When choosing a spread betting broker, the sheer number of options can feel overwhelming. With so many platforms offering varying features, fees, and tools, it’s crucial to choose the right one for your trading style and goals. As someone who’s been trading for a while, I’ve learned the importance of knowing pretty much exactly what to look for in a broker – hence this website.

I’ve decided to break down the most important elements for you to consider when choosing a spread betting broker. Luckily for you, we’ve done most of the heavy lifting already through our spread betting broker reviews, rankings and broker comparisons so you can stack each broker up side-by-side.

What are the Top Factors when Choosing a Broker?

Here are the top 10 things to consider when choosing a spread betting broker.

1. Regulation and Safety

First and foremost, regulation is a critical factor in choosing any financial broker. A spread betting platform that operates under the regulation of a recognized authority ensures that your funds are protected and that the broker adheres to ethical trading standards. In the UK, for example, look for brokers regulated by the Financial Conduct Authority (FCA), which ensures transparency, negative balance protection, and client fund segregation.

Why it matters:

- Ensures safety of your funds.

- Guarantees the broker follows strict rules designed to protect traders.

Tip: Check for FCA or similar regulatory body registration before signing up.

2. Range of Instruments

A diverse range of instruments is essential for any spread betting platform. Whether you’re interested in forex, indices, commodities, stocks, or cryptocurrencies, the best brokers should offer a wide variety to allow diversification of your trades.

Why it matters:

- Different instruments offer various levels of volatility and liquidity, which is crucial depending on your trading strategy.

- Having a broad selection provides more opportunities across multiple markets.

Tip: Look for brokers that offer more than 1000 markets, including major forex pairs, popular indices like the FTSE 100, commodities, and even niche assets.

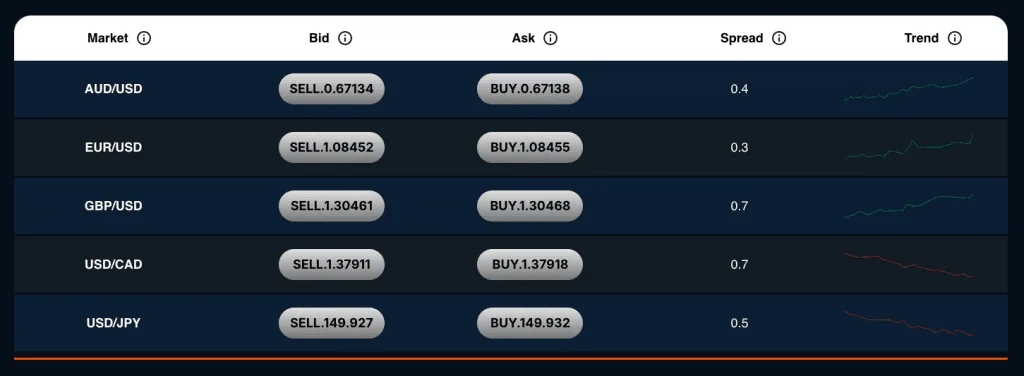

3. Low Fees and Tight Spreads

One of the most significant factors when choosing a spread betting broker is the cost of trading. Fees include spreads, commissions, and other charges like overnight financing fees. While some brokers offer zero-commission trading, they often have wider spreads.

Why it matters:

- Tight spreads are particularly important for day traders and scalpers who execute frequent trades.

- Lower costs can translate into higher profitability, especially if you trade at high volume.

Tip: Brokers like Pepperstone and EightCap are known for tight spreads, especially in forex trading.

4. Platform Usability & Offering

Whether you prefer a proprietary platform or a well-known one like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, or TradingView integration, the usability of the platform can make or break your trading experience. Look for a broker that offers charting tools, advanced indicators, and the ability to set custom alerts.

Why it matters:

- A good spread betting platform should have an intuitive interface that allows easy execution of trades, access to analytical tools, and the ability to manage multiple trades.

Tip: Some brokers offer their own platforms, while others integrate with MT4/MT5, cTrader or even TradingView, all of which are great for algorithmic trading.

5. Execution Speed

Execution speed is crucial for spread bettors, especially those who engage in high-frequency strategies like scalping or day trading. Fast execution ensures your trades are filled at the price you want, minimizing slippage during volatile market conditions.

Why it matters:

- Latency can result in missed opportunities, especially during major news events or market volatility.

