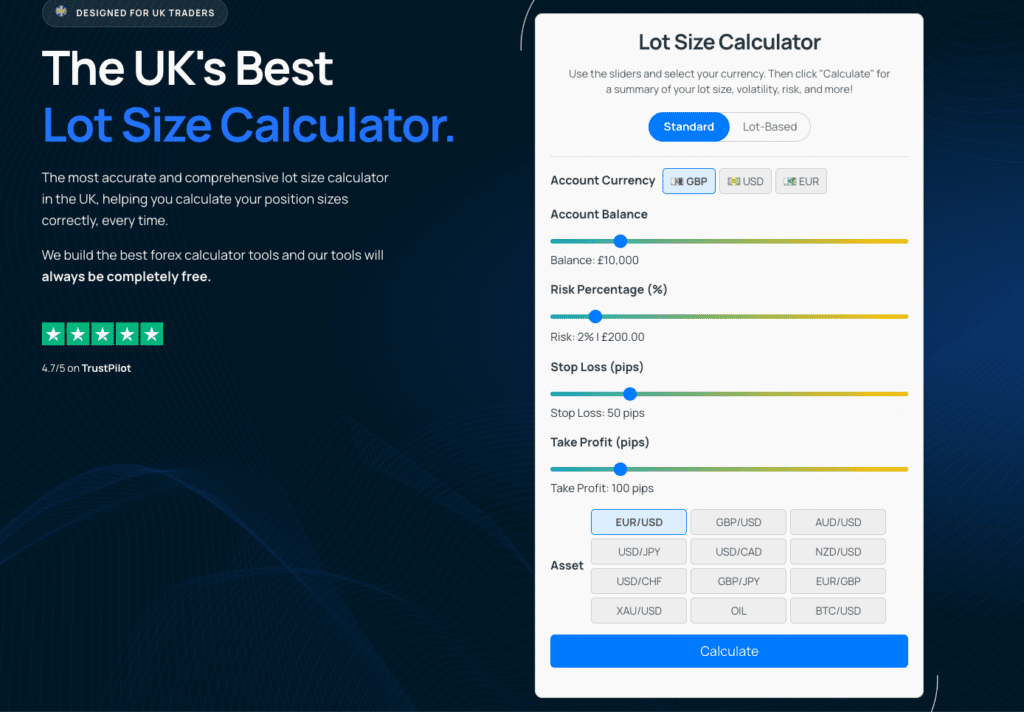

Spread Betting Calculator for UK Traders

Spread Betting Calculator

Use the sliders and select your currency. Then click "Calculate" for a summary of your stake size, volatility, risk, and more!

1. What Exactly Is Spread Betting?

As you may (or may not!) know by now, Spread betting is a way to speculate on the price movements of an underlying financial instrument—like GBP/USD, Gold, or the FTSE 100—without actually owning shares or currency. Instead, you’re placing a bet on whether the price will go up or down. Your profit (or loss) changes based on how many “points” the market moves from your entry in the direction you predicted.

- Stake-per-Point: Instead of buying “lots” or “units,” you decide how many pounds per point you want to stake. For example, if you choose £1 per point and the market moves 50 points in your favour, your profit is £50 (minus any costs/spreads).

- Tax Advantages: In the UK, spread betting is often free of capital gains tax (though tax laws can change, so always check the latest guidelines).

- Flexibility: You can go long or short with equal simplicity.

The flip side is that losses can mount quickly if the market moves against you—especially when trading with leverage. This is where having a proper handle on your risk exposure becomes crucial.

2. How is a Spread Betting Calculator Different?

Stake-Per-Point vs. Lot Size

In traditional forex or CFD trading, “lot sizes” are standard for that, you can always use a lot size calculator but nothing really existed for spread betting calculations, until now!

For instance, 1 standard lot of EUR/USD might equal 100,000 units of currency. You measure the difference between your entry and exit in pips, and each pip might be worth a set amount of money. But spread betting doesn’t use lots; it uses stake per point. That means your main question is: How much will I gain or lose for every point the market moves?

A standard lot size calculator is built to answer a single question: “How many lots should I trade, given my stop loss and risk tolerance?” A spread betting calculator, on the other hand, focuses on how many pounds-per-point you might risk.

How To Use It

It’s easy to slip-up with mental arithmetic. Perhaps you wanted to trade £100 on a particular trade, but after a sudden market move, your stake gets you risking £250. A calculator that’s specifically designed for spread betting helps you avoid these errors by:

- Prompting you for your exact stop loss in points.

- Converting your total risk (like £100 or £200) into a final stake-per-point.

- Accounting for volatility, if it’s built in, so you can see how a high-volatility market might change your required stake size.

Focus on Risk Management

It’s easy to get caught up in potential profits—particularly when you see a big move happening in the market. But one of the first lessons any seasoned trader learns is that managing downside risk matters more than chasing big wins. A spread betting calculator encourages you to:

- Define Your Stop Loss in terms of points.

- Set Your Desired Risk in monetary terms.

