Spread betting is a popular financial derivative in the UK that allows traders to speculate on the price movements of various financial instruments, such as stocks, indices, commodities, currencies, and bonds, without owning the underlying assets. It’s a form of leveraged trading, which means you can control a larger position with a smaller initial deposit. Spread betting is particularly appealing due to its tax-free nature in the UK, meaning any profits made are exempt from capital gains tax and stamp duty.

In this article, we’ll dive into where you can spread bet in the UK, covering the leading platforms, the benefits and drawbacks of each, how to choose the right one for your needs, and the broader regulatory landscape. If you’re considering spread betting in the UK, here’s what you need to know:

What Is Spread Betting?

Before we explore where you can spread bet, it’s essential to understand what spread betting is and how it differs from traditional forms of trading.

In spread betting, you bet on whether the price of an asset will rise or fall. Instead of purchasing the asset, you place a bet on the price difference (or “spread”). Each point the market moves in your favor earns you a profit, and each point against you incurs a loss. Since you don’t actually own the asset, spread betting is considered a “synthetic” financial product.

Spread betting allows for both long (buy) and short (sell) positions. It’s also a leveraged product, which magnifies both potential profits and losses. Leverage means you only need to deposit a fraction of the trade’s total value (known as margin), but this can result in significant gains or losses relative to your initial investment.

Why Spread Bet?

- Tax-free profits: Unlike traditional trading, profits from spread betting are free from capital gains tax and stamp duty in the UK.

- Leverage: You can access markets with a smaller initial deposit, meaning you don’t have to put down the full value of a trade upfront.

- Flexibility: You can go long or short on the market, giving you opportunities to profit from both rising and falling markets.

- Variety of markets: Spread betting platforms offer a wide range of markets, from stocks and indices to currencies, commodities, and bonds.

Spread Betting Platforms in the UK

When it comes to spread betting in the UK, several key platforms dominate the landscape. Each offers its unique features, so choosing the right one will depend on your specific trading style, risk appetite, and market interests.

Here are the most reputable and popular platforms for spread betting in the UK:

1. IG Group

Overview:

IG Group is one of the largest and most well-established spread betting providers globally. Founded in 1974, IG offers access to a wide variety of financial markets, including indices, forex, commodities, cryptocurrencies, and shares. It’s known for its intuitive platform, competitive spreads, and excellent customer service.

Features:

- Access to over 17,000 markets.

- User-friendly trading platform, including web-based, mobile, and downloadable options.

- Extensive educational resources and tools for beginner traders.

- Low spreads, particularly on popular forex pairs like EUR/USD.

- Advanced charting tools and a wide range of technical analysis features.

Pros:

- Long-standing reputation and trusted by thousands of traders worldwide.

- Excellent market range and liquidity.

- Robust mobile trading app for traders on the go.

- Transparent fee structure with competitive spreads.

Cons:

- Minimum deposit of £250 may be high for some beginner traders.

- Overnight holding fees can be expensive for those holding long-term positions.

2. CMC Markets

Overview:

CMC Markets, established in 1989, is another well-known provider of spread betting services in the UK. Like IG, CMC Markets offers access to a wide array of financial markets and is noted for its award-winning platform, which features advanced tools, a clean interface, and excellent customer support.

Features:

- Over 9,000 instruments to trade, including shares, indices, forex, and commodities.

- “Next Generation” platform offers advanced charting features, technical analysis tools, and a customizable interface.

- No minimum deposit, making it accessible for traders at all levels.

- Competitive spreads, particularly for forex and major indices.

- News and market insights are integrated into the platform.

Pros:

- Award-winning trading platform with advanced tools for technical analysis.

- No minimum deposit, lowering the barrier to entry for new traders.

- Wide range of tradable markets.

- Consistently rated highly for customer service and platform ease-of-use.

Cons:

- Spreads can be higher on less-liquid instruments.

- Overnight holding costs can accumulate if you maintain positions over several days.

