friendly reminders:

- Start with a Demo Account

Practicing with virtual funds lets you understand the process without risking real money. - Research the Stock

Study your chosen stock’s financials, industry trends, and recent news. A well-researched bet has a better chance of success. - Use Stop-Loss Orders

Protect your capital by setting stop-loss orders, which automatically exit the position if the stock moves against you. - Start Small

Begin with a low stake per point, like £1, to keep your risk manageable as you get comfortable with stock spread betting. - Focus on Familiar Stocks

Begin with companies you know or have researched. Familiarity with a stock’s behavior can help in making informed bets.

Frequently Asked Questions (FAQs)

What Is Stock Spread Betting?

Stock spread betting involves betting on the price movement of individual shares. You don’t own the stocks but rather speculate on their direction.

How Does Spread Betting Differ from Stock Trading?

Spread betting is commission-free, tax-free in the UK, and uses leverage. In traditional stock trading, you own shares, pay capital gains tax, and often incur commission fees.

Is Spread Betting Risky?

Yes, especially due to leverage, which can magnify losses. Proper risk management, like stop-loss orders, is essential.

What Platforms Can I Use for Stock Spread Betting?

Popular platforms include MetaTrader, TradingView, and proprietary broker platforms. Each offers unique tools and features to enhance your trading experience.

How Much Should I Risk Per Point?

Your risk per point should match your risk tolerance. Beginners should start with a small amount, like £1 per point, to minimize potential losses.

Final Thoughts

Spread betting on stocks can be a powerful and profitable way to trade the markets, especially with the tax-free benefit in the UK. With leverage, commission-free trading, and a straightforward approach to profit and loss, stock spread betting has become increasingly popular among both new and experienced traders.

Just remember, risk management is essential to avoid large losses in the volatile stock market. Use a demo account to practice, research your stocks, and start small to build a strong foundation for success.

Happy trading!

Sources / Resources for Beginners

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-450x338.jpg)

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)