- Automatically Find Your Stake so that if your trade hits its stop loss, you only lose a manageable fraction of your account.

3. Features of a Good Spread Betting Calculator

Here are some useful features that you should look for in spread betting calculators (think of them as tips to help you determine if it is good or not!)

- Stake Conversion:

- It should let you plug in how much of your account (say 1% or £200) you’re willing to lose, then spit out the stake-per-point you need to match that risk.

- Stop Loss & Take Profit:

- You want to see, at a glance, how many points away your stop loss is—and how that ties into your stake size. Similarly, a take-profit level helps you estimate potential gains.

- Currency Options:

- If your trading account is in USD or EUR, the calculator should factor in currency conversion for markets quoted differently.

- Volatility Insights(Optional):

- Some advanced calculators like ours will highlight how volatile a market is (for instance, Gold or Bitcoin) and might warn you if your stop loss is unusually tight for that asset.

- Simple, Clear Outputs:

- End result should state your stake per point, total risk, and potential reward.

Essentially, a well-made spread betting calculator is your “pre-flight checklist,” ensuring your trade setup is aligned with your risk appetite.

4. How Spread Betting Calculators are Different to Normal Lot Size Calculator

Terminology and Focus

A standard lot size calculator is typically built for forex or CFD traders who speak in pips, lots, or contracts. It might default to “pips” for stop loss and automatically reference “lots” or “contracts” for position sizing. Spread betting calculators, conversely, revolve around:

- Points (not always the same as “pips,” especially if you’re spread betting on indices or commodities).

- Stake-per-point (instead of lots).

Tax and Leverage Implications

While a normal lot size calculator might note the margin required for a CFD trade, a spread betting calculator could emphasise the potential leverage or margin usage specifically for spread betting rules in the UK or Ireland. It’s subtle, but the difference is there—particularly in disclaimers about tax treatments or reference to “stake” vs. “lot.”

Built-In Market Summaries

Because spread betting is popular on indices (like the FTSE 100 or S&P 500) and commodities (Gold, Oil), a spread betting calculator can calculated include short summaries or typical volatility ranges for those instruments. Lot size calculators, are usually (not always!) towards forex, focus on pairs like EUR/USD or GBP/USD and may only briefly touch on metals or indices.

5. Practical Use Cases

Pre-Trade Check

Let’s say you see an trade setup on the FTSE 100. You’ve got a £10,000 account, and you only want to risk £100. You plan a stop loss that’s 40 points away from your entry. Rather than manually do the math, you plug those numbers into the spread betting calculator:

- Account balance: £10,000

- Risk amount: £100

- Stop loss: 40 points

The tool immediately shows your stake per point—perhaps £2.50—to keep your total risk near £100. If you decide your stop loss needs to be wider or narrower, you quickly see how your stake changes.

Volatile Markets

Gold is known for big swings. If the calculator factors volatility into its risk summary, you might get a warning if you’ve set your stop at just 15 points or chosen a stake per point that’s too large. This heads-up could save you from being stopped out too soon or risking more than you intended in a fast-moving market.

Account Growth or Scaling Down

As your account grows (or shrinks), your risk tolerance might shift. A spread betting calculator helps you seamlessly adjust your stake. If you’ve grown your account to £20,000 from £10,000, you can keep the same percentage risk but see a new stake-per-point that remains consistent with your risk profile.

6. How to Get Started (Beginner’s Guide)

Here are some useful tips we found for traders who are new to spread betting in the UK – you might find them useful:

- Always Double-Check Stop Loss Levels

- Ensure the calculator’s “points” align with how your broker quotes the market. Sometimes there can be slight mismatches in decimal places.

- Use % Risk When Unsure

- If you’re new, risking 1% or less of your account helps you stay in the game longer while you learn.

- Be Aware of Spread

- Even if the calculator says you’ll risk £100 with a 40-point stop, a wide spread (especially on less liquid markets) can affect your entry price, and thus your risk. Keep an eye on this.

- Experiment

- Try adjusting your stop loss range or target profit in the calculator. This can reveal interesting trade-offs. Maybe a slightly wider stop (60 points instead of 40) lets you breathe easier in a volatile market.

- Review and Refine

- After you close a trade, compare the actual results with the calculator’s estimates. This helps you refine your approach for the next round.

So is a Spread Betting Calculator Worth It?

Using a spread betting calculator addresses a real need for traders who want to seamlessly manage risk in a stake-per-point environment. While a traditional lot size calculator focuses on pip values and lots, a spread betting tool is tailored to UK (and Irish) market conventions—whether that’s understanding points on the FTSE, stake sizes for Gold, or short-term currency bets.

Ultimately, the calculator is about discipline and precision. It’s there to remove the guesswork from your stake sizing, support consistent risk management, and let you trade with a clear plan—rather than winging it on the fly. The next time you spot an opportunity and feel tempted to jump straight in, pause, open your calculator, and run the numbers. Your future self (and your trading account) might just thank you.