3. City Index

Overview:

City Index is another long-established UK spread betting provider. Owned by StoneX Group, City Index offers over 12,000 markets across indices, shares, commodities, forex, and bonds. It’s particularly appealing for traders who want to trade both spread betting and CFDs, as City Index allows for seamless switching between the two.

Features:

- Access to thousands of markets, including indices, forex, and commodities.

- User-friendly platform with advanced charting and analysis tools.

- Mobile apps that provide a high-quality trading experience on smartphones and tablets.

- Fast execution speeds and reliable order execution.

Pros:

- Competitive spreads and low margin requirements.

- Flexible trading platforms that cater to both beginners and experienced traders.

- Seamless integration of spread betting and CFD trading.

- Transparent pricing with no hidden fees.

Cons:

- Some traders may find the platform less intuitive than IG or CMC Markets.

- Smaller range of tradable assets compared to some other platforms.

4. Oanda

Overview:

Oanda is a global broker that has built a strong reputation in forex trading, and it also offers spread betting services for UK residents. Known for its transparency and no-requotes policy, Oanda provides access to a range of assets, including forex, indices, and commodities.

Features:

- Tight spreads on forex pairs and competitive pricing.

- Access to popular markets such as forex, indices, and commodities.

- Platforms include MetaTrader 4 and 5, as well as Oanda’s proprietary platform.

- Real-time news, market analysis, and extensive educational resources.

Pros:

- No re-quotes policy ensures quick order execution.

- Access to the popular MetaTrader platforms for spread betting.

- Transparent pricing with no hidden fees.

- Low deposit requirements and excellent educational tools.

Cons:

- Smaller range of tradable assets compared to larger platforms.

- Primarily focused on forex, with fewer options for other markets.

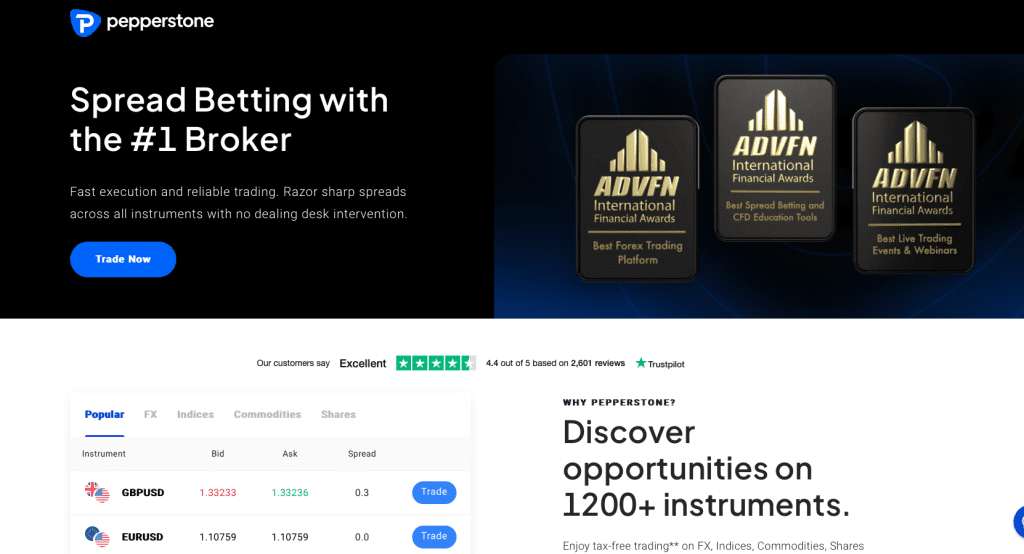

5. Pepperstone

Overview:

Pepperstone is an Australian-based broker that has rapidly grown its presence in the UK. While primarily known for its forex trading services, Pepperstone also offers spread betting on forex, indices, commodities, and cryptocurrencies.

Features:

- Access to over 150 instruments, with a focus on forex and commodities.