- A No Dealing Desk (NDD) or ECN broker often provides faster, more transparent pricing.

Tip : Look for brokers that offer VPS hosting lower latency if you use automated trading strategies.

6. Education and Learning Resources

Whether you’re new to spread betting or a seasoned trader, educational resources can help you refine your strategy. Many brokers offer webinars, eBooks, video tutorials, and access to market news and analysis to help you stay updated.

Why it matters:

- Education can help improve your strategy and make better trading decisions.

- Some brokers even offer one-on-one coaching for VIP or premium account holders.

Tip: Check out brokers with strong educational offerings, such as XTB or ActivTrades, which offer webinars and expert analysis.

7. Risk Management Tools

Spread betting can be highly volatile, and risk management is crucial. Look for a broker that offers advanced risk management tools such as guaranteed stop-loss orders (GSLO), trailing stops, and negative balance protection.

Why it matters:

- These tools can help mitigate losses and protect your capital.

- Negative balance protection ensures that you won’t lose more than your initial investment in extreme market conditions.

Tip: Not all brokers offer GSLO, so check if it’s available if risk management is a priority for you.

8. Leverage and Margin Requirements

Leverage allows you to control larger positions with a smaller amount of capital, but it also increases risk. Different brokers offer varying levels of leverage; in the UK, this is capped at 1:30 for retail traders under FCA regulations.

Why it matters:

- High leverage can increase potential profits but also magnify losses, making it important to understand the broker’s margin requirements.

Tip: Always check margin requirements and available leverage options before selecting a broker. Platforms like Vantage Markets offer competitive leverage ratios.

9. Customer Support

Customer support may not seem like a big deal until you have an urgent question or a technical issue. A good broker should offer 24/5 multilingual support via live chat, email, or phone.

Why it matters:

- Having access to reliable support ensures that any issues with your account, platform, or trades can be addressed quickly.

Tip: Look for brokers that provide live chat support, especially if you’re trading in different time zones.

10. Account Types and Deposit Requirements

Lastly, consider what kind of account types the broker offers. Some platforms, like Pepperstone, offer Razor Accounts and Standard accounts, allowing traders to choose between paying commission or trading with wider spreads. Also, check the minimum deposit requirements—some brokers allow you to start with as little as £100, while others might require more.

Why it matters:

- Account flexibility can be important depending on your trading volume and capital.

- Low deposit requirements make it easier to start trading without committing significant funds upfront.

Tip: If you’re a beginner, consider brokers that offer demo accounts for practice before risking real money.

Our Recommendation

£500 Recommended Deposit

Best Overall

Pepperstone is a Melbourne-based broker that offers an excellent selection of trading instruments in the financial trading markets, including commodities, shares, ETFs and more.

75.5% of retail investor accounts lose money when trading on margin with this provider

Our recommended broker Pepperstone has achieved high-scores on each of these criteria. Here’s why:

- Regulatory Compliance: Pepperstone is regulated by top-tier financial authorities such as the FCA (UK), ASIC (Australia), and CySEC (Cyprus). This level of regulatory oversight ensures a high degree of trust and client fund security, which is crucial when choosing a broker.

- Range of Instruments: You get access to over 1,200 financial instruments, including forex, indices, commodities, cryptocurrencies, and shares, Pepperstone offers a broader range of markets compared to many competitors.

- Low Spreads and Competitive Fees: Pepperstone is known for offering tight spreads, especially with its Razor account, where spreads start from 0.0 pips on major forex pairs.

- MT4/MT5 and cTrader Platforms: Pepperstone offers a huge range of platforms like MetaTrader 4, MetaTrader 5, and cTrader. These platforms provide advanced charting tools, algorithmic trading support, and a range of indicators, which are perfect for technical traders and those looking to automate their strategies.

- Fast Execution and NDD Model: Pepperstone uses a No Dealing Desk (NDD) execution model, meaning there’s no broker intervention in your trades, resulting in faster execution and reduced slippage.

- Comprehensive Educational Resources: Pepperstone goes above and beyond with its educational content, offering webinars, market analysis, and tutorials that help traders improve their strategies and knowledge.

- Customer Support: With 24/5 multilingual customer support, Pepperstone provides responsive and helpful service, making it a reliable partner for spread bettors and traders.

I encourage you to continue looking at our site, especially our Broker Comparisons in order to make your own informed choices around spread betting brokers. Happy trading!

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-450x338.jpg)

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)