- Tight spreads and fast execution speeds.

- MetaTrader 4, MetaTrader 5, and cTrader platforms available for spread betting.

- No dealing desk, ensuring fast and reliable order execution.

Pros:

- Competitive spreads, particularly for forex trading.

- Range of platform options, including MT4, MT5, and cTrader.

- Tight spreads with no re-quotes.

- Low latency and fast execution speeds, ideal for day traders.

Cons:

- Smaller range of markets compared to larger spread betting providers.

- Primarily focused on forex, which may not suit traders looking for broader market access.

Additional Resources

For a deeper understanding of spread betting and its unique tax advantages, you can explore resources from reputable sites like:

How to Choose the Right Spread Betting Platform

Choosing the right platform is crucial for success in spread betting. Here are a few factors to consider when selecting a spread betting platform in the UK:

- Market Access

Ensure the platform offers access to the markets you’re interested in. For example, if you’re focused on forex, a platform like Pepperstone might suit you. However, if you’re looking for broader access, IG or CMC Markets might be a better choice. - Spreads and Commissions

Low spreads are vital for spread betting, especially if you’re trading frequently. Compare the spreads on your preferred assets, such as major forex pairs, indices, or commodities, across different platforms. - Leverage

Each platform offers different levels of leverage, which can amplify both profits and losses. Ensure you’re comfortable with the leverage on offer and the margin requirements. - Platform and Tools

Some platforms are more feature-rich than others. If you’re a technical trader, you’ll want advanced charting tools and analysis features. Platforms like IG and CMC Markets offer comprehensive tools, while others like Oanda focus on straightforward functionality. - Customer Support

Reliable customer support is essential, particularly if you’re dealing with complex financial products. Check the platform’s support options, including live chat, phone, and email. - Educational Resources

If you’re new to spread betting, you’ll want access to educational materials and resources. Platforms like IG and CMC Markets offer extensive educational content, including webinars, tutorials, and trading guides. - Mobile Trading

Mobile trading has become increasingly important for traders who want to manage their positions on the go. Most major platforms offer mobile apps, but the quality and functionality can vary. Check that the app is intuitive, responsive, and provides full trading capabilities. - Regulation

Ensure the platform is regulated by the UK’s Financial Conduct Authority (FCA). This provides an added layer of protection for your funds and ensures that the platform adheres to strict industry standards.

Regulatory Landscape of Spread Betting in the UK

The Financial Conduct Authority (FCA) oversees the regulation of spread betting providers in the UK. FCA regulation is a sign that the provider adheres to industry standards designed to protect traders and ensure the integrity of financial markets.

Conclusion

Spread betting in the UK offers an exciting way to engage with the financial markets, particularly given the tax advantages and the flexibility it provides. The UK is home to a range of spread betting platforms, each offering a unique set of features and benefits. Platforms like IG, CMC Markets, and City Index are industry leaders, offering access to a vast array of markets and sophisticated trading tools, while others like Oanda and Pepperstone cater to niche audiences with specific needs.

When selecting a spread betting platform, consider your trading style, market interests, and preferred features. Look for a platform that aligns with your goals, offers competitive spreads, and is FCA-regulated to ensure your funds are safe.

Ultimately, spread betting is a high-risk, high-reward form of trading, so it’s crucial to approach it with caution, solid risk management strategies, and a clear understanding of how leverage works. With the right platform and preparation, you can take advantage of the opportunities spread betting offers.

James is a former FTSE100 AI Director and trader with 10+ years trading his own capital. He is the Managing Director of SpreadBet.AI and currently trades his own capital through both CFD trading & spread betting as well as working with one of the leading prop firms in the world.

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-450x338.jpg)

![The Best Forex Spread Betting Broker in the UK [2025]](https://spreadbet.ai/wp-content/uploads/2025/05/joshua-mayo-bmj1Vl77ZWM-unsplash-100x100.jpg)